From Nykaa to Paytm, India’s internet firms remain under pressure on the bourses

Uncertainty over the profitability, business models, and revenue projections of Zomato, Nykaa, Policybazaar, Delhivery, and Paytm, have weighed down their shares well below their IPO values.

The chill of November has enveloped India’s leading internet companies , , , and , as they struggle to hold their own on the stock markets amid massive sell-offs by investors uncertain about their growth trajectories.

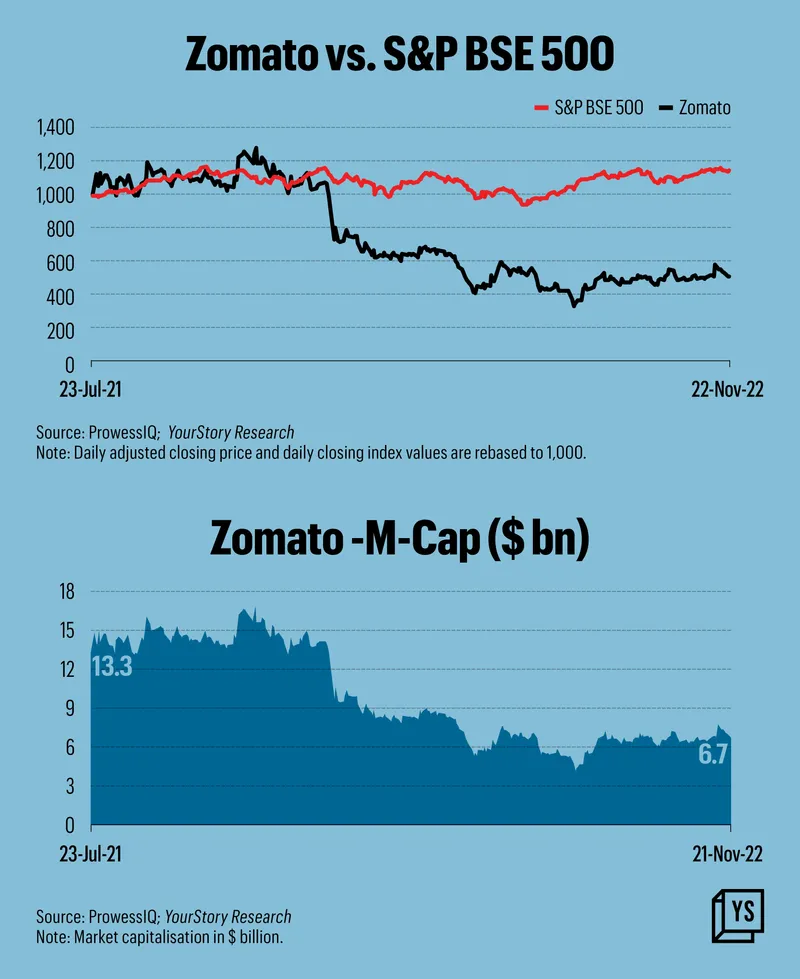

As private entities, these companies were among the most valued in India’s startup ecosystem. Exits had been rare, particularly via IPOs, until food ordering platform Zomato hit the market in July last year and paved a path for other startups to go public.

But these companies have mostly struggled to make the transition as successful public-listed entities.

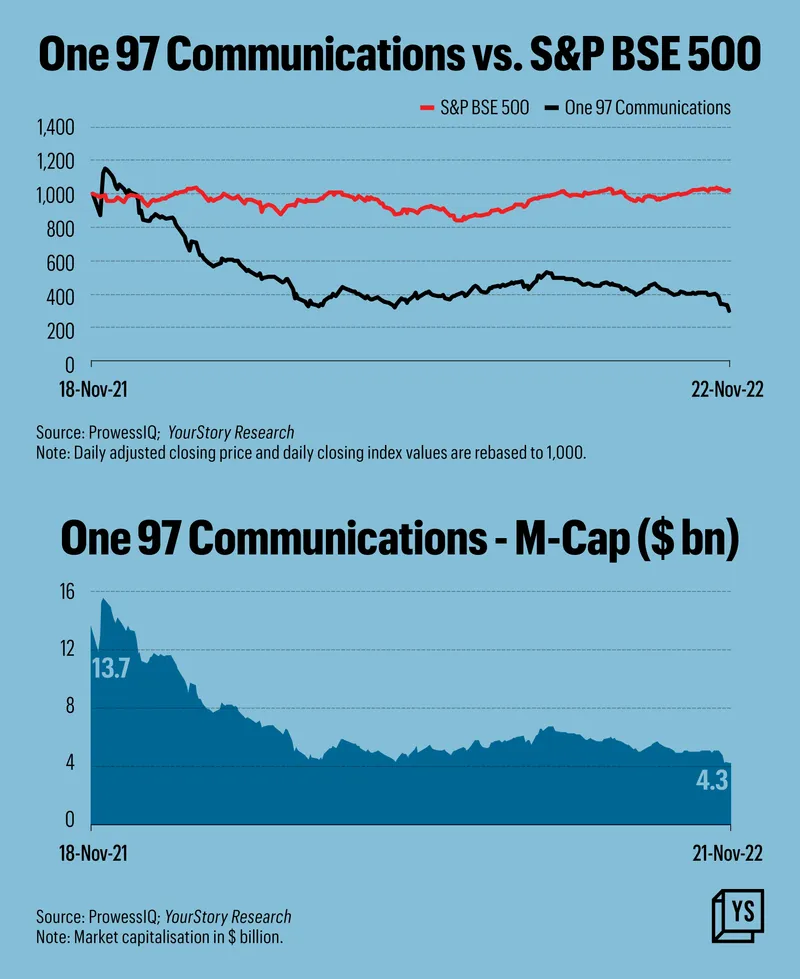

Take the case of fintech giant Paytm. The Rs 18,300-crore initial public offering of Paytm’s parent One97 Communications was one of the largest ever public issues in India. But the company's shares have been dropping since debut. On Tuesday, Paytm’s share price plunged 11.44% to end at Rs 475.55 apiece, its lowest ever.

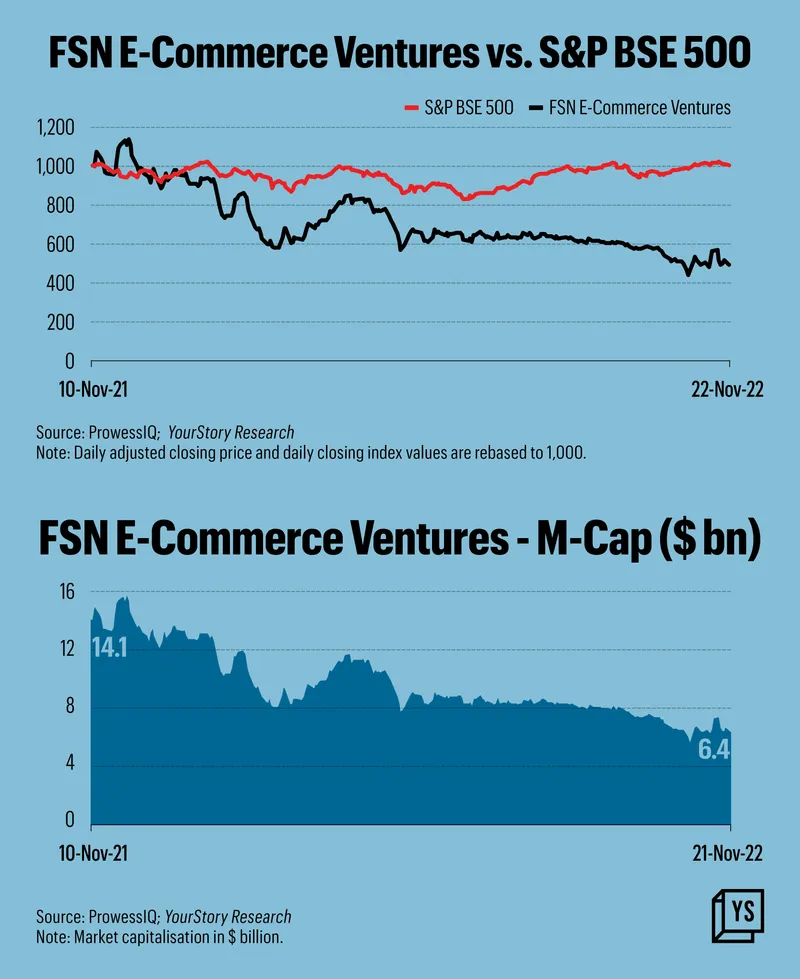

The share prices of all the listed internet companies mentioned above are trading well below their IPO prices, though Zomato and fashion and beauty retailer Nykaa had shown a sharp rise during the initial days of their listing.

The reasons for this fall in their share values are manifold.

End of lock-in period

The IPO lock-in periods for four companies—Nykaa, Policybazaar, Paytm, and Delhivery—expired or are expiring this month, allowing their key pre-IPO investors to sell their shares.

This has seen some hectic buying and selling in these counters.

While Paytm’s key shareholder, SoftBank, sold part of its holdings, in the case of Nykaa (FSN E-Commerce Ventures), Lighthouse India and TPG sold their shares recently, triggering an immediate drop in the share price.

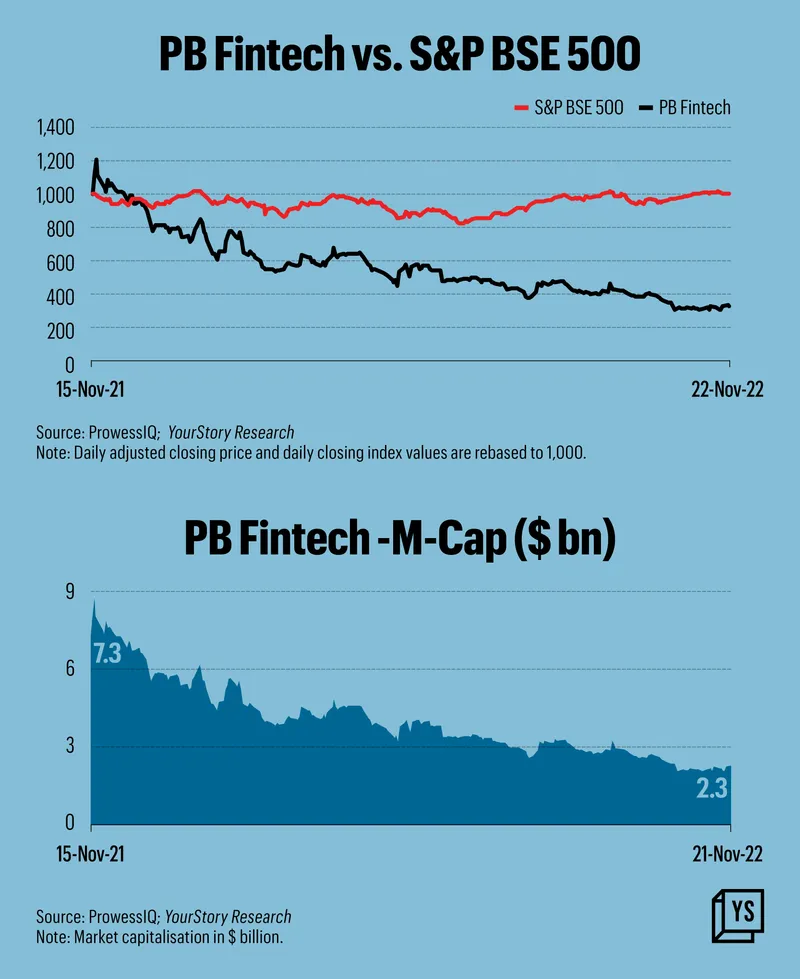

Tiger Global has also divested a certain stake in insurance aggregator Policybazaar (PB Fintech).

Question mark on profitability

A growing concern among the investors has been on the profitability quotient of these companies.

Except for Nykaa, none of the companies have registered any profit, raising doubts among the investors.

Unlike the stock markets in developed economies, the general perception among Indian investors is that there is a higher premium given to profitability and dividends.

Growth projections

Despite these companies posting reasonably healthy revenue numbers, there is a perceptible lack of clarity on their future growth trajectories.

In some cases, there is confusion about the business model of these companies and whether they can depend on one single source of revenue.

For example, Macquarie Group analysts have flagged Mukesh Ambani’s Reliance Industries venturing into the financial services segment as posing a significant growth and market share risk for companies like Paytm.

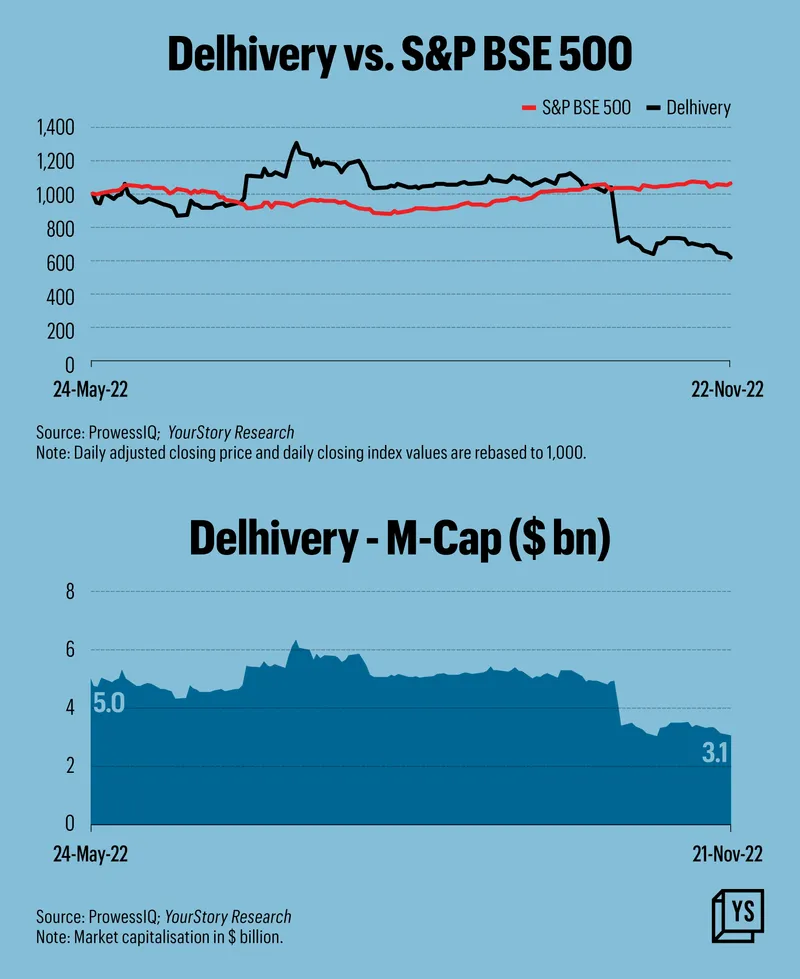

The shares of these companies are struggling to rise despite the broader stock market outperforming when compared to global peers.

On a positive note, ICICI Securities, in a paper on Delhivery, said, “We believe Delhivery’s current valuations provide a great opportunity to BUY this high-quality stock. The risk-reward skew at current market price is very attractive in our view.”

According to the brokerage house, the logistics company’s low-cost structure, technology moat, and high brand recall are some of the factors for the positive rating.

[Infographics by Chetan Singh]

Edited by Megha Reddy