How India’s Central Bank Digital Currency is different from crypto

Central Bank Digital Currency (CBDC) is a concept explored by China, Sweden, countries in the EU, and various other large economies for the last few years.

Central Bank Digital Currency (CBDC) is a concept explored by China, Sweden, countries in the EU, and various other large economies for the last few years.

A CBDC is the virtual form of a government’s fiat currency. It is issued and regulated by local authorities. It is run on a digital ledger system, which may or may not be blockchain-based.

In India, the Reserve Bank of India (RBI) has been toying with the concept and is looking for a phased implementation for CBDCs in the next year.

“Money is evolving, and we are now seeing the concept of digital money emerging from the crypto revolution. There is now a fiat version of digital currency, which are sovereign issued and act as legal tender. This is known as CBDC,” says Tanvi Ratna, Founder and CEO, Policy 4.0, a digital currency think tank.

In fact, crypto has long aspired to act as digital currency, but it is increasingly seen as assets for investment or tokens for performing transactions on blockchains.

In a conversation with BlockchainStory, Tanvi explains the nitty-gritty of CBDCs.

Check out YourStory's full coverage of TechSparks 2021 here.

Click here to download YourStory’s Tech50 report.

The Interview

A chef, content creator, MasterChef India judge, author — Chef Ranveer Brar is a man of many talents. Watch this episode of #InfluencersInc by YourStory to know the chef's secret recipe of success as he delves into his journey in the content creation space while sharing some quick culinary tips!

Editor’s Pick: Monday Motivation

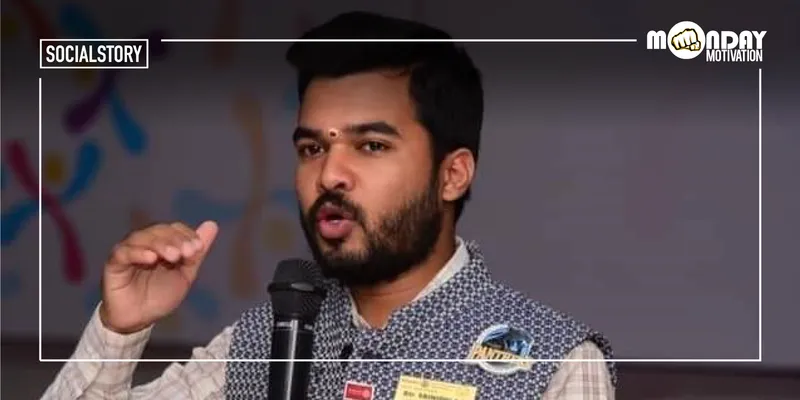

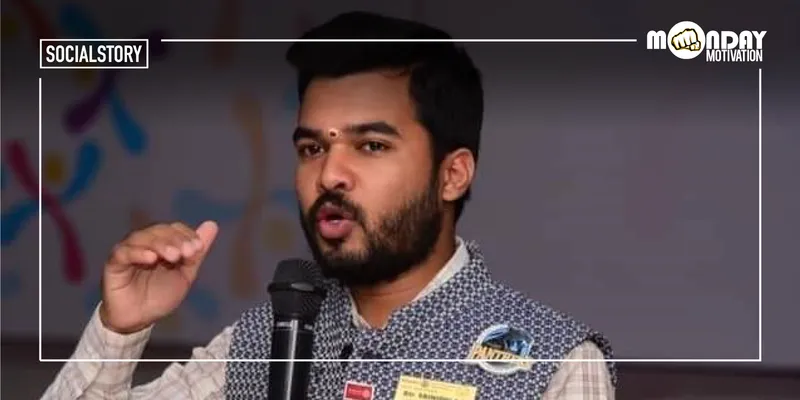

According to the World Bank, about 129 million girls, around the world, are out of school due to poverty, child marriage, and gender-based violence. In India, about 23 million girls drop out of school every year due to menstruation.

Srinidhi SU — one of the six global Rotary People of Action: Champions of Girls’ Empowerment — has been working on the betterment of women since 2018. A teacher by profession, he has devoted his non-working hours to changing the way people talk about menstruation. Read more.

Startup Spotlight

A hyperlocal grocery delivery startup by two Stanford dropouts

Nineteen-year-old entrepreneurs Aadit Palicha and Kaivalya Vohra returned to Mumbai from Stanford University last year and had a difficult time getting groceries delivered in their area. The teen entrepreneurs had collaborated on several projects, including a ride-hailing commute app for school kids.

Disheartened by the execution, the duo found an opportunity in the hyperlocal grocery delivery market and launched (formerly known as Kiranakart) in April this year. Read more.

YS Design team

News & Updates

- Tesla CEO Elon Musk is asking on Twitter whether he should sell 10 percent of his stock in the electric-vehicle company amid pressure in Washington to increase taxes on billionaires like him.

- Ola Financial Services (OFS), a subsidiary of Ola, is looking to expand its insurance business internationally to support the company's mobility service through products designed for the UK and Australia and New Zealand (ANZ) markets.

- The second week of November will see very heightened activity from the Indian startup ecosystem as the initial public offerings (IPOs) of the likes of , , and are at various stages of public listing.

- Electric scooter rental startup Bounce is making an investment of about $100 million over the next 12 months across manufacturing of e-scooters and expanding the battery swapping infrastructure, co-founder and CEO Vivekananda Hallekere said.

Before you go, stay inspired with…

“I strongly believe that today’s girls are the bearers of tomorrow. They need to be healthy. There should be a full stop put on the taboo around periods.”

— Srinidhi SU, Rotary People of Action: Champions of Girls’ Empowerment

Now get the Daily Capsule in your inbox. Subscribe to our newsletter today!