10K investors, 500 channel partners: How this proptech startup is disrupting India’s fractional real estate market

Founded in 2019, hBits amalgamates real estate, finance, and technology to create a platform where retail investors can invest into a property with a foreseeable exit strategy.

Owning one’s own piece of real estate is often considered a milestone in a person’s life. The fundamental problem with such a view is that people are expected to single-handedly own the entire piece of the property themselves. Also, it is often taken for granted that such a property needs to be residential.

However, commercial properties can yield good returns on investment as well. JLL research indicates that 294 million sq ft (REITable asset from stock as of 2018 and includes Embassy Office Parks REIT) of office space stock would be eligible for Real Estate Investment Trust (REIT). “This would translate to a potential investment of $35 billion. This is certainly a big opportunity for Indian investors,” the report added.

There is a dearth of information in the market about how retail investors can invest in commercial properties like retail spaces, offices, data centres, cold storages, tech parks, and warehouses. These investments have historically been led by funds due to lucrative returns. However, technology has disrupted many industries, and real estate is not an exception.

Enter Mumbai-based prop-tech startup hBits. Founded in 2019 by Shiv Parekh, hBits amalgamates real estate, finance, and technology to create a platform where retail investors can invest money into a property with a foreseeable exit strategy.

hBits Founder Shiv Parekh

Such fractional ownership allows customers to own a fraction of Grade A real estate assets and benefit from the share of income, and any appreciation in the value of the asset. This works just like a mutual fund wherein you can invest and divest your share in the physical assets.

“You won’t be tying up large portions of your net worth into one piece of real estate. Instead, you will receive a return the same way you would for an equity stock, but by investing in a commercial property,” explains Shiv in a conversation with YourStory.

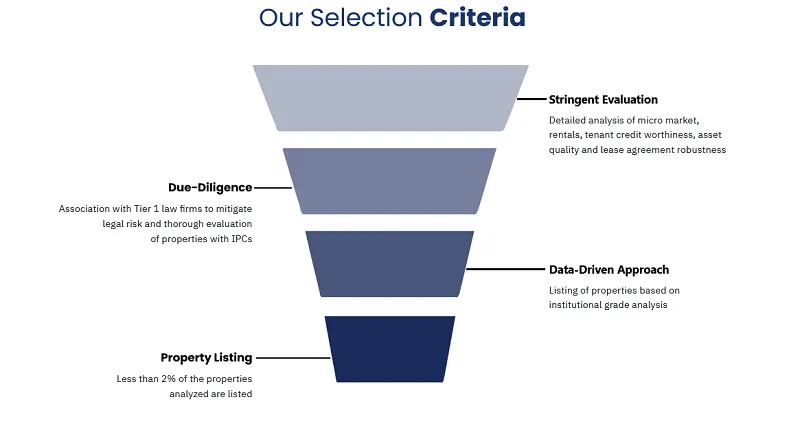

The platform takes care of several critical aspects of investing – right from discovery to liquidation. Helping investors with all preliminary processes such as due diligence, procurement of the title document of the asset, and overall asset and peer group comparison, fractional ownership platforms attract investors interested in building future income.

Within a year, hBits has established its presence in Mumbai, Delhi, and Bengaluru with a total team size of 15. The platform claims to have more than 10,000 registered investors and 500 channel partners on the platform.

“Our investor base comprises lawyers, NRIs, CAs, individuals in armed forces, and salaried professionals of 30+ age group with the majority of them coming from the technology, financial services, and entrepreneurial background,” he adds.

From science to real estate

After completing his undergraduate degree in Bachelor of Science, Engineering Physics at Stanford University, Shiv moved back to India in 2014.

“In Silicon Valley, I learned a lot about different and disruptive business models. I forayed into the real estate business at the age of 23, beginning with a company called WorkLoft, a co-working space, which I started in 2015. Today, Workloft has seven centres in Mumbai, with more centres coming up in other cities,” he narrates.

After scaling WorkLoft for two years, he left for Harvard University to complete his MBA, but kept going back to what he learned at WorkLoft.

“Usually, HNIs invest in real estate, but it’s the middle-income retail investors who do that as they try to diversify their portfolios and build multiple channels for wealth. This marked the foundation of hBits,” he says.

The name is derived from the combination of ‘H’ which is the 8th letter of the alphabet, and bits’ – the smallest units of data in computers.

“It takes 8 bits to make a byte, in the same way, that fractional ownership allows for multiple fractions to own one larger piece of property,” explains Shiv.

Business model, tech stack, and more

hBits allows investors to choose from numerous properties to invest in, while also offering personalised services, both online and offline. The startup allows customers to own hard assets at a low-ticket size, generating monthly income and capital appreciation.

Unlike existing income-generating products, hBits enables customers to own hard assets rather than paper assets. There is no lock-in period and the investors can exit or sell their fraction at any point, with the applicable capital gains tax.

“We earn money by charging a very low management fee of 1 percent per year on the amount invested,” says Shiv.

The platform uses blockchain and machine learning to approach commercial real estate investments. Machine learning enables the team to gather, store, and sort through current and historical rental data.

“We use blockchain to transparently disseminate information about our portfolio properties, simplify the ease and security of transactions, and perform transactions. There is no need for brokers or middlemen,” he added.

The startup also creates video content to break down the business model and returns for investors, explaining the new concept to investors.

Creating differentiation and product-market fit

Although fractional ownership is a new concept in India, there are a few startups already leading this space, including Fracsn, BRIKitt, , PropertyShare, Realx, Myre Capital, Assetmonk, Renivesh, and , among others. There are also other indirect competitors among retail investors like FDs, gold, and stocks.

hBits looks to differentiate itself here around four areas:

- Products: The products have high upside potential due to rental income and capital appreciation with minimum downside risk.

- Technology: The platform is completely tech-enabled and accessible to individuals globally.

- Experience: hBits has a strong team in all functional areas like digital marketing, real estate and people from Ivy leagues, IITs, IIMs, and professionals with over 100 years of cumulative experience in international property consulting firms and other MNCs. Consequently, they rely on having industry knowhow, established relations with IPCs and brokers, and experience of directly dealing with the tenants.

- Culture: The leadership team at hBits is looking to build a cross-team collaboration, inspire team empowerment, and build an inherent culture at the startup.

The way ahead

The main challenge for hBits was educating the investors about the fractional ownership concept. It is a relatively new concept in India. However, as they add more commercial assets to their portfolio, more people are slowly realising the potential value of such an investment.

Shiv shared that COVID-19 gave the startup a great opportunity to pick up assets, because while asset quality was still good, the developers who owned them felt pressure in COVID-19 due to the overall business situation to deleverage, and so, they were able to get assets at good prices.

According to a CNBC report, fractional ownership is already a $5 billion beast in India. It is a perfect entry point for new investors as it offers a uniquely safe and secure investment option with long-term income and confirmed monthly cash flow in an otherwise high-risk market.

Going forward, the team aims to achieve Rs 100 crore in investments by March 2021 and Rs 500 crore by December 2021 while establishing its presence in six cities

“We have already achieved investments of Rs 60 crore in the last two leased properties, and are in the process of closing investments for our current deal worth Rs 45 crore before March 31, 2021. Our tenants for our most recent deal are and ,” tells Shiv.

Edited by Kanishk Singh