Dhanteras is here, and here’s the best way to buy gold

Purchasing gold during Dhanteras is symbolic of luck, prosperity, abundance, and auspiciousness. But what should you keep in mind while buying the yellow metal as an investment?

India is known for its strong cultural affinity for gold. Dhanteras is a very auspicious occasion, and it is believed that buying precious metals like gold and silver will protect people from negativity and bad omen. Purchasing gold is also symbolic of luck, prosperity, abundance, and auspiciousness.

As a metal, gold is highly liquid and portable as an asset. The yellow metal benefits from diverse sources of demand as an investment, a reserve asset, an adornment, and a technology component. Although most Indian populace survives on a meagre income, they have always found a medium to buy gold.

Gold has the second largest allocation at 11 percent next to real estate, as per an RBI report. Over the last 10/20/30 years, the price of gold (in rupee terms) has compounded at an annualised return of 5.9 /11.8 /9.2 percent, respectively.

In general, gold prices are more volatile as they tend to respond to many economic factors, liquidity, interest rate moves, and currency and commodity prices. In August 2020, prices reached an all-time peak of $2,069 per ounce, and corrected to $1,680 levels by March 2021.

The ensuing volatility in the short term and ‘mini crash’ has led to some panic among investors. We suggest that investors do not get carried away by short-term fluctuations and focus on the medium-term outlook and objectives.

Cultural affinity and the long-held tradition of buying gold during festivities are the vital qualitative drivers for the demand in India. Quantitatively, the increase in income, price of gold, and government levies in the form of duties and other taxes are the key long-term drivers for the demand.

As per recent research by The World Gold Council, for every 1 percent increase in gross national per capita, gold demand rises by 0.9 percent. Similarly, for each 1 percent increase in the rupee-based price of gold, demand falls by 0.4 percent.

While it was expected that demand would be impacted by income and price, the surprising part was the relative weight of the influence. The research reveals that the demand responds more to income than to price.

Indian investors can choose from different gold investment products, including physical gold (bar and coin), digital gold, gold ETFs, gold funds, and Sovereign Gold Bond (SGB).

SGB is the most optimal investment vehicle if the investment is to hold to maturity perspective. As liquidity and availability are constraints, those who want strategic asset allocation may invest through SGB. Those who do not want to hold investment till maturity may look at other instruments.

Gold ETF is the most optimal investment vehicle from a liquidity perspective. If one is bullish on the rupee vis-à-vis the US dollar, one can look at offshore Gold ETFs as well.

One trend that has caught up with investors during COVID with jewellery shops being shut down is the widespread popularity of digital gold. It is a vault-stored tool that allows a user to buy/sell 24k, pure Gold that can be accessed via digital channels, like mobile wallet platforms.

The concept and offering is relatively new and lacks many regulations. Recently, the stock exchanges relayed a SEBI circular asking brokerages to discontinue the sale of digital gold on their platforms. However, some recent reports suggest regulators are looking to frame guidelines for the sector.

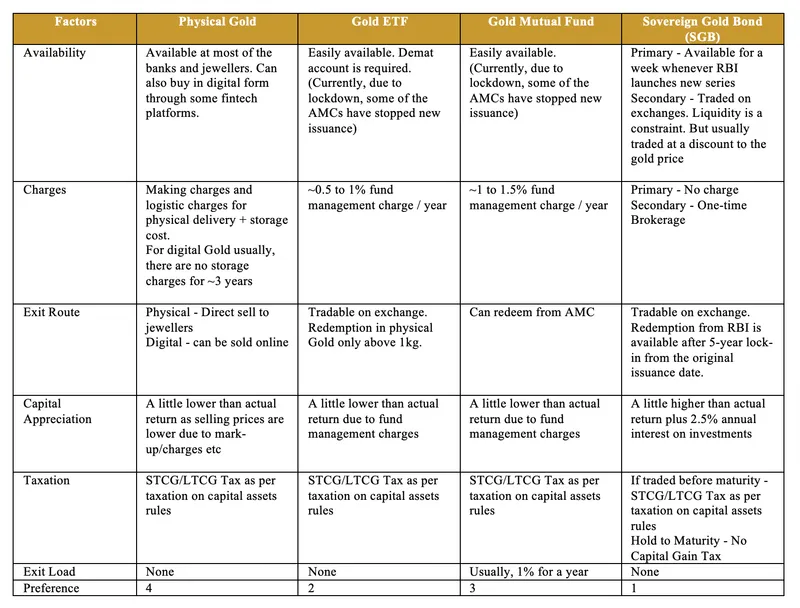

Certain relevant features of all four types of products are shown below

Edited by Teja Lele

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)