Women’s innerwear market is pegged to touch $12B by 2025: RedSeer report

A report by consulting firm RedSeer said that the female innerwear market is expected to become a $12 billion opportunity in the next five years in India.

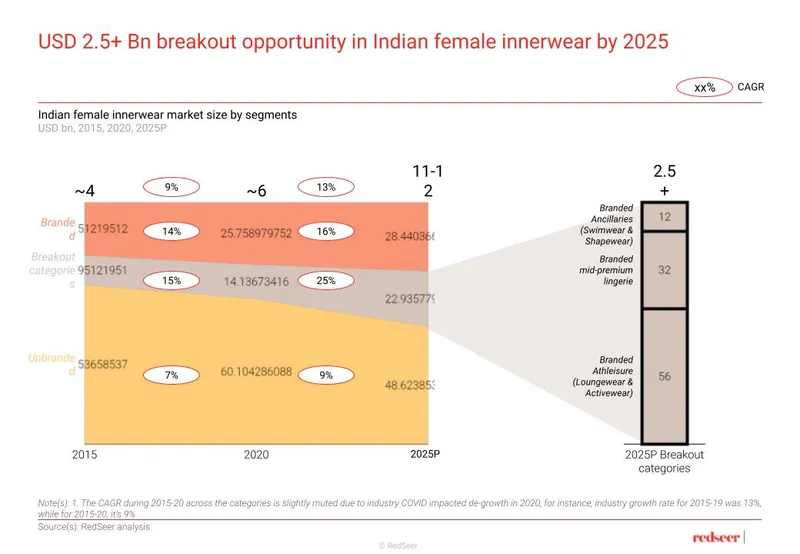

The homegrown consulting firm RedSeer’s report - ‘Female innerwear’s USD $12 billion opportunity’, stated that the women’s innerwear market in India was at $6 billion in 2020 and will be touching $12 billion by 2025, marking a 2x rise.

The report said – “It [Innerwear] is among the fastest-growing apparel categories. This market comprises lingerie, athleisure (loungewear and activewear), and ancillaries such as shapewear and swimwear. In this segment, the online women’s innerwear market will be growing at 6x in the same period to touch $1.2 billion in five years.”

Anil Kumar, Co-founder and CEO of , said,

“There have been clear shifts in consumer behaviour favouring the use of casual or leisure wear. This was further enhanced by the pandemic as consumers spent time indoors and working from home, so they opted for more comfortable wear, spent more for better quality and explored online options.”

“Having experienced the convenience and quality of online products in the category, a significant number of customers are likely to stick – which is further validated by our consumer research. Overall, online purchase sentiment has increased by 5-10 percent across categories, which means that Direct-to-Consumer brands have a significant opportunity going forward,” he added.

According to the report, the five reasons for this shift are:

- Higher incomes, discretionary spending leading to higher consumption

- More young women joining the workforce

- Influence of social media

- Convenience-led online shopping

- Increased exposure to better brands, new trends and occasions, and willingness to try new styles

Increasing growth in Tier II cities

The report explained that there the growth of the female innerwear market in Tier II+ cities is significant and is estimated to be 1.5x that of the metro cities. In Tier II+ cities, the major growth factors are:

- Digital penetration - India’s digital penetration growth has been one of the fastest in the world. With a projected user base of over 975 million internet users and 800-850 million smartphone users by 2025, the next wave of growth is expected to be driven by smaller cities and towns.

- Brand awareness - As brands penetrate deeper into smaller cities, there will be overall more awareness about products and offerings, leading to higher growth of these brands in the smaller cities. The brands will see consumers buying economical products but relying on the brand image. This will benefit the brands as they onboard new customers.

“In the metros and Tier I cities, the users are more of mid-high income, younger cohorts. The growth in metros will come from higher-order frequency of existing users as well as increasing adoption from the lower-income and the higher-age cohorts. Whereas in the smaller towns, adoption is still largely among the young, high-income, internet-savvy cohorts, with a vast majority of the population still not penetrated. Hence, a large portion of the next-wave users are likely to be value users from the Tier II+ cities,” said the report.

Business models that stand out

The women’s innerwear market is divided into –

- Offline focused brands like Amante, Enamor, and Triumph that also have an online presence.

- Broader ecommerce players like Flipkart and Amazon that also have women’s innerwear as a specific category, and online marketplaces like Myntra, Ajio that have different fashion offerings.

- Digital-first omnichannel players - These are innerwear focused players, with a very focused target group of customers, and value chains customised accordingly. For instance, Clovia and Zivame.

Of these, in the online models, digital-first omnichannel players have the highest consumer satisfaction, with a Net Promoter Score (NPS) of 49 percent, which was much higher than 38 percent for online fashion marketplaces.

The report stated that within the branded segments, there are a few breakout categories that are likely to witness the highest growth, and is estimated to be a $2.5+ billion opportunity by 2025.

Credit: RedSeer

They are -

- Branded mid-premium lingerie (the innovative, affordable yet high quality lingerie increasingly preferred by women),

- Branded athleisure (includes loungewear and activewear),

- Branded ancillaries (includes swimwear and shapewear).

The reason for this shift towards these categories is that new-age brands have been innovative around product design and have optimised supply chains to bring very high-quality products (comparable to premium brands) at affordable prices.

There also is a significant investment made by the brands towards educating customers about such products.

The category is evolving into ‘casuals at home’ or ’at home smart clothing’ with increasing use-cases of athleisure and nightwear merging from a consumer behaviour standpoint

Athleisure and activewear are also benefiting from tailwinds like a jump in aspirations, people becoming fitness conscious, higher engagement with gyms, and specialised activities like cycling amongst others.

The report added that international brands like Reebok, Nike, and Puma have been present in India for over two decades and have made a considerable investment in education and awareness around the category. The brands are widely distributed and are now often alternatively used as casual wear.

However, the market is still highly fragmented with up to top 15 brands accounting for approximately just seven percent of the market, which shows a clear opportunity for brands to establish a strong position.

The branded market is expected to grow 2x as fast as that of the unbranded market by 2025. The growth of branded products is expected to be driven by:

- Easily accessible brands – With new-age brands introducing new trends and an array of offerings, it lures consumers who typically settled with local brands.

- Lifestyle shifts - Safe and accessible infrastructure has led to women feeling increasingly comfortable in engaging in physical activities like sports, yoga, and gym.

- Value-addition - Further, with better understanding and awareness about style, shape, comfort, and utility of various innerwear products, women are increasingly adopting more premium and branded offerings.

Edited by Kanishk Singh

![[Funding alert] Women’s activewear brand BlissClub raises $2.25M led by Elevation Capital](https://images.yourstory.com/cs/2/11718bd02d6d11e9aa979329348d4c3e/Imagewf2p-1607509774638.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)