PhonePe, Breathe Well-being, Gullak, and others raise capital

YourStory presents daily funding roundups from the Indian startup ecosystem and beyond. Here's the roundup for Thursday, January 19, 2023.

The startup space saw the emergence of a new decacorn on Thursday as closed a $350 million funding round from private equity firm General Atlantic at a pre-money valuation of $12 billion. The late-stage funding is significant for a couple of reasons. First, it comes amid a prolonged funding winter following tough global macroeconomic conditions, and second, the regulators tightening scrutiny over the fintech sector, making a lot of firms walk on eggshells.

Further, a few early-stage deals also made the news. Diabetes reversal startup Breathe Well-being raised Rs 50 crore in pre-Series B funding co-led by 3One4 Capital, Accel Partners, and General Catalyst, with participation from FounderBank Capital and Supermorpheus.

Besides startups, Mumbai-based SEBI-registered Category 1 Angel Fund Piper Serica Advisors raised Rs 75 crore from a wide range of investors. The fund has already invested in five companies since its launch last year. It expects to back another 25-30 companies.

Sundaram Alternate Assets Ltd, a subsidiary of Sundaram Finance Limited, announced the first close of its debut corporate credit fund at Rs 205 crore (about $25 million). It looks to invest via debentures and mezzanine securities in a portfolio of companies across MSME (micro, small and medium enterprises), fintech, manufacturing, and services.

An education-focused non-banking financial company (NBFC), Avanse Financial, also got an Rs 800 crore-capital infusion from private equity firm Kedaara Capital to drive its growth.

More deals

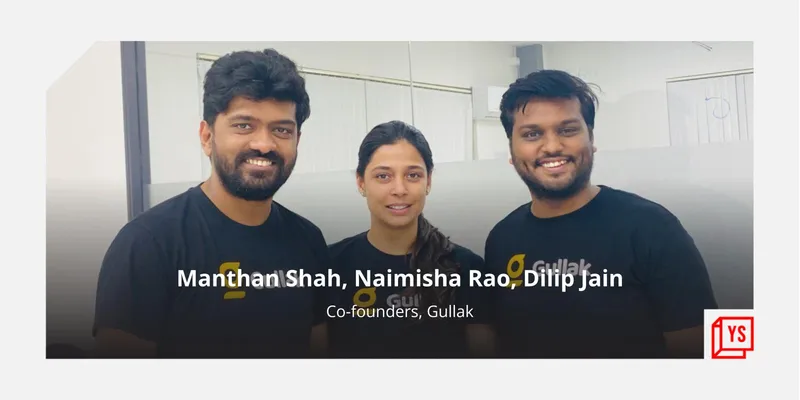

Saving and investment app Gullak raises $3M

Y Combinator-backed saving and investment app raised $3 million in a seed funding round from new investors YC and Rebel Partners, and existing investor Better capital.

Good Water Capital, GMO Fintech Fund, TRTL Ventures, and angel investors, including Kunal Shah (CRED), Akshay Mehrotra and Ashish Goyal (Early Salary), and Kevin Moore also participated.

The startup will utilise the funds to increase average revenue per unit (ARPU) by offering more financial products, strengthening the current product, and expanding its user base. It also plans to invest in community-building and financial awareness exercises.

Founded by former Juspay executives Manthan Shah and Dilip Jain and Naimisha Rao, the app helps automate savings and allows users to save on a regular or monthly basis and automatically invest the same in digital gold.

Since seven months of its launch, the app claims to have a daily GTV of 22 lakhs. The startup had previously raised $1.3 million as part of its pre-seed round.

Gullak faces competition from Tiger Global-backed fintech app Jar and Spenny, besides other saving and investment apps, including Niyo and Appreciate, which operate in the spare change model and invest in mutual funds.

“We have doubled our GTV after the launch of Gullak Gold+ with zero marketing dollars, and we are hoping to see great retention numbers through this offering. We have just begun, and the journey ahead seems exciting” says Manthan Shah, Co-founder of Gullak.

Edited by Suman Singh