Delhivery reports 30% YoY growth in revenue in Q1FY23

Delhivery said revenue from Express Parcel services grew 34% YoY from Rs 785 crore in Q1FY22 to Rs 1,051 crore in Q1FY23 on the back of robust shipment growth and new client acquisitions.

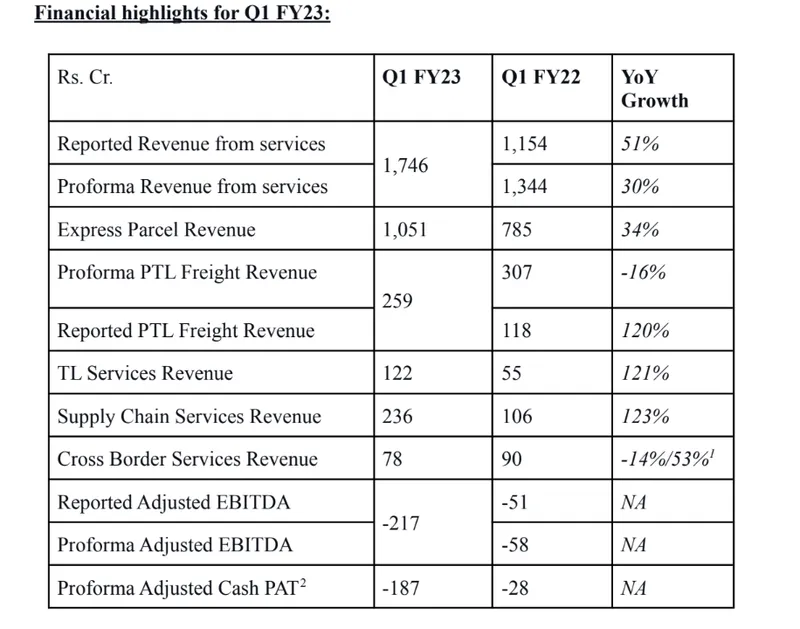

Gurugram headquartered Limited has reported Rs 1,746 crore revenue from services in Q1FY23, up 30% YoY from Rs 1,344 crore (proforma) in Q1FY22.

The company, which was listed earlier this month, also reported a marginal rise in net loss at Rs 120 crore for the fourth quarter ended March 31, 2022.

The company reported that revenue from Express Parcel services grew 34% YoY from Rs 785 crore in Q1FY22 to Rs 1,051 crore in Q1FY23 on the back of robust shipment growth and new client acquisitions.

Express Parcel volumes grew 50% YoY from 102 million shipments in Q1FY22 to 152 million shipments in Q1FY23. Revenue from Part Truckload Services were lower by 16% YoY at Rs 259 crore in Q1FY23, from Rs 307 crore (proforma) in Q1FY22.

Sandeep Barasia, Chief Business Officer and Executive Director, Delhivery, stated, “We continue to see strong demand for our integrated supply chain solutions across industry verticals, including auto, industrial goods, chemicals, and consumer durables."

According to the press statement, Truckload Service Revenue grew 121% in Q1FY23 over Q1FY22 and the company added over 1,000 new fleet partners to its Orion marketplace. Cross Border Services grew 53% YoY in Q1FY23 as the company continued to strengthen its market position through its partnership with global leader FedEx Express, which is also a minority shareholder.

Overall, Delhivery incurred an adjusted EBITDA loss of Rs 217 crore in Q1FY23 vs adjusted EBITDA loss of Rs 58 crore (proforma) in Q1FY22.

Image Credits - Delhivery

“Our EBITDA margins were temporarily affected through the integration phase with Spoton as a result of inherent seasonality in the PTL business, slightly slower than planned phasing of customer restarts, and retention of capacity to maintain service quality and in anticipation of H2 volumes”, said Abhik Mitra, Chief Customer Experience Officer, Delhivery and CEO of Spoton.

“H1 is the period during which we commission new capacity in preparation for seasonally higher volumes in H2. As PTL Freight volumes continue to recover and Express Parcel shipments continue to grow, we expect capacity utilisation to improve,” said Ajith Pai, Chief Operating Officer, Delhivery.

Sahil Barua, Managing Director and Chief Executive Officer, Delhivery, stated that the company continues to be "extremely well capitalised, with cash and investments of over Rs 6,000 crore as of June 30, 2022," and will continue to "invest in building infrastructure, technology, and operational capacity to deliver high-quality service to our customers”.

(This story has been updated.)

Edited by Teja Lele