White House unveils framework on regulating digital assets

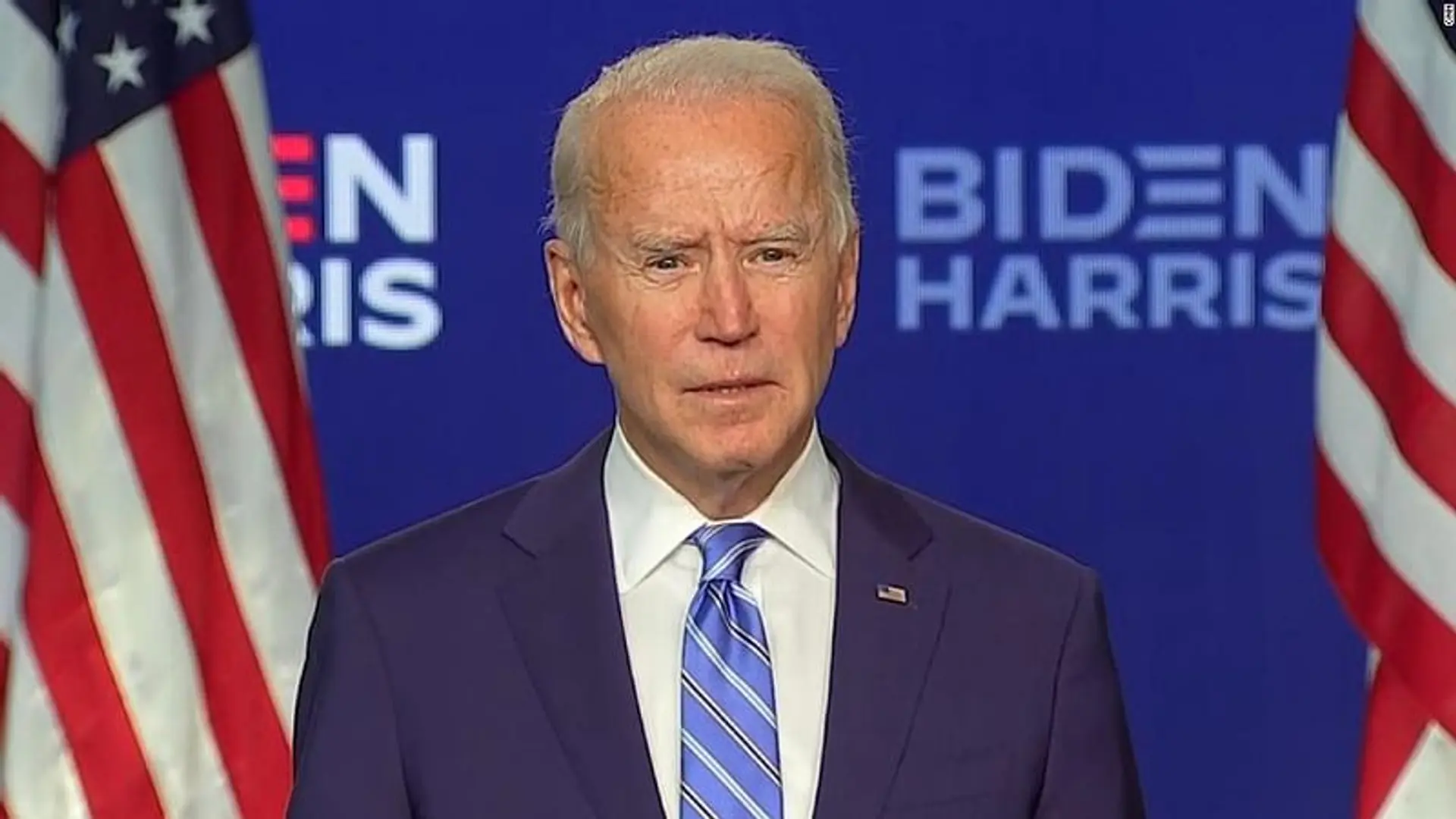

The framework for digital assets comes six months after US President Joe Biden urged federal agencies to examine the risks and benefits of digital assets and report their findings.

The White House has issued a comprehensive framework on regulating digital assets. This explores how the US financial services industry should evolve to facilitate borderless transactions while minimising fragmentation in the crypto space.

The framework comes six months after US President Joe Biden urged federal agencies to examine the risks and benefits of digital assets and report their findings.

For six months, agencies have been working to develop their own frameworks and policy recommendations to address half a dozen priorities listed in the executive order: promoting financial stability; US . leadership in the global financial system and economic competitiveness; consumer and investor protection; responsible innovation; and financial inclusion.

The new mandates are set to make the US a leader in terms of regulation and management of digital assets on both a national and international level, said Brian Deese, Director of the National Economic Council, and National Security Advisor Jake Sullivan.

The framework spotlights the potential benefits of a central bank digital currency (CBDC). CBDC would be a digital version of the US dollar that is completely regulated, centralised, and backed by the Federal Reserve.

It also talks about eliminating illegal activity in the industry. The fact sheet shows that the US President is considering urging Congress to make amendments to the Bank Secrecy Act (BSA), anti-tip-off statutes, and laws against unlicensed money transmitting to apply explicitly to digital asset providers, including nonfungible tokens (NFT), and digital asset exchange platforms.

According to the fact sheet, the US President will also consider urging Congress to raise the penalties for unlicensed money transmitting to match the penalties for similar crimes under other money-laundering statutes and to amend relevant federal statutes to let the Department of Justice prosecute digital asset crimes in any jurisdiction where a victim of those crimes is found.