[Weekly funding roundup July 27- Aug 2] Sharp rise in VC inflow

The sharp increase in venture capital funding in the first week of August was largely due to reasonably large sized transactions

August has brought with it a cheer in the venture capital ecosystem.

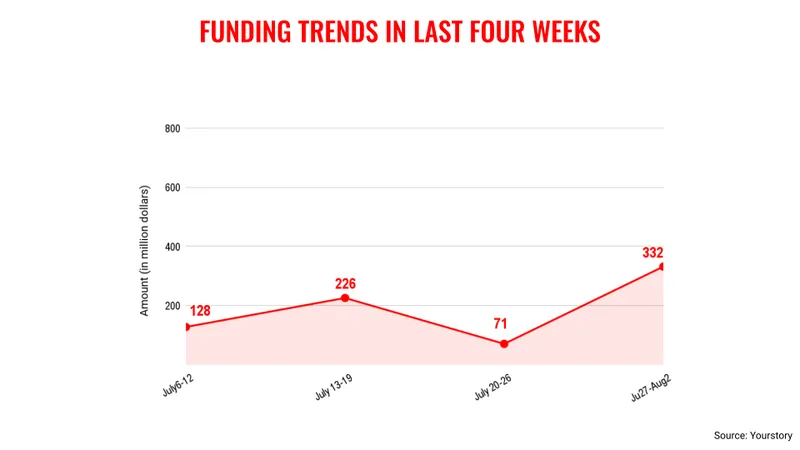

The first week of the month saw venture capital funding touching $332 million across 22 deals. In comparison, the previous week saw only $71 million coming in. The startup ecosystem also had a unicorn this week—mobility startup .

This rise in VC funding comes as a relief after it dropped to below $100 million in the preceding week. Rapido's $120 million funding made a difference this week. This is good news as large deals, the ones that affect VC inflows, have been few and far between lately.

However, it is unlikely that more large deals are coming into the Indian startup ecosystem as investors continue to remain cautious about providing larger value cheques.

At the same time, the Indian startup ecosystem continues to witness a flurry of activity with three companies—Ola Electric, FirstCry, and Unicommerce tapping into public markets with their initial public offering.

This provides hope to the startup ecosystem that stock exchanges can provide an exit to investors.

At the same time, startups that have become public companies are putting up strong numbers in their quarterly results. These include Delhivery, Freshworks, and Zomato.

The positive reception from the public markets and private capital i.e., VC is a good sign for the Indian startup ecosystem.

Key transactions

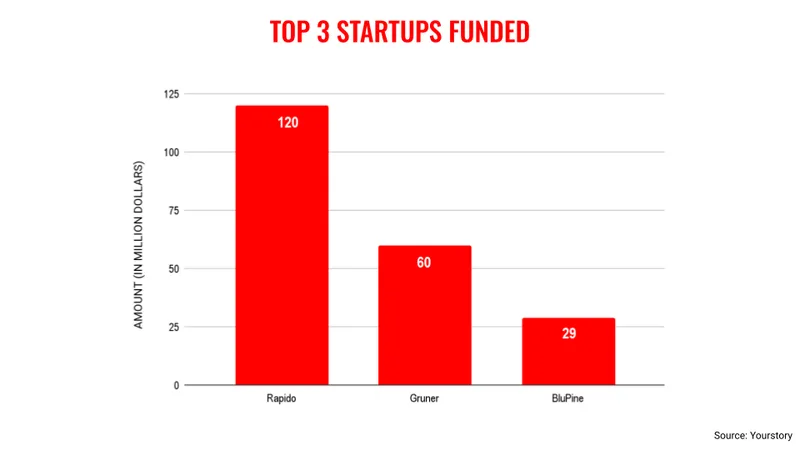

Ride-hailing startup Rapido raised $120 million led by WestBridge Capital at a valuation of $1 billion.

Noida-based sustainable biogas solutions company Gruner Renewable Energy raised $60 million in funding.

EV startup Simple Energy raised $20 million from family offices and high-networth individuals.

EV startup Kinetic Green raised Rs 168 crore ($20 million approx.) in equity and debt from London-based private equity fund Greater Pacific Capital.

Wedding services startup Meragi raised $9.1 million from Accel, Peak XV Partners, and Venture Highway.

EV startup Ather Energy raised Rs 60 crore ($7.1 million approx.) in debt funding from InnoVen Capital India Fund.

Spacetech startup GalaxEye Space raised $6.5 million from Mela Ventures, Speciale Invest, ideaForge, Rainmatter, Navam Capital, Faad Capital, and Anicut Capital.

Edited by Affirunisa Kankudti

![[Weekly funding roundup July 27- Aug 2] Sharp rise in VC inflow](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-roundup-LEAD-1667575602969.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)