VC funding in August nearly quadruples YoY as large deals keep kitty above $1B

August reflected a recovery from the funding winter as Indian startups raked in $1.7 billion during the month, giving both founders and investors a shot in the arm.

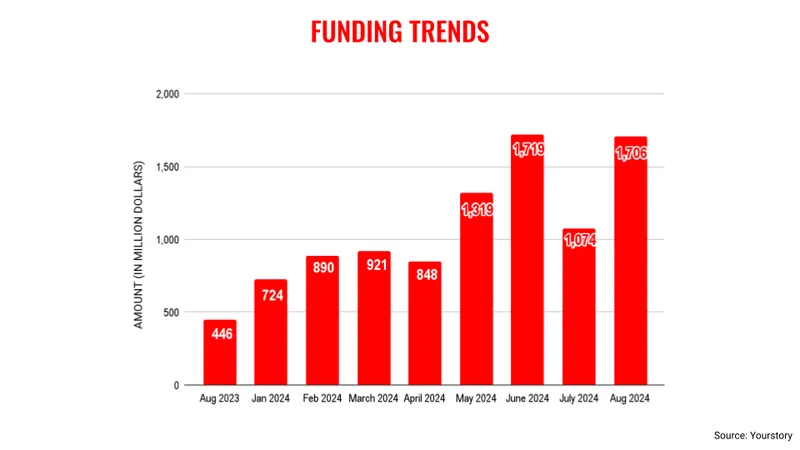

The Indian startup ecosystem seems to be gradually emerging out of the funding winter. Over the last four months, venture capital (VC) inflow has consistently punched above the crucial $1-billion mark, signalling investor confidence in startups.

In August, startups bagged a total VC funding of $1.7 billion, cutting across 117 deals. This was a 283% increase compared with a similar period a year ago, according to YourStory Research. Compared to the immediate previous month, i.e. July, it was a 59% increase.

VC funding in August was also the second-highest this year, with Indian startups raising just $13 million more in June.

The year saw a slow start to VC funding, with the capital ingestion only picking up in May. The expectation is that this trend will continue for the remainder of the year.

The first eight months saw total funding of $9.2 billion, and the total capital inflow by the end of 2024 is expected to cross the previous year's record of $10.8 billion. While the difference may not be that wide, it is certainly a welcome change given that there was a steep drop in equity investments between 2022 and 2023.

There were a few large-value transactions in August. Zepto raised $340 million, taking the total funds raised to $1 billion at a valuation of $5 billion. Ather raised $71 million and entered the coveted unicorn club. OYO also raised $173.5 million.

However, industry observers believe that 2025 will see a further increase in VC inflow as there are numerous conversations taking place between startups and investors, and these deals are likely to be finalised by the next year.

The month of August saw the largest quantum of funding from the late-stage category, amounting to $881 million from just six deals. In contrast, the early stage saw a total amount of $348 million from 89 deals.

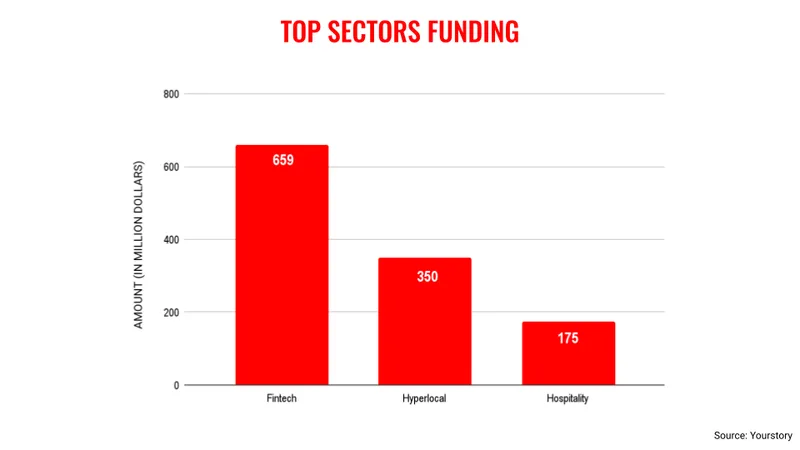

In terms of sectors that received the highest VC funding, fintech topped the list with $659 million followed by hyperlocal commerce at $350 million and the hospitality segment raised $175 million. Fintech has consistently remained on the top three list right through the year.

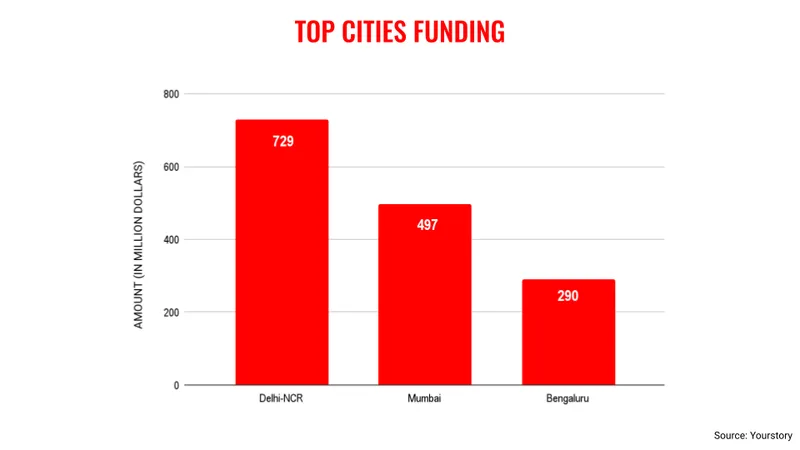

The previous month also threw a surprise on cities that raised the highest funding. Delhi-NCR topped the list at $729 million, followed by Mumbai at $497 million. Bengaluru, which is generally regarded as the startup capital of the country, was third at $290 million.

There were also a few interesting developments on the public bourses with the listing of startups including Ola Electric, FirstCry, and Unicommerce. The reception from the stock markets has been positive, which is expected to enthuse investors with a viable exit option.

Edited by Kanishk Singh