[Funding alert] Bank of America extends line of credit to solar power-focussed Fourth Partner Energy

Hyderabad-based Fourth Partner Energy will be deploying the funds to grow its operational solar portfolio over the next 18 months.

Distributed solar power-focussed startup Fourth Partner Energy announced on Monday that Bank of America has extended a line of credit worth Rs 356.5 crore (or $50 million). The Hyderabad-based Fourth Partner Energy will be deploying the funds to grow its operational solar portfolio over the next 18 months.

Vivek Subramanian, Co-founder, Fourth Partner Energy, said:

“India has achieved under 15 percent of its ambitious rooftop solar target of 40 GW by 2022, and there is a dire need to accelerate capacity installation. For us, this access to capital from Bank of America is important not just to strengthen and expand our businesses at efficient costs, but also because this relationship can open the door to long-term capital solutions for the sector.”

While speaking to YourStory, Vivek said they will be immediately receiving 30 percent of the credit, and in the next 12 months they will be utilising the entire $50 million. He further said the freshly infused funds will be used to reinforce the company's position in the market.

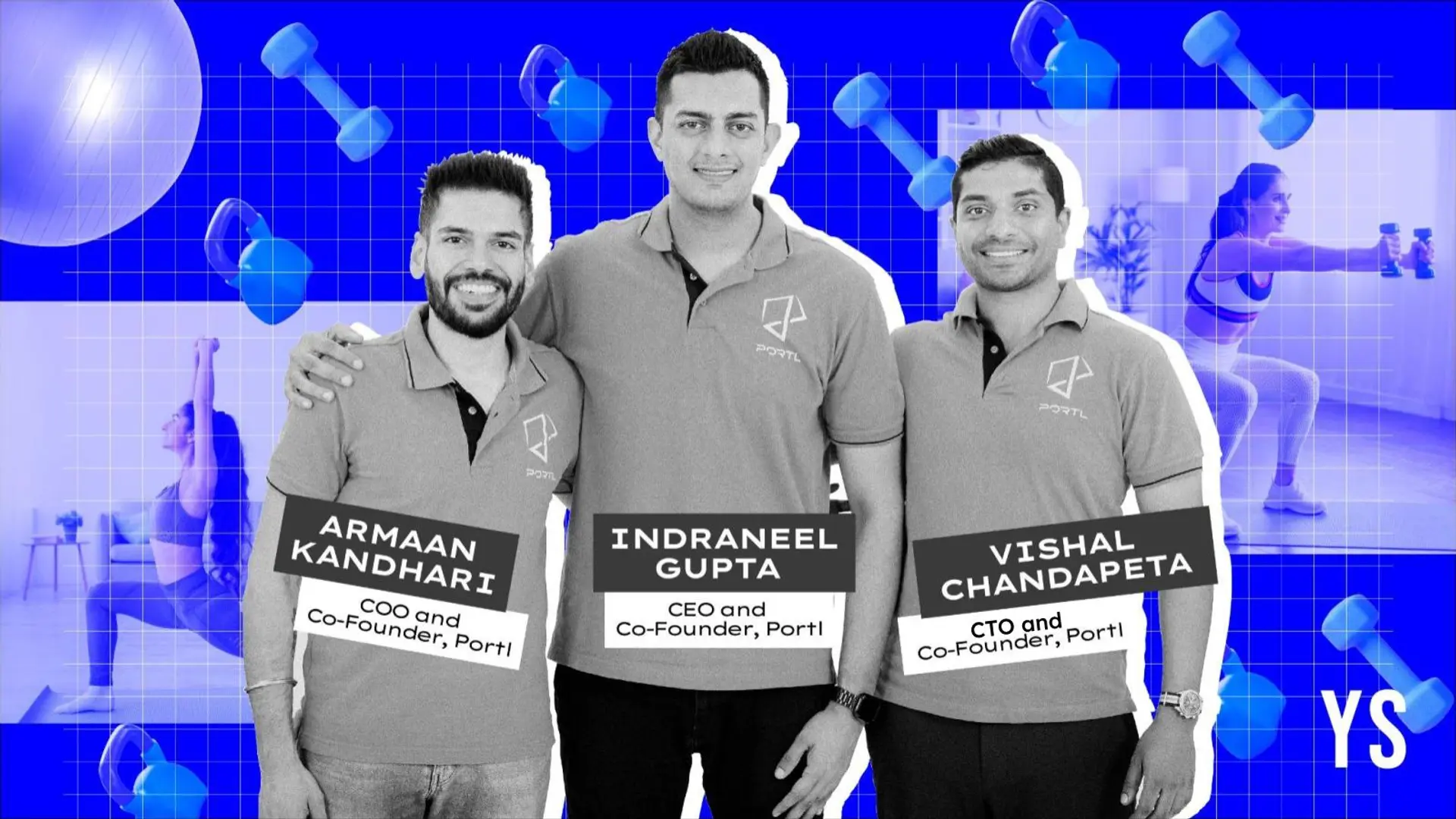

The startup is focussed on building and financing solar projects across the private and public sectors for commercial, industrial, and institutional entities. It was founded in 2010 by Vivek, Saif Dhorajiwala, and Vikas Saluguti.

Over the past nine years, Fourth Partner Energy has built end-to-end capability, including in financial structuring, design, turnkey execution, and servicing of captive solar assets, and is one of the leaders in this disruptive market segment.

The startup has a pan-India presence with headquarters in Hyderabad and 10 other offices in Bengaluru, Pune, Gurugram, Mumbai, Kolkata, Chennai, Coimbatore, Ahmedabad, Jaipur, and Ranchi.

To date, the startup has executed projects for 150 clients including Coca-Cola, Pepsi, Walmart, Schneider, Skoda, Ferrero, Airtel, D-Mart, and ICICI Bank.

With an operational portfolio of 200 MW installed capacity across 23 states, the startup has embarked on a journey to expand beyond distributed solar and into a variety of clean-energy solutions including storage and EV charging infrastructure.

Fourth Partner Energy claims to have helped reduce India’s annual dependency on coal by over 1.3 lakh tonnes and carbon emissions by 2.8 lakh tonnes – an equivalent of planting around 1.3 crore trees.

The startup is looking to add 220 to 250 MW of capacity to its operational portfolio this year and is actively pursuing the Open Access Group Captive model. The firm has commenced international operations across Sri Lanka, Vietnam, Bangladesh, Nepal, and Myanmar.

Earlier, in June 2018, Fourth Partner Energy had raised $70 million in equity from TPG’s The Rise Fund. Prior to that, Chennai Angels had invested in the company.

The most recent funding received is part of Bank of America’s Environmental Business Initiative, which deploys capital to low-carbon, sustainable business activities. Since 2007, Bank of America has directed more than $145 billion to these efforts through lending, investing, capital raising, and developing financial solutions for clients around the world.

“The need to mobilise and deploy capital to drive a clean-energy future is critical to accelerating the global transition to low-carbon, sustainable energy sources and advancing many of the United Nation’s Sustainable Development Goals,” said Anne Finucane, Vice Chairman of Bank of America, adding,

“India plays a vital role in curbing global emissions, and Fourth Partner Energy is driving that change. Through innovative financing products like this one, we can help scale projects that are reducing greenhouse gas emissions, as well as support India’s role in solar energy development.”

(Edited by Athirupa Geetha Manichandar)

![[Funding alert] Bank of America extends line of credit to solar power-focussed Fourth Partner Energy](https://images.yourstory.com/cs/2/3fb20ae02dc911e9af58c17e6cc3d915/yourstorysolarmp11576490564552png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)