LIC IPO oversubscribed nearly 3X; issue closed

The policyholders' portion was subscribed 6X, while QIB subscribed 2.83X, as per LIC's latest update at 4:39 pm IST. LIC will make its debut a week from today.

Life Insurance Corporation of India's mega IPO, slated to be the country's biggest so far, was oversubscribed nearly 3X on the last and final day of its offer.

The insurance giant set a price range of Rs 902 and Rs 949 for the issue of 162 million IPO shares, which have already been trading at a premium in the unlisted markets.

The state-owned insurance company, which has 13 lakh+ on-ground agents, received applications for around 473.5 million shares, as per a latest update.

Its QIB (Qualified Institutional Buyers) portion was subscribed 2.8 times, policyholder 6X, and employees 4.36X. Retail investors interest in the subscription was nearly 2X than the number of shares reserved.

The strong demand for LIC came despite its shares losing steam in the grey markets. Last week, LIC was trading at a nearly 7 percent or Rs 80-Rs 85 premium, but the rapid declines in the capital market, caused by concerns around runaway inflation in India, depleted much of its premium.

LIC's IPO size had been reduced for similar reasons as well. Earlier, the government was looking to dilute 5 percent in the insurance giant, but downsized it due to concerns around Ukraine-Russia war. The current issue size represents 3.5 percent of the government's stake in LIC. Net proceeds are expected to be Rs 21,000 crore.

LIC is expected to debut on May 17, 2022, on both the BSE and the NSE.

ALSO READ

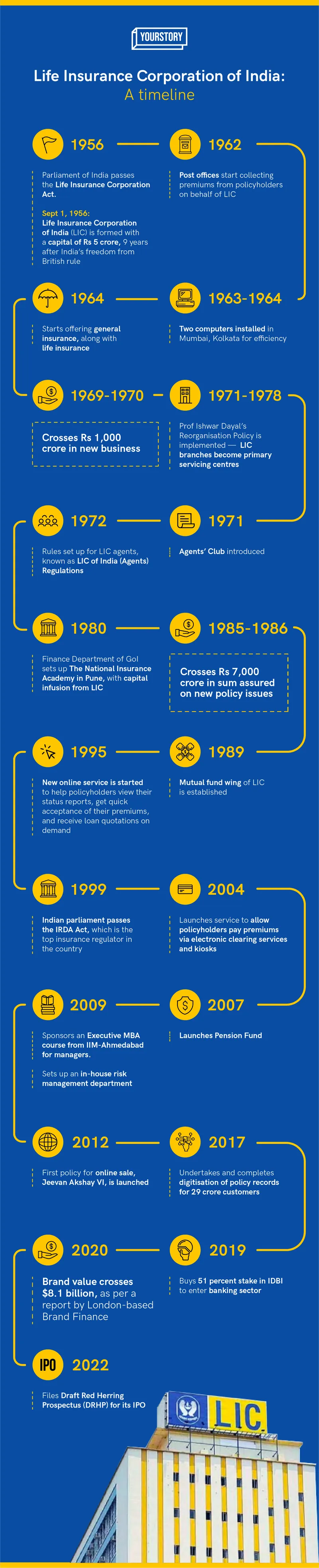

Here's a quick look at the insurance behemoth's history:

(Design credit: Daisy Mahadevan, Team Design @ YourStory)

Edited by Kanishk Singh