For a match made in the cloud: SaaS Insider to launch app to enable funding deals

SaaS Insider is planning to launch an app in June to help early-stage SaaS companies get funded by connecting with investors on its platform.

fvSaaS Insider is convinced that it’s an idea whose time has come. The ‘idea’ being an app for SaaS founders and investors to connect and firm up deals, while the ‘time’ element refers to the current funding winter.

The Bengaluru-based SaaS community, which was set up in 2020, began work on the free-to-use app after a poll of 60 early-stage SaaS startups in November revealed that funding was seen as the biggest hurdle to success. Almost 90% had voted for it.

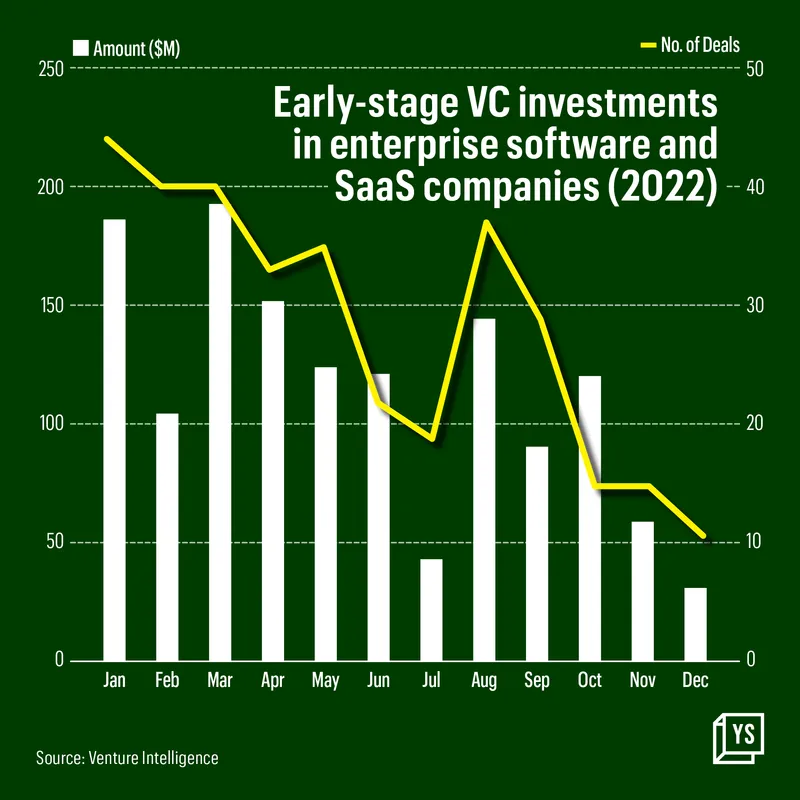

At first though, it may seem as a bit of an overreaction, what with the SaaS industry cornering most of the deals last year and producing six unicorns in the process. But look closer, and it will be clear that the bulk of funding happened during the first half of 2022, when all of the new unicorns emerged, and is down to a trickle in the past few months.

"There is a funding winter and it is difficult for startups to get funding. In reality, if you know the right people and the right information, it (funding) does go through," says Chameli Kuduva, who was working with email collaboration platform Hiver when she began writing blogs to help the SaaS community.

The blog metamorphosed into SaaS Insider at the peak of the pandemic in April 2020, and she was soon joined by her two co-founders Hari Pragdish and Gautham Prasad in August 2021.

To be sure, the app is not limited to making deals and will include other features such as discussion threads, job postings and mentorship. To access these features (except for networking/discussion threads), users have to be part of an ‘Insider Circle’, which has 180-200 startups and venture capital (VC) firms with a total member count of 430. Another 300-odd members are on the waitlist.

To enter this exclusive club within the app, SaaS founders will have to prove that their company is incorporated and has an active business, among other things.

“This becomes a place where the handshakes become a lot faster and easier,” says Archit Anand, Founder and CEO of , a platform that helps direct-to-consumer brands become profitable by optimising costs. “The time to raise funds goes down through a community like this."

Anand joined the SaaS Insider community last year. Through the community, he has been able to meet different investors and is looking to close his first round of fundraising in a few months.

Govind Mundhra, Founding General Partner at Paradigm Shift Capital, agrees that it’s a step in the right direction. “If you are getting an opportunity to meet investors on a particular platform, which is designed and designated for a certain sector, it is a great initiative,” he says. Paradigm Shift Capital has invested in , a product management platform and Customerglu, a low-code customer engagement platform, among several others.

“I’m sure it will be beneficial for founders and investors—they are also looking for a healthy pipeline for their dealflows,” says Mundhra.

The SaaS growth story

The Indian SaaS industry—already the second-largest in the world—is poised to grow at a scorching pace, according to a recent report by Bain & Co. Giving an indication of this growth, the report said the annual recurring revenue of the country’s SaaS industry is expected to touch about $35 billion in 2027, from $12 billion-$13 billion in 2022.

This makes the role of SaaS communities and groupings operating all the more important. The oldest and biggest is SaaSBOOMi, which was born as SaaSx in 2015. But smaller ones like SaaS Insider are also playing their part.

SaaS Insider, which currently has about 6,000 members, is registered as a private entity and is owned by Kuduva, Pragdhish, and Prasad. It gets most of its revenue through events and sponsorships.

The app itself is expected to become active in June. Co-founder Pragdish, who was earlier with Zoho and Freshworks, says the app has become SaaS Insider’s top priority now. “With these initiatives, we can make more money flow into the market, because if not, we will see a huge chunk of companies failing this year,” he says.

Chameli Kuduva (Founder) and Hari Pragdish (Co-founder) of SaaS Insider

The workings of the app

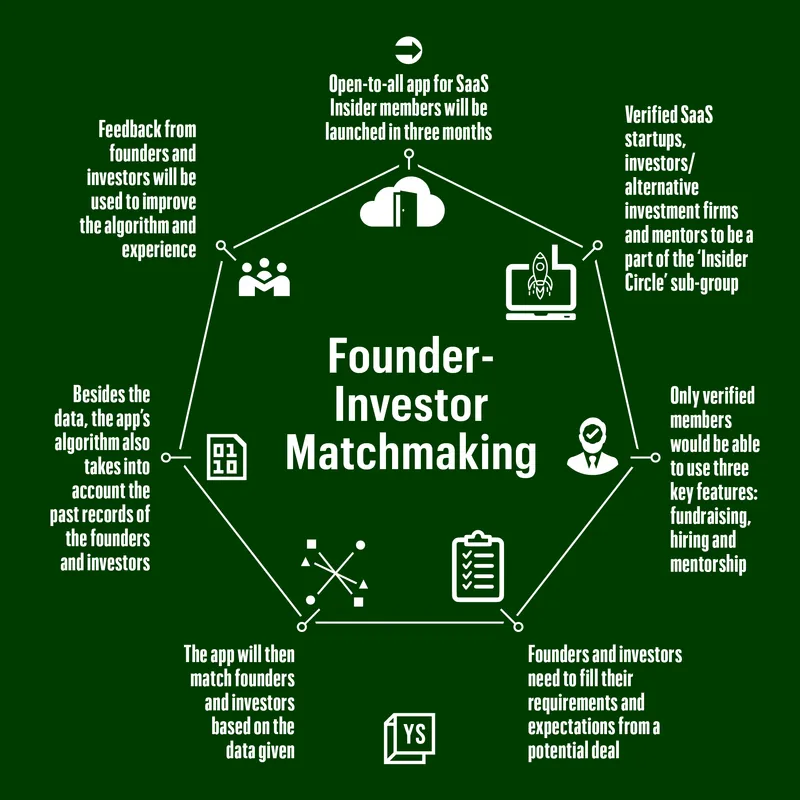

The idea is to make most of the matchmaking automatic with manual interventions wherever required. The app is being designed for startups needing pre-seed to Series A funding as after that the funding process becomes a little too complicated.

To use the app for funding, founders need to enter data like how much money are they looking to raise, what percentage of equity are they willing to dilute, where their company is registered, and so on.

While onboarding investment firms, the SaaS Insider team will try to understand their investment thesis, their average cheque sizes, the minimum equity they want, and a few other details.

Besides factoring in founder and investor requirements and preferences, the app’s algorithms will also be fed with SaaS Insider’s assessments of the investors and startups they have helped do matchmaking in the past. The community members would also cross-check and verify all the details filled in by founders and investors and make changes if the claims are inconsistent with past records.

For instance, if a venture capital firm claims to fund startups at the ideation stage but their past record is not consistent with it, then the algorithm will be tailored to reflect that.

Through the app, SaaS Insider also wants to create a feedback loop where founders and investors can log in their observations after interacting with each other, which would again be assessed and verified before putting it out on the public domain. This would help everyone in the ecosystem to get an idea about a particular founder or investor.

“Basically, we want to democratise the whole field. The feedback should be raw and open,” explains Pragdish. “This is good for both the investors and the founders to know each other’s opinions. On top of our filtration, there will be user feedback that will help things move much faster.”

Though the app will be free for the startups, SaaS Insider is considering monetising the matchmaking initiative by charging the investors for using the app after a year or two.

Deals so far

SaaS Insider has some experience in firming up deals. In 2022, SaaS Insider helped 12 startups to get a total of around $30 million in Seed and Series A funding from around 10 domestic venture capital firms. It has been working with around 80 India-focused VC firms for the past 12 months or so.

As part of its international investment corridor plans, the Bengaluru-based community has been busy selling the India startup story to VC firms who have not made any investments in the local market.

“Founders here don't know which of the funds could potentially invest in SaaS,” says Kuduva. “Access to global markets and positioning Asian SaaS is also something we would like to achieve through this (the app), hopefully soon.”

SaaS Insider has convinced 12 VCs to fly down for its annual event in July this year and the target is to get at least 30-35 such companies to meet up with Indian SaaS startups. By the end of the year, it wants to take the count to 50 international VC firms to consider investing in Indian SaaS startups.

"We have built a very good partnership with SaaS Insider. They have embarked upon this journey of solving the funding problem for SaaS founders and we have been actively working with them to be able to address that," says Kaustav Das, Founder and CEO of Efficient Capital Labs, which offers non-dilutive forms of capital to B2B SaaS businesses. Through SaaS Insider, his company has had 17-18 conversations with different startups and has been able to help fund four startups.

But as Pragdish points out, all this will work only if the SaaS startups continue to raise the bar. “Ultimately, the deals happen only if the founders are able to convince investors about their ideas, businesses and their vision,” Pragdish says. “Our job is to create a level-playing ground where they can get connected.”

(Infographics and cover image by Chetan Singh)

Edited by Jarshad NK