Inside the gender gap that's stopping MENA from adding $2.7T to the economy by 2025

There is a significant investment gap between men and women-led startups in the MENA region. Closing the gender gap could unlock an economy worth $2.7 trillion by 2025 for the region, according to a report on gender diversity in boards.

The Middle East and North Africa (MENA) region may be the new playground for entrepreneurs, but it's still not a level-playing field for women founders.

In the past few years, the MENA region has witnessed, among other trends, great business expansion, high investments, and the emergence of several startups.

According to a report by Wamda and Digital Digest, startups in the MENA region raised $3 billion in funding in 2022. In October, they recorded investments of $646 million. Of this, startups in the UAE received $460 million, Egypt $113 million, and Saudi Arabia $70 million.

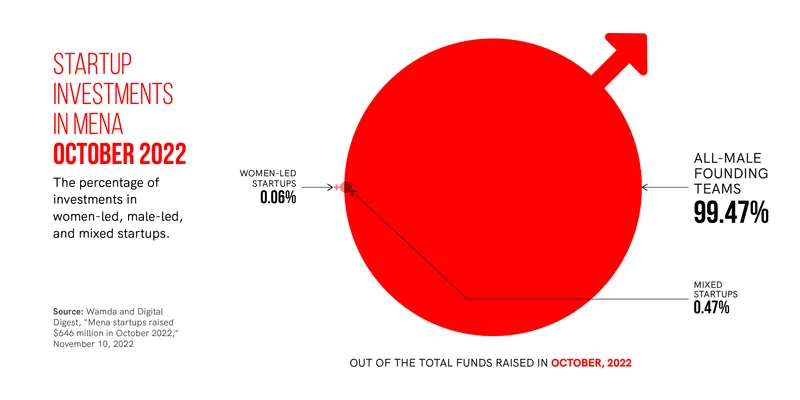

Although the growth has been positive for businesses in the region, it has not been the same case for women-led startups, which raised just 0.06% of the total funding.

While all-men-led companies received 99.47% of the overall investments made, startups with both men and women founders obtained just 0.47% of the funding.

Startup investments in MENA | October 2022

Bringing $2.7 trillion to MENA

Globally, gender disparity pervades all aspects of the economic structure.

As per the World Economic Forum Global Gender Gap Report 2022, the MENA region—with an average population-weighted score of 63.4%—accounts for the second-largest workforce gender gap after South Asia.

Speaking to YS Gulf, Aradhana Khowala, Chair of the Global Advisory Board, The Red Sea Development Company, Saudi Arabia, says, “Governments need to introduce public policies, laws, and measures for businesses to improve women’s work-life balance and encourage an equal division of unpaid care work.”

In a report titled 'Gender Diversity on Boards in Gulf Cooperation Council (GCC) Countries', the State Street Global Advisors highlights that closing the gender gap could add $2.7 trillion to the economies in the region, including the GCC nations, by 2025. Furthermore, women-led businesses are about half as likely as their male counterparts to remain in operation—three and a half years after their launch.

When asked what the region can do to help women entrepreneurs, Aradhana says, “Play smart and encourage. Educate, invest in, and back up businesses in areas such as femtech, education, healthcare, etc., where women have a significant competitive advantage and knowledge over men."

"This," she says, "will allow a more rapid scaling of solutions and make the business case in the region loud and clear."

Changing landscape

Highlighting how the investment landscape in the region is changing, Abhishek Rajput, Senior Consultant at Redseer Middle East, says women founders have received increasing attention from policymakers and the larger public.

“For example, in the UAE, female entrepreneurship grew 68% when the pandemic struck. Also, 29% of female-owned businesses across the MENA region are global enterprises—a greater proportion than their male peers,” he says.

According to Abhishek, global data from 2021 shows a 400% increase in women-led companies reaching unicorn status compared to 2020.

Aradhana encourages women to become financially self-sufficient. “We need to proactively encourage and educate women to become investors and get involved not only in venture capital but also start investing as private investors for their retirement plans.”

Understanding and tackling the problem

According to a report by TiE Dubai, TiE Women, and Wamda, $3 billion was invested in the MENA region last year, across 639 deals, last year. Less than 1% of this went to women-led startups.

Of the $2.4 billion invested in the first nine months of this year (January-September 2022), MENA-based women-founded startups received a mere 2%—less than $50 million—representing 38 women-led startups out of 482 startups.

Gender gap in MENA-based startups

Based on the responses of 125 women founders, the report noted that a majority (57.8%) of the female founders believe that MENA-based investors are less likely to invest in women-led startups than global investors.

Moreover, raising funds ranked first among the obstacles faced by women founders, followed by a lack of investor interest/knowledge in the founder's sector or business and a lack of visibility or role models. Other factors included societal expectations, lack of financial literacy, and finding a co-founder.

Aradhana believes having more women investors on the board would help bridge the glaring gap. She says, “We need women to invest in women's ideas not solely based on their gender but because they are uniquely positioned and intellectually equipped (or biased) to grasp the potential of solutions that try to tackle the rest of the four billion points of view in the world."

According to Abhishek, for a long time, the absence of a social network in the region—ideal for facilitating funding deals—has affected women-led businesses.

Some respondents in the Wamda report agree with this, adding that a lack of access to investor networks has contributed to the decreased capital inflow.

Abhishek says, “Women receive a smaller share of venture capital (VC) funding because there are fewer women in the process than men. The ownership gap is reflected in the funding gap.”

Aradhana agrees with a majority of respondents when she says facilitating access to capital and creation of specialised investment funds and accelerators focusing on women-led businesses is necessary.

Many respondents also noted that the solution is to have more women partners in VC firms, while others said women-focused programmes, incubators, and accelerators, and better financial literacy education would help the cause of women.

Nearly 65.9% of respondents said they are more likely to pitch to an investment company that has a female partner on the team.

However, a study by Harvard Kennedy School revealed that almost 70% of investors preferred pitches presented by male entrepreneurs compared to female entrepreneurs, although the pitch content was the same.

According to a recent report by the United Nations Industrial Development Organisation, the MENA region has the largest entrepreneurial disparity between men and women globally.

The report highlighted that the region has less than 5% women-led businesses compared to the global average of 23% to 26%.

“Studies show that women in the MENA region face some of the highest levels of discrimination in accessing productive and financial resources," the report noted. "As the venture capital industry is 92% male, gender bias seems to play a role in men funding other men, often overlooking the female entrepreneurs who are also seeking business funding.”

Gender-related conversations often reiterate that a nation’s true potential is realised by equal participation by all citizens.

In line with this thought, an analysis by Boston Consulting Group (BCG) said that if women and men participated equally as entrepreneurs, the global GDP could rise by about 3% to 6%, which would boost the global economy by $2.5 trillion to $5 trillion.

Edited by Suman Singh