Over 71% of Indian retail MSMEs embrace digital tech: Survey

The PayNearby survey also highlighted that small business owners between the ages of 18 and 30 were the most digitally proficient, with over 75% of them using smartphones to manage business activities.

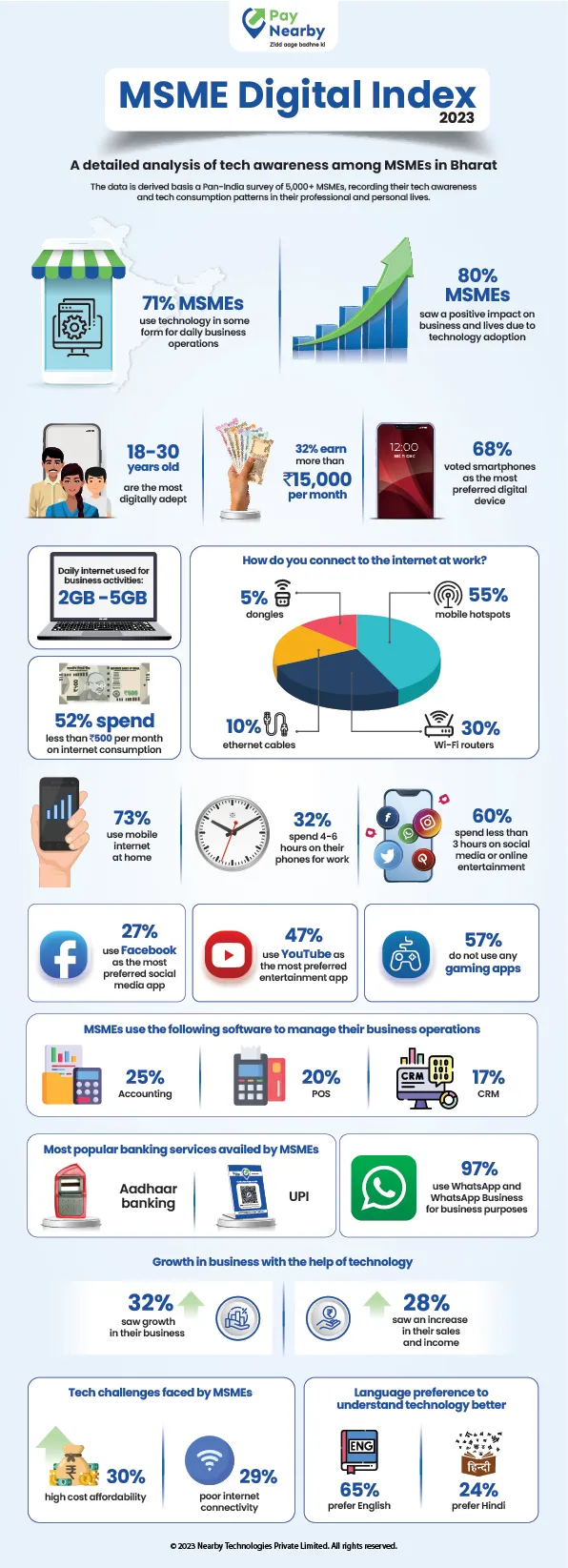

MSMEs in India are increasingly embracing digital technology, with over 71% of retail MSMEs utilising digital tools for their day-to-day operations, according to a recent survey by financial services network, .

The survey, titled "MSME Digital Index 2023," revealed that over 80% of MSMEs acknowledged the positive impact of digital technology on their businesses and personal lives. It also highlighted that small business owners between the ages of 18 and 30 were the most digitally proficient, with over 75% of them using smartphones to manage their business activities and access digital content.

This trend underscores the vital role played by the internet in bridging infrastructure gaps and facilitating tech inclusion among MSMEs.

Among digital devices, smartphones emerged as the most popular choice, preferred by 68% of users. Around 66% of MSMEs reported using smartphones for business purposes, consuming 2-5 GB of internet data per day. Interestingly, over 52% of these businesses spent less than Rs 500 per month on internet consumption, thanks to the affordable internet services made possible by initiatives like Digital India and BharatNet.

Image credits: PayNearby

Ecommerce will unleash the potential of MSMEs in India: MSME ministry

Regarding internet connectivity, approximately 55% of respondents relied on mobile hotspots while 30% used Wi-Fi routers. Ethernet cables and dongles were less commonly used at 10% and 5%, respectively. Moreover, 73% of MSMEs used mobile internet to connect at home.

While digital devices were primarily used for work-related tasks, the survey revealed that most MSMEs spent less than three hours on social media and online entertainment. Facebook was the top social media app with 27% usage, while YouTube dominated as the preferred entertainment app with 47% usage. Interestingly, gaming apps were not widely installed, as reported by 57% of respondents.

The survey also delved into the usage of digital tools for business operations, revealing that 25% of tech-savvy MSMEs employed accounting software, followed by point-of-sale (POS) software and customer relationship management (CRM) software at 20% and 17%, respectively. Additionally, Aadhaar banking and UPI were the most popular financial services availed by MSMEs, while WhatsApp and WhatsApp Business emerged as the most widely used messaging apps, with 97% usage.

When asked about the positive impact of technology, 32% of MSMEs reported improved business efficiency, while 28% observed increased sales and income. Some of the challenges in technology adoption include affordability (30%) and poor internet connectivity (29%). English was the preferred language for technology understanding and business transactions for 65% of respondents, followed by Hindi at 24%.

The survey was conducted among more than 5,000 micro, small, and medium enterprises across various retail sectors such as kirana stores, mobile recharge stores, and medical stores.

Anand Kumar Bajaj, Founder, MD and CEO of PayNearby, noted that Bharat (rural India) is rapidly catching up with India (urban India) in terms of digital technology adoption. He emphasised the need for an ecosystem that provides affordable and accessible technology and facilitates the development of digital skills.

Jayatri Dasgupta, CMO of PayNearby, highlighted the importance of upskilling, improved connectivity, and affordable infrastructure to bridge the digital divide and support MSMEs in integrating into the fast-moving economy.

PayNearby aims to empower MSMEs through its tech-led distribution-as-a-service (DaaS) platform, which offers data insights, artificial intelligence (AI), augmented reality (AR), and machine learning (ML) solutions.

Edited by Kanishk Singh