SoftBank expects further upside from public listing of Paytm, Policybazaar

Patym and Policybazaar are portfolio companies of SoftBank, and both have announced plans to go public.

SoftBank is expecting further upside from the public listing of its portfolio companies in India like Paytm and Policybazaar, according to a top executive of the Japanese private equity major.

Navneet Govil, Managing Partner and Chief Financial Officer, SoftBank Investment Advisers, made these comments during its first quarter results, according to media reports.

SoftBank is one of the leading investors in the Indian startup ecosystem, having deployed around $2.46 billion in the first six months of the year. SoftBank’s Vision Fund unit reported a net profit of $2.14 billion for the first quarter, making gains from the public listing of its portfolio companies.

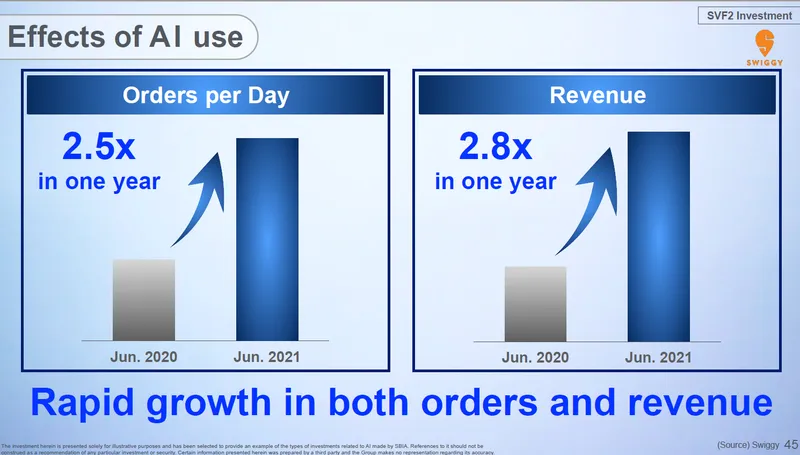

Performance of Swiggy. Pic Credit: SoftBank first quarter performance presentation

In the first quarter, Vision Fund unit gains included 310 billion yen from selling shares in investments such as delivery firm DoorDash and Uber.

At the same time, these gains have also been tempered with new regulations in China, which have deeply impacted the shares of technology companies like Alibaba and Didi Chuxing.

Reuters quoted Navneet as saying, “Having a large public portfolio introduces volatility, but at the same time, it allows us to continue to monetise in a very disciplined manner."

These developments come when the Indian startup ecosystem is warming up to the stock markets through initial public offerings. The successful listing of food tech startup Zomato has given the booster shot.

Other companies looking to go public soon are Paytm, Policybazaar, Nykaa, and Mobikwik. The most awaited IPO would be of Paytm, as it aims to raise more than Rs 16,000 crore where SoftBank is a major investor through its Vision Fund 1.

More than two-thirds of the portfolio of the first $100 billion Vision Fund is listed or exited. SoftBank has distributed $27 billion to its limited partners since inception.

SoftBank is also ramping up investing through Vision Fund 2, to which it has committed $40 billion of capital, with the unit making 47 new investments worth $14.2 billion in the April-June quarter alone.

Edited by Anju Narayanan