Fintech, SaaS, AI help B2B startups gain momentum in India

B2B startups have come into the reckoning with a growing number of investors keen on putting their money in these companies, in a great boost to the ecosystem

Wydr, Customer Success Box, GoBolt, Whatfix and Daybox. These are some of the startup names one would not easily recall from the Indian entrepreneurial ecosystem but such B2B companies are the potential game-changers with investors also shifting their focus on to them.

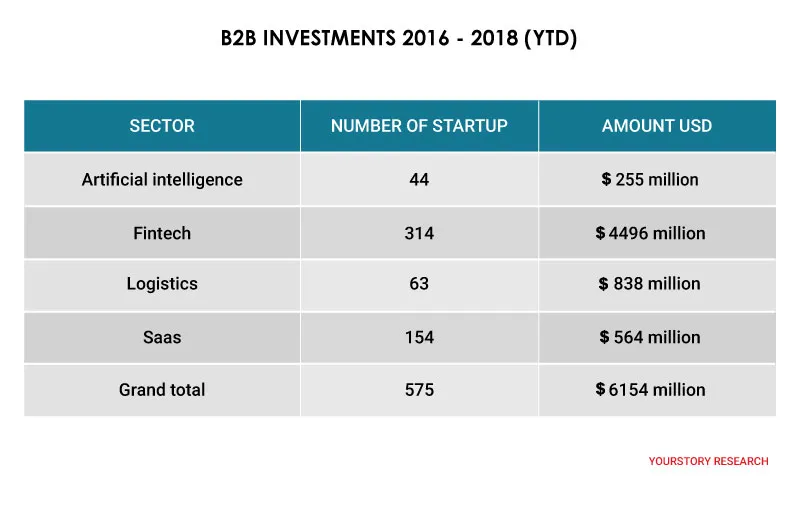

The numbers are also doing the talking. The investment in startups across segments such as Artificial Intelligence (AI), Fintech, Logistics and Software as a Service (SaaS), which typically falls in the B2B category, touched $6.1 billion, with investment in 575 firms since 2016 till now, according to data provided by YS Research.

Among these segments, fintech topped the chart in terms of funding with $4.4 billion, followed by logistics at $838 million, reveals YS Research.

The recently-unveiled ‘The India Startup Report – 2018’ by YourStory says: “Significant transformations are occurring in the organisational world and business ecosystem, which open up opportunities for startups in the B2B (business to business), B2E (business to employee) and B2B2C (business to business to customers/consumers) products. SMAC technologies (social, mobile, analytics, cloud), AI, and ML are disrupting big businesses and are enabling agile strategies for a new generation of enterprises and small and medium-sized businesses, though these are early days for block chain.”

The startups in the B2B space are very unlikely to attract the hundreds of million or billion dollar investments, but there is a firm investor interest. Manish Singhal of Pi Ventures, which focuses on AI and IoT startups, feels the momentum still remains very strong in the B2B segment. “The next set of companies that are going to become big in India are likely to be from the B2B space,” he says.

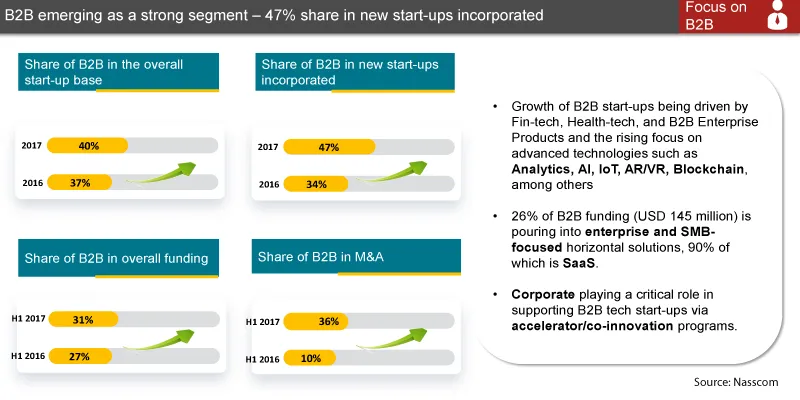

The National Association for Software Services Companies (Nasscom), the Indian IT industry’s premier trade body, in its 2017 report on the startup segment says, around 50 percent of the incepted startups during the course of last year were from the B2B segment, with fintech and healthtech being the key areas. Currently, India has over 5,200 startups.

“India is witnessing a rapid rise in the B2B tech startup landscape, focused on verticals like healthtech, fintech, and ecommerce/aggregators,” the report said.

According to Nasscom, advanced technology startups were growing at a compounded annual growth rate (CAGR) of 30 percent, with Artificial Intelligence (AI) being one of the key growth segments.

Pick up in momentum

There has been a growing interest within the investor community on B2B startups, which includes VCs, corporates, accelerators, and angels.

“This should have happened long time ago,” says Vidhya Shankar, Executive Director, Grant Thornton India. He feels the Indian B2B startup eco-system is fast maturing with the coming in of investors who understand deep enterprise technology, and are willing to place their bets on these new-age startups.

The B2B startups are never going to attract multi-billion dollar valuations, for the simple reason they never receive that kind of funding. In short, the B2B startups are more capital-efficient, and probably require lesser time to turn profitable, which eludes a large number of B2C ventures.

“If the software product of a B2B startup is good, then the incremental cost of acquiring the next customer is virtually next to nothing,” says Shankar.

This is unlike a B2C company, which has to constantly engage in the sales and marketing exercise to add more customers. Typically, the quantum of investment required in a B2B startup is also quite small.

Rise in valuation

The B2B segment is now seeing a rise in its valuation. For example, Exfinity Ventures, a private equity fund started four years ago, has already doubled its valuation.

“We are already enjoying 2X rise in valuation, with most of our portfolio companies doing well,” says V Balakrishnan, Chairman, Exfinity Ventures.

Exfinity Venture was the brainchild of former Infosys board members V Balakrishnan and TV Mohandas Pai, former Wipro CEO Girish Paranjpe, and i-flex Co-founder Deepak Ghaisas. The company has raised Rs 425 crore funding till now with the launch of two funds, and invested in 15 B2B startups.

A report by Nasscom-Zinnov on the Indian startup ecosystem ‘Traversing the maturity cycle’ says,

“With 40 percent of startups in the B2B segment, the B2B’s share in the overall tech startup funding is over 30 percent. Corporates are playing a vital role in supporting these, with over 50+ collaboration programmes, 20+ corporate accelerators (recording a 33 percent YoY growth), and 30-40 active corporate investors, thus increasing their role in the rise of the startup ecosystem.”

A typical B2B startup focuses on solving problems for the enterprise customers, which are usually large corporates.

The strides made by B2B companies generally gets hidden in the whole glamour of B2C companies, such as the funding announcements in the likes of Flipkart, Ola, Swiggy, and Zomato, leading to a Unicorn status.

However, the B2B startups have gained the attention of global tech giants like Little Eye Labs, a Bengaluru-based startup getting acquired by Facebook, or ZipDial by Twitter.

Domain strength

B2B startup investors do not typically look at the entities based on which industry they are focusing, but on their technology prowess. Pi Ventures, an investor in B2B startups, focuses on Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT). Similarly, Exfinity Ventures invests in startups that have strong domain expertise in areas such as cloud, IoT, AI, augmented reality and virtual reality.

Providing a glimpse of Exfinity’s performance, Balakrishnan says, around three to four firms have performed extremely well, while the rest put up a more modest performance. Exfinity remains invested in a firm for a minimum of 5-6 years, before it looks for an exit. Typically, the B2B startups that provide technology to enterprises are likely to be bought out or merged with large companies. According to Balakrishnan, a leading global technology company was interested in its portfolio firm, but they felt it was too early to get into such kind of a transaction.

Bigger opportunity

Things are falling in place for B2B startups in India, given the low penetration of technology here, and this only gives them a bigger market opportunity. This is besides the global market, which these startups can address.

“People love it when cutting-edge work is being done here, and the sales team is sitting in the US. It is also a fantastic model when the cost is in rupees, and revenue comes in dollars,” says Shankar.

B2B startups in India, however, have dug themselves deep into the entrepreneurship eco-system, and there is no question of looking back now. “B2B is the rock bed of innovation in India, and there is a lot of work happening,” Singhal says.