Online festive sales in 2021 likely to touch $4.8B in GMV in week one: RedSeer report

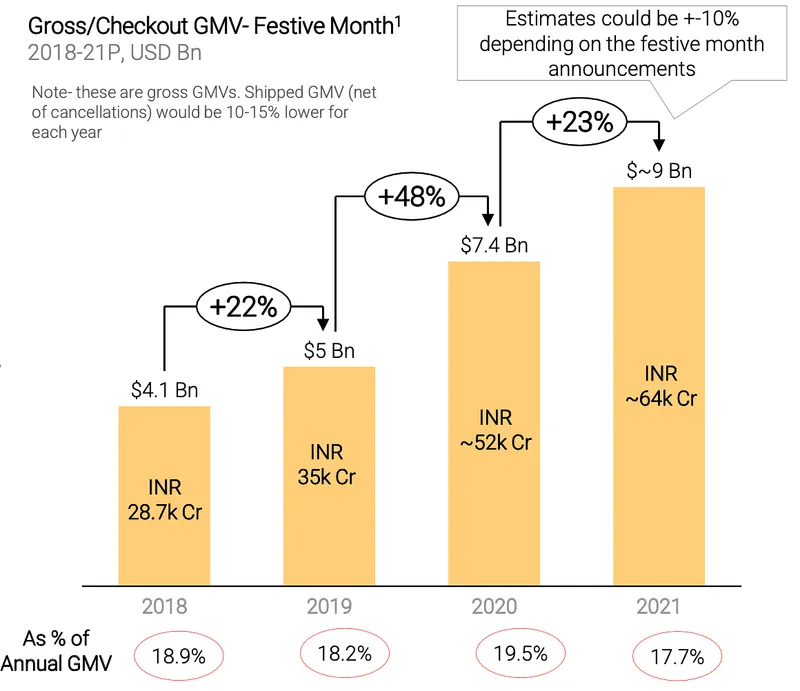

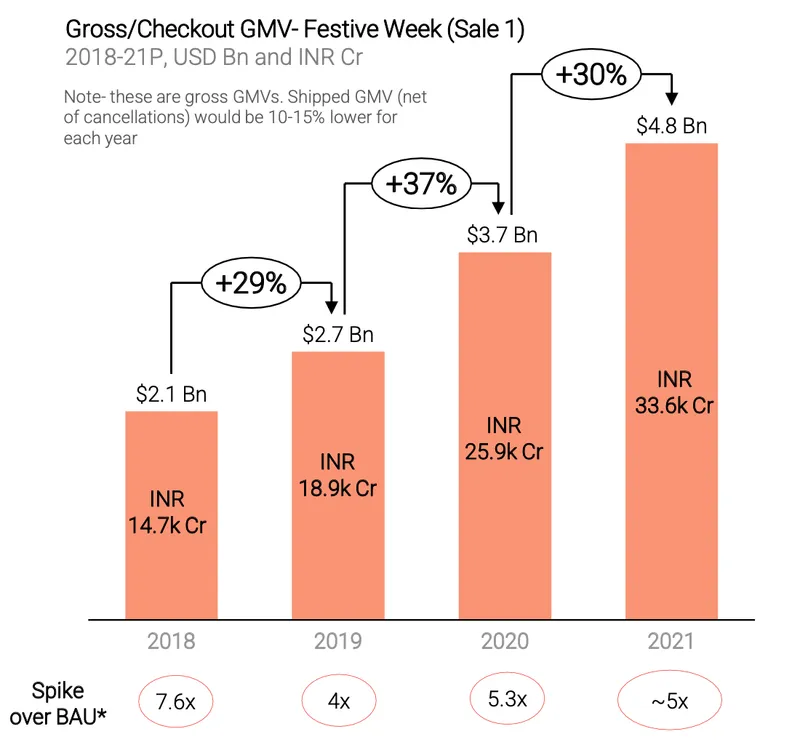

A RedSeer report estimates that online festive sales in 2021 will see a 30 percent YoY growth, touching a $4.8 billion GMV in the first week, and reaching $9 billion after the festive month.

According to consulting firm RedSeer, the 2021 festive sales GMV is expected to grow 30 percent year on year to $4.8 billion during the first week of the festive season, and potentially clock over $9 billion GMV during the entire festive month.

In its ecommerce Festive Season Report, the firm said this is a 23 percent increase from last year wherein the players clocked a GMV of $7.4 billion. The report added that the growth will be significantly driven by the accelerated online adoption which has been witnessed as an effect of COVID-19.

Data by RedSeer

Bullish on festive sales

The overall online GMV is expected to touch $49 billion-52 billion, a growth of 37 percent from last year, primarily driven by strong consumer funnel expansion and the high adoption of online shopping across categories post COVID.

“We believe that the 2021 online festive sales will continue to ride on strong tailwinds of greater consumer digital adoption supported by an increasingly positive macro and consumption sentiment after the second COVID wave has passed," said Mrigank Gutgutia, Associate Partner at RedSeer.

"At the same time, we see strong bullishness in sellers towards online festive sales as approximately 80 of them believe that the festive sales will enable them to drive strong sales growth and make up for the losses during COVID.

"Driven by the above, we expect strong 30 percent y-o-y growth in festive sale week in 2021 to reach $4.8 billion in gross GMV with growth across categories, and setting the stage for a strong year for ecommerce in 2021,” he added.

The report added that the online customer base has been rising throughout the year, driven by accelerated digital adoption post COVID. "We expect this expanded customer base to reflect during the festive sales period as well."

Focus on Tier 2 and beyond

The report stated that the growth of Tier 2+ shoppers would continue, driven by growing reach and targeted selection and supported by growing expansion of the affordability constructs.

Tier 2+ shoppers are expected to comprise 55-60 percent of the total shopper base this year, similar to or higher than 57 percent during the 2020 festive days.

Categories wise, mobile would dominate the sales with new launches, electronics are expected to see the second highest demand driven by the wide range of selection and easy payment options among other factors.

“Fashion is also expected to see a steady recovery this festive season with greater outdoor mobility of consumers and steady rebound of fashion and office wear. The report finds that the sellers are very bullish on this year’s sales and are looking to recover the losses they suffered due to COVID.

"Nearly 80 percent of sellers agree that festive sales will play a key role in recovery from COVID losses while 70 percent agreed that the bigger online players have been supportive and positive, which led up to the sales event,” the report said.

Edited by Teja Lele