Founded by ex-Google and Freshworks execs, this startup offers affordable insurance for SMEs, startups

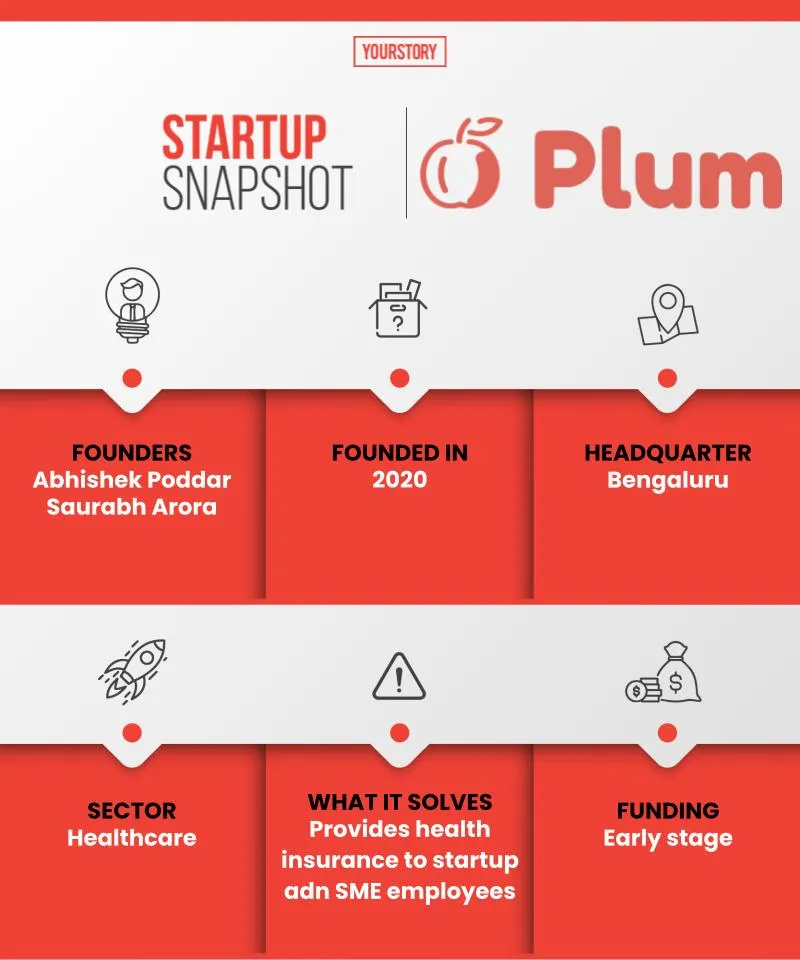

Bengaluru-based Plum Insurance provides insurance to SMEs and startups within 60 minutes. It aims to accelerate health insurance adoption in India by making employment insurance accessible, affordable, and usable.

The coronavirus pandemic has left a mark on almost all sectors and industries in the country, and health insurance has definitely taken the front seat.

Back in 2020, Abhishek Poddar and Saurabh Arora found a massive gap in the employee health insurance space. They felt the most important HR benefit for any employee from an organisation is health insurance, and most are unaware of its benefits.

“We dug deeper into the market and saw a large opportunity. Insurance in India is deeply under penetrated. This is because very few people are able to buy health insurance, and many depend on their employers to provide health insurance to them and their families. It is the only scalable way for India to accelerate the adoption of health insurance,” says Abhishek.

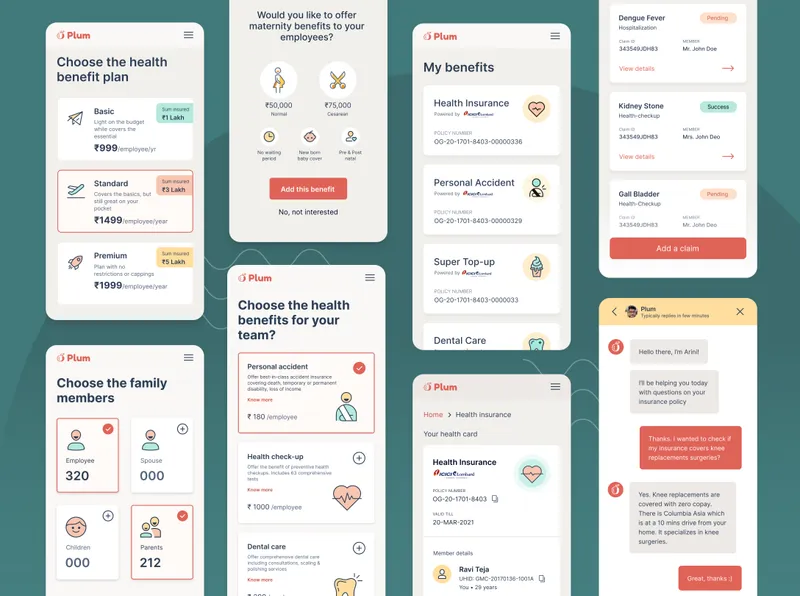

The Plum Insurance App

The duo, who met through common friends, started discussing the gap in the health insurance space and realised that most SMEs and startups don’t get the right health insurance solutions for their employees.

Abhishek and Saurabh felt they could build a tech product in the space given their combined experience. This got the duo to start Insurance in 2020. It is a Bengaluru-based group health insurance startup that works with corporates.

Working with nine insurance companies at present, Plum on boarded 100 companies as customers within just four months of launch. Today, the startup claims to be growing at 30 percent month-on-month. Some of its prominent clients include , , , and .

The journey and workings

Both Abhishek and Saurabh had started up prior to starting Plum. Abhishek a Stanford graduate had co-founded Hypertrack, and had worked at Google, and Saurabh, had founded Airwoot, which was acquired by Freshworks. After working at Freshworks, he went on to found blockchain startup Starteum.

According to the co-founders, Plum understands the needs of a corporate and guides them to set up their group health insurance in less than 60 minutes. It provides employees with improved health benefits, including doctor consultations, health check-ups, fitness and yoga, mental wellness, nutrition, and dental care. The platform, which has a registered intermediary with IRDA and a registered broker for IAGIA, enables ease of experience for employees with guided claims support.

The company has to enter basic details about the company on the platform, and Plum recommends three different insurance plans. However, these can be tailored and companies will get the pricing in real-time. It provides the payment details, and once you make a payment, your plan is activated and your employees get on boarded.

However, it took the duo six months to do their initial groundwork and research. They spoke with the stakeholders — insurance people, HR ecosystem, and corporates.

“The idea is to understand how the health benefits are procured, and also understand what employees thought of the health insurance and benefits,” adds Saurabh.

The challenges

Abhishek explains that health insurance in India has not changed much in the past two decades. He says it takes 60 to 90 for a company to buy health insurance plans for the employees.

“There is no concept of MRP when it comes to health insurance. You have to negotiate really hard. An employer may pay 2x or 3x of what the employer next door will be paying for the exact same health insurance and the same size of the company and the exact same benefits,” says Abhishek. This is primarily because there is no transparency.

Also, the market is riddled with traditional broking firms, which are over 100 years old. They end up selling for large corporates. “These companies do not care about small companies - 10 to 30 people strength or even 50 to 100 people,” says Abhishek.

But according to Abhishek the number of people employed in India is dominated more by the SME and startups in the country. Abhishek says Plum Insurance focuses on this segment and makes it accessible to the smaller companies.

According to the startup, one of the problems was to find the right kind of insurance product for the demography at the right price. There is a core challenge with regard to the accessibility and affordability of the insurance.

The next problem was how do you make insurance companies that were previously providing group health insurance to provide insurance only to 100 plus employed companies. And how do you provide that at the kind of price point that is affordable?

“Our mission is to accelerate health insurance adoption in India by making employment insurance accessible, affordable, and usable,” adds Abhishek.

Market and future

According to IBEF, the health insurance sector was pegged to be close to $280 billion in 2020.

Plum Insurance has raised a seed round from Sequoia Capital and is also a part of Sequoia’s Surge programme for early-stage startups. It has partnered with four of the largest insurance players and is exploring partnerships with more insurance companies.

“Every company should be able to provide health insurance to their employees and their families. But most employees in India today are not covered. Plum aims to address this massive gap by re-imagining group health insurance, making it scalable, affordable, and transparent. We have been deeply impressed by the caliber of the founding team and their approach to creating a platform that provides frictionless health insurance to all Indians,” says Rajan Anandan, Managing Director, Sequoia India.

Plum Insurance gets brokerage from insurance companies. It is also a registered broker with IAGIA, and get margins between 7.5 percent and 9.75 percent. Some of its competitors include Nova Benefits and Acko.

“Our first milestone is to get 10 million lives insured by 2025. How can you keep building self-insurance, more and more affordable for the SMEs that we are targeting,” says Abhishek.

Edited by Megha Reddy