Revised MSME definition a welcome move but challenges persist, say experts

As part of the Aatmanirbhar Bharat stimulus package, the Indian government rolled out a slew of policies last year. One of the changes included revising the definition of MSMEs. A year after its announcement, entrepreneurs and stakeholders tell SMBStory the hits and misses of this move.

Last year, as part of the Aatmanirbhar Bharat stimulus package, the Indian government rolled out a slew of policies to uplift the micro, small, and medium enterprises (MSMEs) sector from the ravages of the coronavirus pandemic. One of the changes that managed to grab attention apart from the Rs 3 lakh-crore collateral-free loan was the revision in the definition of MSMEs.

Finance Minister Nirmala Sitharaman had said the new definition will ensure MSMEs can exhaust benefits without the fear of outgrowing. The objective of this was to provide ease in doing business, attract investments, and create more jobs in the MSME sector.

Nearly a year after the FM announced changes in the definition of MSMEs, entrepreneurs and industry stakeholders say the classification has been a game-changer of sorts for the ecosystem. In fact, the Udyam Registration portal, which came into effect in July 2020, saw over 30 lakh MSMEs being registered by mid-May. As per data shared by the MSME Ministry, the maximum number of registrations are from micro-enterprises.

While the government’s move helped the country’s most vulnerable small businesses survive the first wave of the Covid-19 pandemic, it continues to pose challenges for larger enterprises even as they can now compete more effectively with global peers.

SMBStory spoke to a few industry experts to analyse the impact of the revised definition on the MSME sector.

Importance of a criteria

Indian MSMEs form the backbone of the Indian economy. According to IBEF, the country has around 6.3 crore MSMEs, which contribute to about 30 percent of the country’s GDP. It is also the second-largest job creator (around 11 crore), second only to the agriculture sector.

Sudhir Jha, Vice President of MSME Development Forum and General Secretary of All India Confederation of Small and Micro Industries Association (AICOSMIA), says a new definition is helpful both for the regulators as well as the enterprises.

He says, “Government schemes and policies are based on certain parameters. Without a yardstick or criteria, no policy can be rolled out. In addition, a criteria helps the government to understand two things - how to distribute the benefits and whom to distribute.”

MSMEs redefined

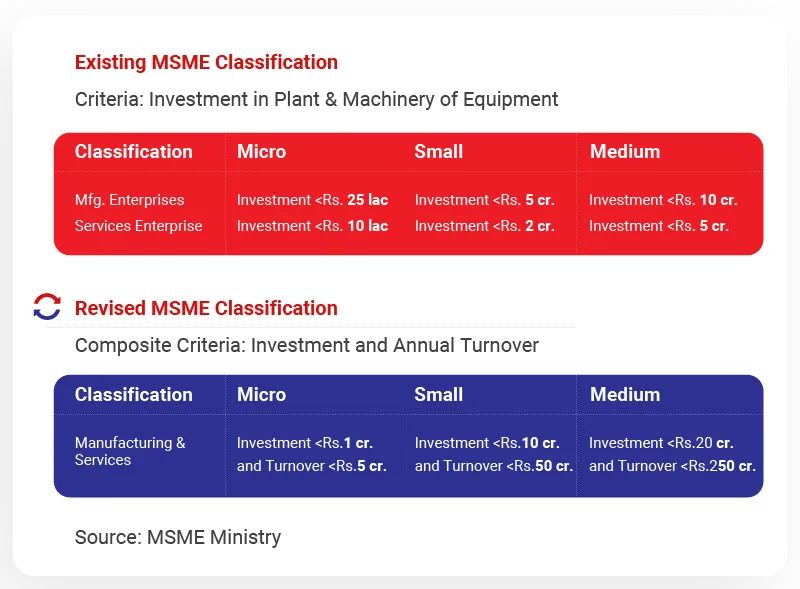

According to the new classification, a single criteria will be in use to define and bifurcate companies operating in the manufacturing and services sector. Apart from this, earlier, the MSMEs were defined on the basis of investments put in, but the revised definition will include the turnover of the company.

According to the new criteria, this is how MSMEs will be classified:

- Manufacturing and services enterprises will be classified under the same criteria.

- For micro enterprises, the investment and turnover limits should not exceed Rs 1 crore and Rs 5 crore, respectively.

- For small enterprises, the investment and turnover limits should not exceed Rs 10 crore and Rs 50 crore respectively.

- For medium enterprises, the investment and turnover limits should not exceed Rs 50 crore and Rs 250 crore, respectively.

Graphic: YourStory

India came up with a definition for MSMEs in 2006. In 2018, some amendments were made, including the classification norms changing from ‘Investment in plant & machinery and equipment’ to ‘annual turnover’. However, this definition still had gaps, and in 2019, Nitin Gadkari, the Union Minister for MSMEs, said that the government will make changes to the definition of MSMEs. In May 2020, the Finance Minister added the turnover to the criteria.

Commenting on what compelled the policymakers to introduce turnover in the classification criteria, Deepak Sood, Secretary-General of ASSOCHAM, says, “There may be companies where you need high capital investment, but the revenue output may not be very high value and vice-versa. Similarly, for service-based enterprises, they may have low investment, but a high turnover. So you need a cover that provides flexibility to both the enterprises as well as policymakers.”

Naman Shah, Co-founder and CEO of NowPurchase, says, introducing the turnover in the criteria has made it easier for the industry to identify MSMEs. He says, “The revised parameters will allow the government to look at an organisation’s actual turnover in the GST database to classify it as an MSME.”

Experts hail the move

Some industry stakeholders have welcomed the move and say the revision of the classification criteria will boost the growth of small companies.

“Until now, we had not been able to create a large ecosystem of Tier I, II or III suppliers. We had constrained ourselves (from growing) because of the investment criteria. When you invest small, you think small and you remain small,” says Deepak.

With this shift in policy, he says, there is an increase in the scope of the organisation. “The business will continue to get benefits while it is expanding and becoming large.”

Naman particularly applauds the government’s step of removing the boundaries between manufacturing and service enterprises and putting them under one umbrella definition.

Deepak and Naman also point out that the new definition will help MSMEs compete better in the global market.

“Previously, the investment could not exceed Rs 10 crore. However, with the revised investment classification of Rs 50 crore, enterprises now have more opportunities to modernise their facilities, which will help them compete globally. This provision also excludes exports from the calculation of turnover, which will encourage MSMEs to export more without the fear of losing the benefits of an MSME unit,” says Naman.

Deepak says that if MSMEs want to create value on the global platform, they need “scale, transparency, and proper operations,” and that is why this change in definition might become a game-changer for the sector.

Some not in favour

While many welcomed the move, a few pointed out some key gaps in the revised definition.

Milan Thakkar, CEO of Walplast, believes that the change in definition will create a lot of unfair competition. He elaborates, “There are 6.3 crore MSMEs in India. The gap defining medium enterprises (between Rs 50 crore to Rs 250 crore) is too wide. Some of the big companies that come in the micro-segment are actually corporates.”

He says that smaller enterprises need support and putting them in a pool with enterprises clocking Rs 200 crore or Rs 250 crore turnover will not ensure a level-playing field.

Assessing and identifying those who need loans, access to debt schemes, etc. in a large pool will definitely pose a challenge for the government.

Another issue the government failed to address is how traditional companies are going to compete with the direct-to-consumer (D2C) brands that are selling online.

Naman argues the revised definition directly affects the manufacturing sector. D2C brands are not directly involved in the manufacturing as many of them outsource the services via third-party units (TPUs). Moreover, he says, “Some of the D2C brands are backed by angel investors, VCs, etc. They have raised a large amount of money and are looking to expand beyond Rs 250 crore turnover.”

Traditional manufacturing companies, most of which are bootstrapped, will also find it difficult to compete with brands that are backed by large investors.

Additionally, while 30 lakh companies have registered on the government portal over the last 10 months, there is still a long way to go. Awareness and educating these businesses about registering themselves on the portal is important in order to help these businesses avail perks, loans, and other benefits.

A much-needed move

While the new definition does have a few gaps, experts argue that it was a much-needed move.

Anuj Mundra, founder of Nandani Creation, a Jaipur-based MSME-listed company, says the change in definition helped the company during the first wave of the pandemic, and will help in surmounting obstacles posed by the second wave as well.

“MSMEs are able to establish a stable and continuous production along with various kinds of measures. MSMEs also get preference in public procurement as 25 percent of the purchases by the government are reserved for the micro and small players,” she adds.

Deepak says, “Any large economy requires very large businesses to run that economy. You need large companies which are standing on a very strong foundation of MSMEs which are tier two and three suppliers.” He also says that this pool is also the breeding ground from which several large companies will emerge in the future.

Conclusion

The MSME sector has been witnessing the slings and arrows of time since the beginning of 2020. However, in January 2021, the sector was in a celebratory mood as it felt it won the battle against the first wave of coronavirus. The businesses were recovering and some were even close enough to report pre-pandemic level sales and revenue.

However, when the second wave hit, small businesses once again saw themselves being caught in a whirlpool of expenses, restrictions, and the lockdown.

The road to recovery for Indian MSMEs is long and arduous. However, not all hope is lost.

According to Deepak, MSMEs must continue to focus on digitisation, technological upgradation, innovation and “automating their product lines.”

And when the government decides to revise the definition again, it must consider aspects like growth and inflation, he says.

Naman agrees that inflation and revenues are important factors to be considered if and when the government plans to revise the definition.

Milan says the fundamental approach to see any change in the MSME definition is to enable entrepreneurship, provide better support to the informal sector and the economically vulnerable enterprises, something which the new definition will definitely contribute to.

Edited by Megha Reddy