Are you willing to apply for your personal loan online?

Before applying for a personal loan online, it’s important to compare personal loan interest rates. Understand the features of the online personal loan and Apply now with few clicks.

Wednesday September 06, 2017 , 4 min Read

Personal loans are one of the quick ways to arrange money for any unexpected requirement. It is of two types, secured and unsecured. A secured personal loan requires collaterals as security whether in unsecured personal loans there is no need of any collateral against the loan amount.

In this digital era, every bank has upgraded their services and offering it online. The conventional offline service still works the same way as earlier. A borrower can avail them as per their convenience. Now let’s talk about the type of personal loans available in market.

For secured personal loan the borrower needs to submit their assets, house, car or other valuable things as collateral. Lenders ask for collaterals as the security against the loan amount. If the borrower fails to repay the loan amount then the bank can liquidate those assets to repay the loan amount. In unsecured personal loan bank never ask for any collateral, therefore, the interest rates on unsecured personal loans are quite high as compared to the secured personal loan.

If you are willing to apply for your personal loan, then there are many factors that you must need to consider before applying for a personal loan. Banknomics India requests every borrower to keep following things in mind when going to apply for a personal loan:

Things to consider before applying online personal loan

Before you apply for personal loan online, compare personal loan interest rates from different lenders and choose the one with lowest interest rate. It’s an important step towards the best personal loan deal. Online personal loan has many features. Some major features are as follow:

• User-friendly tools

• Eligibility check tools

• Quick loan Approval

• Flexible repayment options

• Quick loan amount disbursement

• Exclusive offers and money saving deals

User-Friendly Tools: Online Personal Loan offers user-friendly and handy tools like EMI calculator and line of credit EMI calculator. These tools can help a borrower to set an appropriate EMI to their applied loan.

Eligibility check tools: Most lenders offer Eligibility check tools to know the eligibility criteria for the particular loan and whether your profile suits in it or not. The highlight of this tool is that a borrower can find the loan amount for which they are applicable.

Quick loan Approval: An online process ensures that the loan application process will not take much time as it takes in manual process. Most of the lenders approved the loan on the same day or next day.

Flexible repayment options: Online personal loan comes with flexible EMI options. Pre-payment of the loan amount, re-availing prepaid amounts are some additional features of online personal loans.

Quick loan amount disbursement: Applying for personal loans online ensures a borrower that they can use their loan amount more quickly as compared to the offline personal loan. Most of the banks or NBFCs disburse the loan amount within 72 Hours.

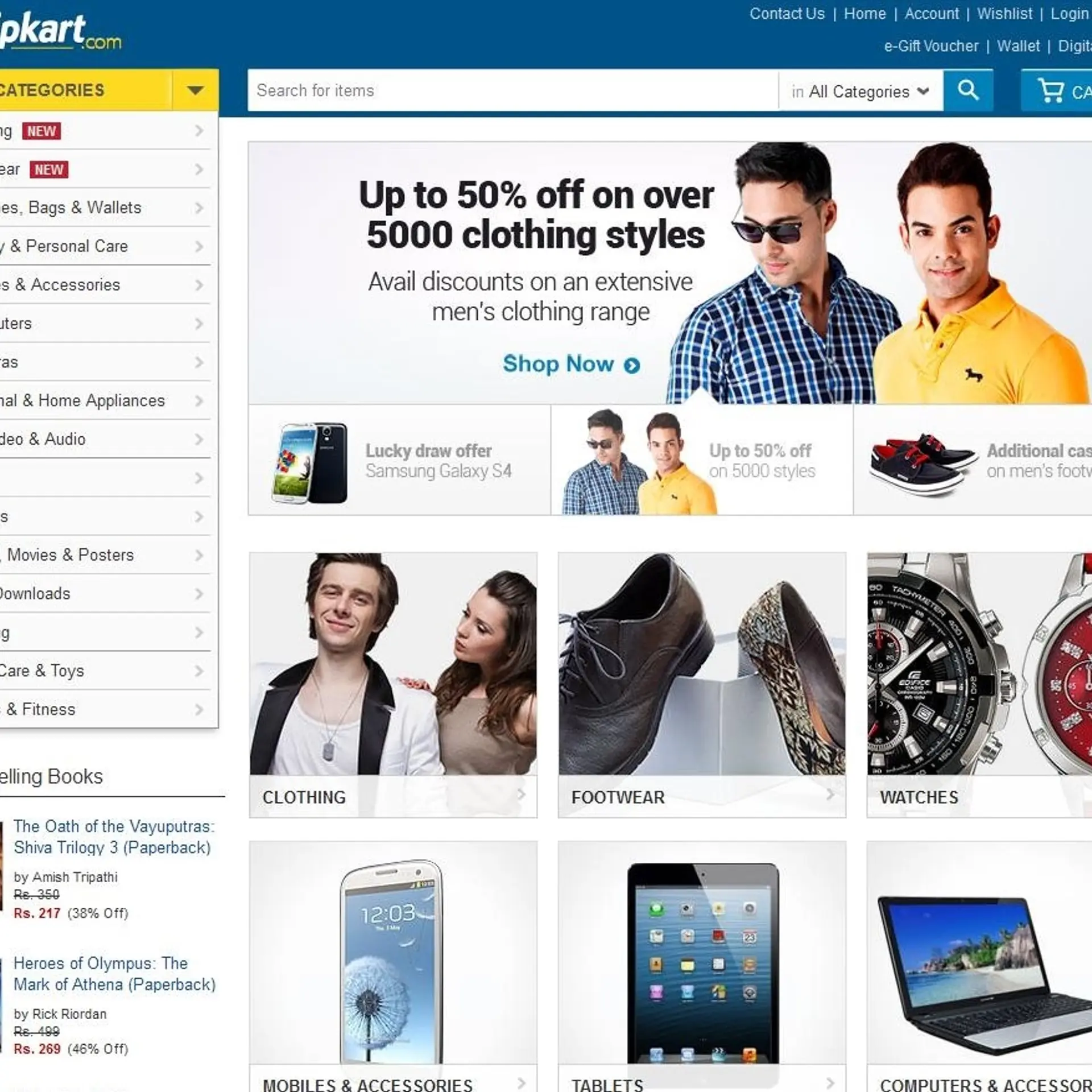

Exclusive offers and money saving deals: In this competitive era all the lenders try to attract the borrowers, therefore, they offer exclusive offers and money saving deals on their personal loans online.

Things to follow before applying for a personal loan

1. Identify the exact requirement on funds

2. Collect the documents

• ID Proof

• Address Proof

• Last six month’s bank account statement

• Salary slips for last 3 months

• ITR for last two or three years

3. Compare the offers from different lenders

Applying for a Personal loan online is very easy and convenient as compared to traditional loan process. With online personal loan, a borrower can get a hassle free loan amount in just few clicks. Financial consultants like Banknomics can be a better choice to apply for personal loan online because they provide the list of most popular banks as per their interest rates. Go online and apply for personal loans easily.