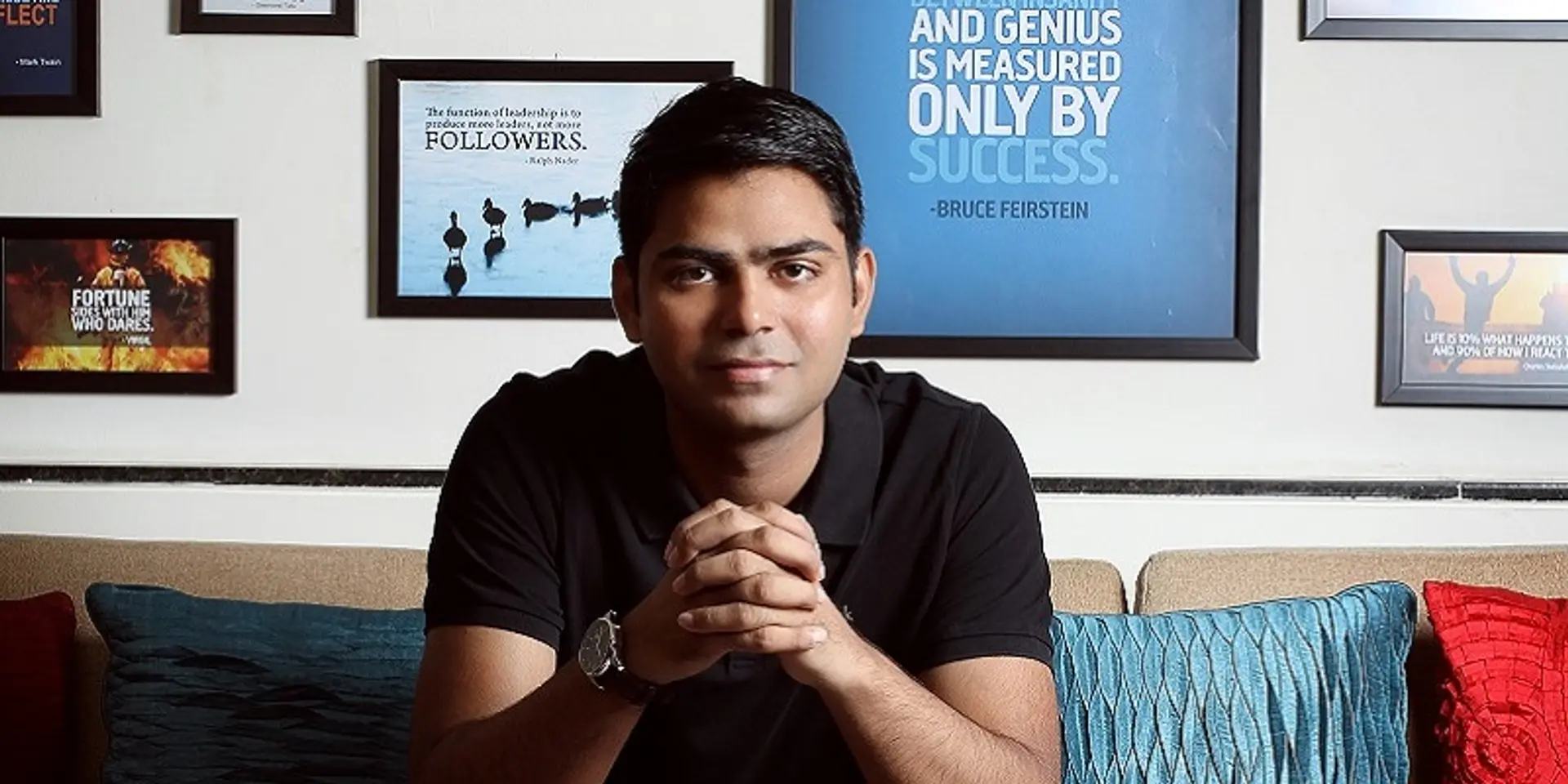

Info Edge files FIR against Rahul Yadav over alleged misuse of funds in 4B Networks

The company has stated that the FIR will not have any significant financial impact on its business operations.

, the parent of online job listing portal Naukri, has lodged a First Information Report (FIR) against Rahul Yadav, the founder of its portfolio company 4B Networks. The FIR accuses him and others of engaging in fraud and misusing funds allocated to the startup.

"An FIR has been registered by the Bandra Police Station (Mumbai Police) on November 29, 2024 against Yadav, Devesh Singh, Pratik Choudhary, Sanjay Saini (and unnamed others) in connection with 4B Networks (an indirect subsidiary), alleging inter alia commitment of certain fraudulent acts involving 4B Networks’ funds," the company said in an exchange filing.

The company has stated that the FIR will not have any significant financial impact on its business operations.

4B Networks, launched in November 2020 by Rahul Yadav, the founder of Housing.com, 4B Networks, facilitated communication and business transactions between real estate developers and brokers through its Broker Network Platform, enabling site visits and home-loan services.

Info Edge, led by Sanjeev Bikhchandani, invested Rs 288 crore in 4B Networks through its subsidiary ALLcheckdeals India. The investments, made in multiple tranches since early 2021, gave Info Edge a 59% stake in the startup.

In 2022, Info Edge initiated a forensic audit after 4B Networks failed to provide crucial details about its operations, financial transactions, and dealings with related parties, which it was contractually obligated to share. Following this, Info Edge approached the Delhi High Court in July 2022, leading to arbitration proceedings.

Later, in August 2023, the company lodged a complaint with the Economic Offenses Wing (EOW) against 4B Networks and Yadav, accusing them of engaging in suspicious transactions with 4B Realtech Pvt Ltd, allegedly linked to one of Yadav's associates.

Info Edge disclosed a total loss of Rs 532 crore from writing off its investment in 4B Networks, which included its Rs 288 crore cash infusion and the remaining as a notional loss based on the startup's earlier valuation of Rs 719 crore.

Edited by Affirunisa Kankudti