Why we stopped supporting Cash on Delivery (COD) – and are loving it!

Myth-buster: COD support isn’t necessary for business!

COD (Cash on Delivery) is the lifeline of an e-commerce business, but why did Fynd take such a bold decision to stop COD completely? Here is why.

Since its inception in November 2015, Fynd always had COD as one of the payment modes available to its customers. Our RTO (Return to Origin) numbers in 2016 were as low as 0.12 percent. But then this two-year journey from 0 to about 10 million customers was a roller-coaster ride with a lot of experience to learn from. We soon noticed some alarming patterns in our COD orders. Our RTO rates rose up to 31 percent by 2017. When we asked other e-commerce companies for their numbers, everyone said that these (30-45 percent RTO) are industry-standard numbers, and we were shocked at how they could brush this off as BAU (business as usual).

So what went wrong?

While we were working day and night to scale up the order volumes and efficiently deliver them, we attracted some unwanted fishes to the party. These were mostly of two types:

- Affiliate networks

- Customers you don’t want

Affiliate networks

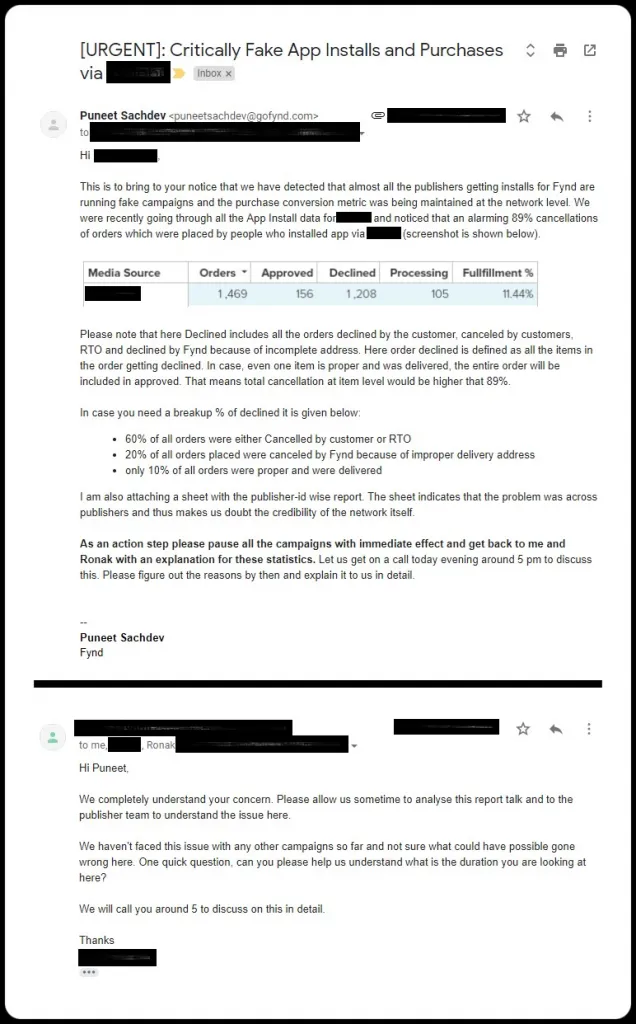

Being a data-driven company, we were always looking for ROIs on whatever growth activity we did. We partnered with some major affiliates who were running performance-driven campaigns on our behalf. All the payouts were tied to purchase conversion rates so that we not only spend on digital ads but also derive ROI out of each publisher network. But we soon realised that we were working on the (fad) term ‘ROI’ and optimizing it as well. We made mistakes at two levels in this entire approach:

Level 1: measuring ROI on top line numbers

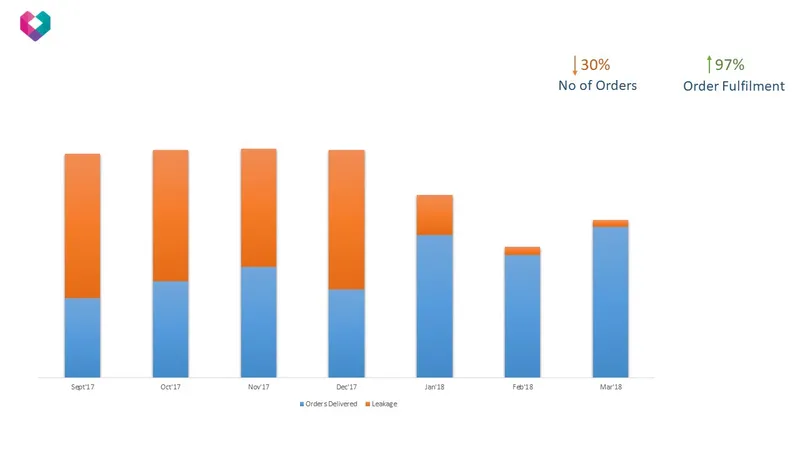

While we were looking at the fancy purchase conversion numbers on the third party attribution tools, we were not connecting the data with the post-purchase customer journey. This resulted in the publisher networks exploiting us (and many others with a similar approach). Their concept was simple – make somebody download the app (using their link) and place x orders on COD every day, and cancel it immediately or refuse to accept it during the delivery. Their fraud was to a level that one person based in a remote location placed 72 orders in a day, and obviously, all of those either got cancelled or RTOed.

When we confronted them with post-purchase data, they initially denied any wrongdoing, but since we had strong data points to prove our case, they agreed to the fraud and claimed to have blacklisted the publisher, waiving off our marketing fee for all fraud orders.

Since then, all ROI numbers for us and for our all performance channels (including Facebook, Google, etc.) are measured on the bottom line. It doesn’t matter how many orders we get via a channel – how many we deliver is what defines our ROI.

Level 2: ignoring the impact of operational cost

Getting rid of such fraud affiliate partners did not solve the problem completely – we were still losing money on operational costs.

To throw some more light to this, assume that delivery to the customer costs around Rs 100 per order. In case it is a COD order, there is an additional cash collection fee of Rs 40 per order. This jumps up the net delivery cost to Rs 140 for every delivered order. For the orders that did not get delivered, the delivery partner charges Rs 100 for taking it to the customer’s doorstep. But since the customer refused to accept the order, they charge Rs 100 extra to get the product back to us, which brings up the total operational cost of non-delivered orders to Rs 200. For each RTO order, thus, you earn zero and lose Rs 200!

Hence, more the number of RTO share in the total orders, the more money we lose on operational cost and make absolutely zero money on revenue. As a result, the top line numbers look good, but at the bottom line, the company would start bleeding because of operational costs.

The customers you don’t want

Conventional wisdom dictates that every customer is a good customer. But that’s not always the case. Sometimes, there are some customers who try to mess around with your company for no justified reason. Though these customers are lesser in number, once they start causing trouble for you, it can turn into a real mess in no time. When we tried reaching these customers, most of them were just “enjoying ” playing with the system. This made us rethink whether COD is a service which we should offer to everyone, or it should be an elite service which is offered only to genuine customers. Anyway, customers gamed the system, and there was no common rule which we could apply to all, except for blocking these customers only once they have done “enough fraud” in the system.

What did we do?

Initially, one of the obvious corrective measures was to keep a tight check on performance networks and stop the publishers which have a high cancellation rate.

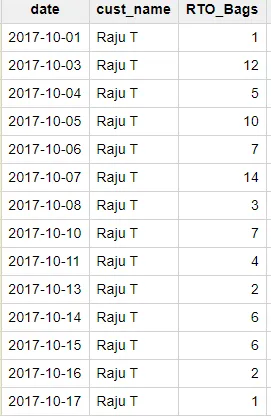

The second corrective measure which we took was to discourage people to opt for COD orders by levying a COD fee of Rs 50 against each order. Even though this reduced COD orders by a good 25 percent, it didn’t curb the problem completely.

We also implemented a third-party tool, Third Watch, to detect the probability of an order not getting fulfilled even before shipping it. But who are we kidding? If 95 percent of the orders are failing, how much improvement can a third-party tool do anyways? So, we had to take a bold decision!

Being bold: the ultimate correction

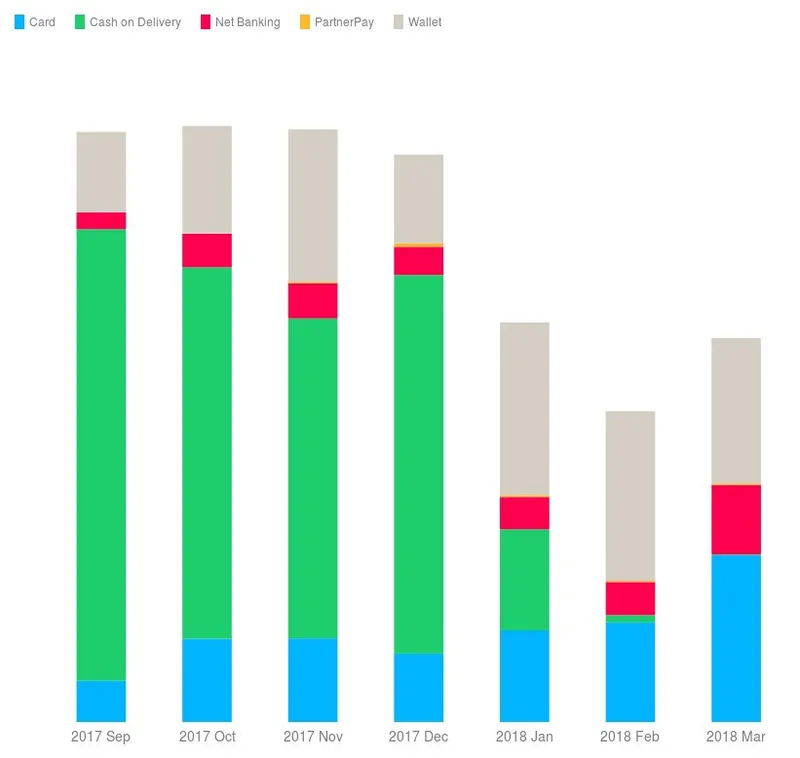

In January 2018, we shut down COD completely. We trusted our genuine customers to still transact with us and shut off the noise of unfulfilled orders which were mere numbers for us.

Also, we added every payment mode possible to our system, so that none of the customers trying to pay online is left out. We optimized our payment flow so that customers can checkout fast using our “Flashpay” payment service. In short, we did our homework and prepared well before getting into this decision.

The impact

Completely shutting down COD definitely impacted our top line numbers. Our conversion rates suddenly collapsed and marketing ROIs shook up. Overall order volumes saw an impact as well, but we were well prepared for it. In the end, we were okay doing less business with genuine orders than more business with false orders. This was a conscious call and we held onto it. Slowly, our COD line diminished and more and more people started accepting the same, in turn switching to the prepaid system.

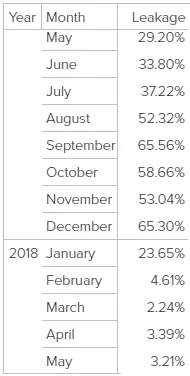

In terms of our bottom line numbers, the overall order volumes decreased, but the order fulfilling rate kept increasing. So, the efforts started paying off. We were not only saving Rs 210 per order on orders not getting delivered but also more and more of our customers were getting comfortable in making online payments. Moreover, our leakage numbers, which soared up to as high as 65 percent, were now down to a minimal 3.21 percent, which we can bet is the best in the e-commerce industry (any vertical).

So, at the end of the day, we did suffer some initial downfall in the top-line numbers with this decision, but the numbers say it all – and it broke the biggest myth in our mind:

COD is a must-have for any e-commerce network!

We now not only have a controlled operation cost but are increasing in the top-line month after month. Also, our targets are to bring down this leakage to a 1.5 percent mark. Yes, that means 98.5 of every 100 orders placed will be successfully delivered to our customers.

Harsh Shah is the Co-Founder of Fynd, a unique fashion e-commerce portal which brings the latest in-store fashion online.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)