This fintech company helps underbanked Tier III, IV cities with digital banking solutions, rakes over Rs 10,000 cr annual GTV

Here’s how BANKIT helps unbanked and underserved segments of the country by providing safe, secure and convenient banking, finance, and payment solutions with kirana owners as primary agents. It serves more than 21 lakh customers in a month, across 4856 pin codes.

The Digital India campaign, launched in 2015, saw various sectors including retail, manufacturing, finance, hospitality, and others, adapt to the rising speed of technology. Traditional small businesses and MSMEs steadily moved their infrastructure to digital, and have since experienced efficiency and ease of doing business.

The Indian banking industry has seen very unique progress in digital adoption. According to PwC India, the digital payments landscape in the country has been growing rapidly over the last few years. The Reserve Bank of India (RBI) reported a compound annual growth rate (CAGR) of 61 percent in volume, and 19 percent in value for digital payments in India between 2014–2019. This growth has been supported and propelled by the continuous emergence of new technologies, payments products/methods, the introduction of disruptive market players and regulatory interventions, among many other factors.

So while digitisation of small and medium scale businesses has seen rapid adoption of technology in India’s Tier III and IV towns, people in these areas are yet to take digital payments seriously. And this is where organisations like play a role, as they ensure financial services to the last mile of the society.

“In rural areas, people walk miles to visit the bank and deposit their hard-earned money, and ATMs are not always easily accessible. People are yet to trust digital payments, and this is where we play a strong role,” says Amit Nigam COO, Executive Director and co-founder of BANKIT.

BANKIT is a fintech company based out of Noida, Uttar Pradesh that provides secure banking financial services, and helps residents of rural areas to experience easy and fast digital payments through a single platform. Founded officially in 2010 by Amit and Satyajit Limaye, the company began its first set of operations seven years later in 2017.

“Between 2010 to 2017, we worked towards setting up the business, and understanding the gaps in the fintech sector. I worked with various companies during this time. Once the Digital India campaign began, and demonetisation happened, leading to the growth of the fintech space, we decided to step in and cater to the population of Tier III, IV, and V towns,” says Amit.

Today, BANKIT is present in more than 23 states, has 50,000 outlets from where it offers its services, and has achieved a gross transaction value (GTV) of Rs 10,645 crore.

SMBStory spoke to Amit to understand BANKIT’s operations. Edited excerpts from the interview:

SMBStory: How does BANKIT help citizens in rural areas?

Amit Nigam: The idea behind starting BANKIT was to empower the unbanked and underserved segments of the country by providing safe, secure and convenient banking, finance, and payment solutions.

Through our platform, we reach out to the people of remote areas to whom banks and ATMs are not easily accessible. We have associated with different banks, and through our network agents and channel partners, we provide banking facilities to unbanked and underserved people who have limited or no access to banking, financial facilities and digital payment solutions. In the process, we are also empowering local kirana store owners, as they are our primary agents.

SMBS: What is the process of BANKIT to provide financial services to people, and how is it empowering Kirana stores in these areas?

AN: Being a fintech company, BANKIT operates on a business-to-business-to-customer business model in order to provide banking and financial solutions under one roof. We partner with neighbourhood kirana and retail stores, who have the ability to help locals. They offer assisted digital financial services like Domestic Money Transfers (DMT) and cash-out through Aadhaar-Enabled Payment Systems (AEPS)/micro-ATMs (mATMs).

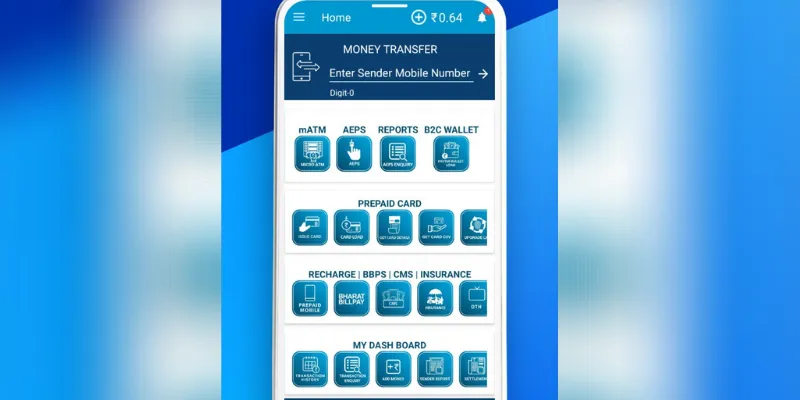

We also have our own Prepaid card services, apart from additional services in recharges, utility bill payments, insurance, travel booking etc. Our modern solutions are designed to make financial transactions seamless, easy and quick to empower our agents.

Today, BANKIT has more than 50,000 outlets/agents that serve more than 21 lakh customers in a month across 4856 pin codes, and this figure is increasing every day.

BANKIT's agent app snapshot

SMBS: What is your business and revenue model?

AN: We provide services to consumers through our agent networks. For Domestic Money Transfers (DMTs), we charge consumers one percent on the remittance business, which is as per the RBI guidelines. For other models like cash withdrawals through AEPS/ mATMs, mobile/ DTH/ fastag recharges, bill payments, insurance, CMS etc., percentages are charged either through banks or aggregators.

Although Bankit has remained profitable since inception, the coronavirus-induced lockdown gave us a tough time initially. However, our vast line of services, especially the cash-out service turned out to be a game-changer for our business. We have registered maximum revenue growth and transactions amid the lockdown, and seen an upward trend for several of our offerings.

SMBS: What are your future plans?

AN: We have seen growth in the GTV and revenues only in the last two months. This period has turned out to be optimistic for the fintech industry, as we have seen organisations partnering for vertical and horizontal growth. Our revenue growth jumped to 91 percent in October 2020 vs March 2020, which has incredibly profited the business.

In FY 2019-2020, BANKIT touched a GTV of 10,645 crores (approx), with a revenue of 127.78 crores, and we expect this figure to grow 2x to 3x in a year. Moreover, we used to onboard 500 agents a month for our business, which has now increased to approx 5,000 new agents per month. The demand to join our business has increased in rural areas, as people who have gone back to their hometowns and villages are approaching us, and are interested to work with us.

We hope to add many new services and products to our existing platform in the coming days so as to enable our agents across the country to serve more unbanked and underserved customers.

Edited by Anju Narayanan