Why it's time for India's IoT startups to pick up the pace

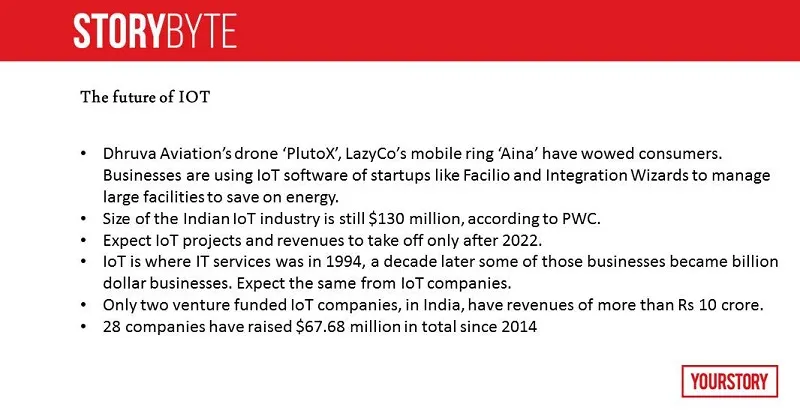

According to PWC, the IoT market in India is a mere $130 million , but can account for long-term business worth $47.5 billion if adopted properly.

India’s IoT journey is only about five to seven years old, but has been suffering from being stuck in long sales cycles and generating little revenue. Of the 40 Indian IoT companies surveyed by YS Research, three had annual revenue in excess of Rs 5 crore as of FY2017. All the 40 companies have raised money, with 28 of having raised $67.68 million in venture capital funding.

“There are several new-age entrepreneurs using their software knowledge to extract data from digital devices on a real-time basis and create AI and Machine Learning platforms on top to make human-machine interaction better,” says Prabhu Ramachandra, founder of Facilio.

India’s IoT boom, one can say, began when Qualcomm Ventures and Cisco invested $43.3 million in Hyderabad-based system-on-chip design company Ineda Systems.

The internet connects several machines which, in turn, interact with humans on a daily basis to make an IoT ecosystem. Sensors allow machines to be intuitive and make human tasks efficient. For example, LazyCo’s ring understands a person’s daily patterns and habits. It can connect to a coffee machine at home, and guide it to have a cup ready by 8 am every day. It can also book your cab ride to the office.

The concept of Internet-of-Things is built on the premise that sensors extract data generated from homes, factories, and offices to make the workforce efficient, and eliminate mundane human tasks. IoT works on a bunch of communication protocols like RFID, ZigBee, Wifi, Bluetooth, and BACNet. While the science of it has gone commercial, what remains a mystery is why India’s revenues from IoT startups are yet to pick up.

“Starting this current financial year, several companies will have to go out and raise more money or show value in their clientele and earnings. India’s IoT adoption is still very nascent,” says Venk Krishnan, founder of NuVentures. He says Indian IoT entrepreneurs who are focused on verticals will make it big in a few years.

Surprisingly, of all the 40 IoT companies researched, only two annual revenue higher than Rs 10 crore.

Stellapps’ big data IoT stack “Smart Moo” is used in the dairy industry to track the health of cows, and manage the milk supply chain; it doubled its revenue and turned profitable in 2017. It did not disclose its FY2018 revenue, but its revenue in FY2017 stood at Rs 21 crore, and it had reported a profit of Rs 1.8 crore. The company was founded in 2011.

“We figured it was the right time to use it to solve problems across verticals. Agriculture and dairy appeared the most potent, so we decided to stay focused on the sector,” Ranjith Mukundan, CEO of Stellapps, had said in an earlier interview with YourStory.

The second largest IoT company in India is GoQII; it had gross revenue of Rs 11 crore in FY2017, and company sources say it has already crossed Rs 15 crore in revenue this financial year ending March. The four-year-old company is yet to break even operationally.

On the consumer side, IoT business models will pick up from wearable devices, smart grilles, smart refrigerators, smart cars, watches, and smart homes. The average wearable watch costs less than Rs 2,000 today, while some of the devices are upwards of Rs 1 lakh.

The business model for consumer startups is built on charging customers for connecting them to an ecosystem of content providers, businesses, and services. For example, GoQII charges consumers for a special coach on a yearly basis just like your gym subscription. Alexa and Google Assistant are prime examples of how IoT ecosystems are coming together.

“The status quo, and the ability to invest in innovation is very low in India – albeit changing - with experiments happening in the top corporate companies,” says Vishal Jain, founder of Synconext, an IoT company that uses sensors to enable employees or companies to use buildings intelligently. In his seven-year journey, Vishal has built a company with $500,000 in revenue with 20 clients.

“Scaling is the biggest challenge, but the industry adoption is going to take off only from this year. The years of experimentation and pilots are over, clients want to know how we can help them in their entire IoT journey,” says Karen Ravindranath, CEO of WebNMS, the $50 million of IoT Corporation.

Companies are using IoT, but need to scale

In North Karnataka, around 5,000 farmers use Mahindra & Mahindra’s tractors and have got themselves a technology sweetener, thanks to Bosch India. All the tractors are connected, and data from each one helps M&M understand how farmers use these tractors. Now, many might say this is invasion of privacy, but the benefits are very real.

The failure of any part can be predicted well before it breaks down and there are alarms to warn farmers when, say, the next oil change is due.

“This makes customer service proactive; it increases brand loyalty, and helps the farmer in saving costs. Predictive and prescriptive maintenance are some of the benefits of IoT,” says Vijay Ratnaparkhe, MD of Robert Bosch Engineering India Ltd.

This is only one use-case of industrial IoT, which is being used by GE, Airbus, and Boeing among others to build solutions in-house. In India, Bosch supports IERO, a startup that can understand consumer habits while walking in a retail store. The store understands the presence of the customer through WiFi or Bluetooth, and uses edge computing to manage customised content.

Say, you are in the meat section, the system could suggest a pepper sauce that goes well with the pork sausage. “The possibilities of IoT applications are endless. By the way, all the data is secured because it sits within the enterprise and no personal data is taken other than buying habits of the consumer, where the customer signs up with the retailer to be served content,” says S M Hemanth, co-founder of IERO.

IERO was founded in 2016, and has marquee customers like Spar.

Why, then, is adoption low?

KPMG, in a report, says there is increasing interest from business leadership to implement IoT. However, enterprises have not been able to define, govern, run, design, and fund IoT implementations.

PWC throws greater light at why the market may see potential only beyond 2020. IoT is only a $130 million market in India today, and the government’s objective is to develop the industry to the tune of $15 billion by 2020. PWC’s report says that with the government’s keen interest in the development of IoT, the market in India is projected to grow at a CAGR of more than 28 percent annually by 2020.

“I repeatedly tell startups that moving from pilot to scale is the challenge. They can do so if they focus on getting paid customers and spending time on handling scale. By scale, I mean that the technology and the startup team must have the skills to handle different geographies, networks and industries seamlessly. Only then will large companies adopt IoT solutions because they see frictionless business and cost saving,” says V Ganapathy, CEO of Axilor Ventures.

There you have it. IoT 1.0 may have just ended, and startups may have to gear up for IoT 2.0, which is about scale and winning new business with long-term contracts.