Mamaearth parent files IPO papers

The company plans to utilise the net proceeds from the IPO for advertisement expenses towards enhancing the awareness and visibility of its brands, setting up new brand outlets, and investing in its subsidiary, BBlunt for setting up new salons.

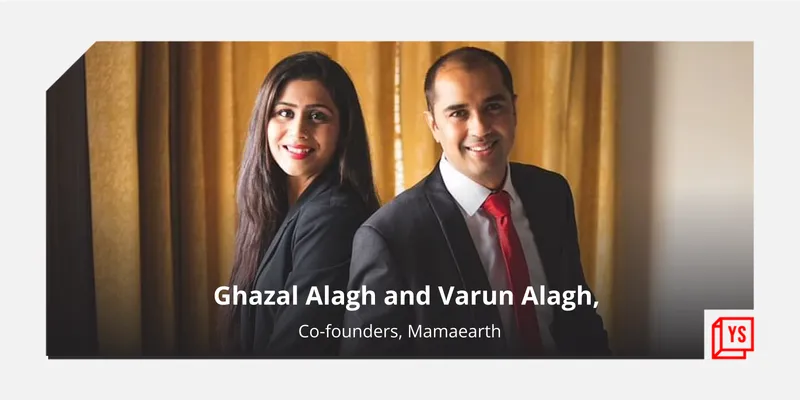

Honasa Consumer Limited, the parent company of brands like , The Derma Co., Aqualogica, Ayuga, and BBLUNT, has filed a Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for an initial public offering (IPO).

As per the DRHP, the company plans to raise funds through a fresh issue of equity shares (the face value of each equity share is Rs 10) and an offer-for-sale (OFS). The fresh issue of equity shares aggregates up to Rs 400 crore and the OFS size comprising external investors and individual shareholders is up to 46,819,635 equity shares.

The OFS shareholders include Varun Alagh (up to 3,186,300 equity shares), Ghazal Alagh (up to 100,000 equity shares), Evolvence India Coinvest PCC (up to 220,613 equity shares), Evolvence India Fund III Ltd (up to 862,987 equity shares), Fireside Ventures Fund (up to 7,972,478 equity shares), Sofina Ventures (up to 19,133,948 equity shares), and Stellaris Venture Partners India (up to 12,755,965 equity shares). was not mentioned under the OFS.

Other OFS shareholders are Kunal Bahl (up to 777,672 equity shares), Rishabh Harsh Mariwala (up to 477,300 equity shares), Rohit Kumar Bansal (up to 777,672 equity shares), and Shilpa Shetty Kundra (up to 554,700 equity shares).

The company plans to utilise the net proceeds from the IPO for advertisement expenses towards enhancing the awareness and visibility of its brands; setting up new brand outlets; investing in its subsidiary, BBlunt for setting up new salons; and general corporate purposes and inorganic acquisition.

"The combined size of the IPO could range between Rs 2,400 crore and Rs 3,000 crore, though the exact quantum at the time of listing would depend on final valuations," according to a Moneycontrol report.

"The plan is to launch the deal in March next year but that timeline is subject to market conditions," the report noted.

The book-running lead managers on the IPO include Kotak Mahindra Capital Company Limited, Citigroup Global Markets India Private Limited, JM Financial Limited, and J.P. Morgan India Private Limited.

Honasa was the first company to join the unicorn club this year, in the first week of January 2022. It raised $52 million in a round led by Sequoia at a valuation of $1.2 billion.

One of India’s fastest-growing direct-to-consumer (D2C) companies, Honasa has employed a house-of-brands strategy through which it aims to go deeper into the D2C beauty and personal care segment. Mamaearth competes with platforms like , , Biotique, , , , and .

Edited by Affirunisa Kankudti