Hospitality industry’s bucket list for Budget 2024

Stakeholders from the hospitality industry put forth their suggestions and recommendations as they await the key announcements and policy measures from the government during the Interim Budget.

After undergoing the lowest of lows during the pandemic, phenomena like revenge tourism and increase in disposable income have finally shown the hospitality industry some sunny days. Furthermore, the government’s initiatives such as the hosting of global events–G20 summit and the ICC World Cup–has further uplifted the industry.

Currently pegged at $24.61 billion, the Indian hospitality sector is expected to reach a whopping $31.01 billion by 2029, recording a CAGR of 4.73% in the forecast period.

Additionally, with the recent series of events–the promotion of Indian islands such as Lakshadweep, and the inauguration of Ayodhya Ram Mandir, the country’s hospitality sector is sure to benefit.

Interestingly, PM Narendra Modi recently urged citizens to focus on our country first. He said: “If you are planning a vacation, look up tourism sites in your homeland and consider visiting these places with your loved ones. Do what you can to promote tourism in India.” He further pushed for ‘Wed in India’, promoting destination weddings in the country itself.

While these developments are in line to help promote the growth of the industry, the hospitality sector has more in its Budget 2024 bucket list.

“The Union Budget 2023 provided significant boost to tourism through its multifaceted mission mode…It is important that the momentum is maintained in the upcoming interim budget, by announcing policies that will support the demonstrated resilience of the sector and foster the expansion of hotels to bridge the huge gap between the supply of rooms and their corresponding demand,” says Siddhant Salgaonkar, Director of Sales at Hilton Goa.

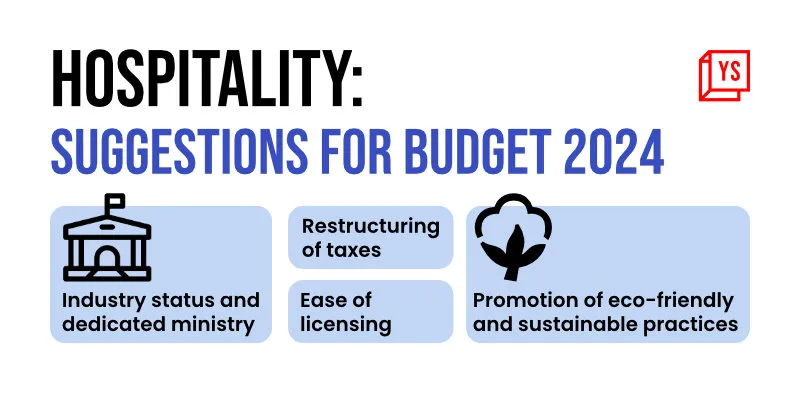

While there won’t be many major declarations during the interim Budget, stakeholders await some of the key announcements and policy measures such as a dedicated ministry, industry status, tax incentives, and the promotion of eco-friendly and sustainable practices to boost tourism and hospitality sector ahead of Budget 2024. YS Life spoke to some of the key players in the sector to know about their expectations and demands.

Industry status and dedicated ministry

According to the Hotel Association of India, the hotel market is expected to contribute $1,504 billion to the country’s overall GDP by 2047, growing from $65 billion in 2022. Considering the significant growth and the potential employment opportunities it will generate, the hospitality sector demands an infrastructure status.

“The sector has just bounced back after COVID-19, despite no fiscal support. However, going forward, we will need focused support from the government, starting with a dedicated ministry and industry status to sustain growth,” says Pranav M Rungta, Vice President of NRAI (National Restaurant Association of India).

For restaurants, he suggests, the industry structure will provide access to formal credit and cheaper power. For hotel businesses, the industry status will allow advantages of lower utility tariffs, lower property taxes, easier access to finance, and softer loans, thus, “significantly reducing the cost of doing business,” Salgaonkar explains.

Furthermore, it will reduce the gestation period for hotels and make return on hotel investments more attractive.

Ranju Singh, Complex General Manager at Novotel Goa Resort and Spa, and Novotel Goa Candolim, believes that the infrastructure status may also attract foreign investments in the hospitality space.

Restructuring of taxes

Over the last couple of years, the primary concern of the hospitality industry has been the restructuring of indirect taxes, particularly the Goods and Service Tax (GST) on hotel tariffs and restaurant services.

“The current GST rate of 18% is comparatively higher and should be reduced to a more globally competitive rate of 10% to 12%,” suggests Salgaonkar.

Kishan Reddy, Union Minister for Culture, Tourism, and DoNER G., informed the Lok Sabha in December last year that according to the data received from the Bureau of Immigration, foreign tourist arrival (FTA) in India is likely to reach pre-pandemic levels by 2024. The rationalisation of GST will be vital for bolstering the global competitiveness of Indian hotels and will directly affect tourism in the country.

“Aligning with benchmarks observed in competing destination countries like Singapore, and Thailand, where hotel taxes range between 5-7%, would be one of the ways to position India as an attractive destination, particularly for inbound travel,” Salgaonkar added.

Devendra Parulekar, Founder of SaffronStays, which operates in the holiday homes segment, is of the same opinion. He says a uniform 12% GST will promote domestic tourism in the country.

“This will make domestic tourism more affordable and accessible to Indians, instead of cheaper South-East Asian and overhyped destinations,” he adds.

Karrtik Dhingra, Co-founder of Goa-based restaurants Barfly and Titlie, suggests that considerate measures like GST input relief or tax incentives could alleviate financial burdens on small and independent F&B establishments.

Ease of licensing

At present, restaurateurs need a myriad of municipal, state, and central licences to start a business. The process is not only tedious, but also expensive.

“One nation, one licence is what is needed for ease of doing business,” suggests Rungta, who is also the Co-founder and Director of Nksha Restaurant in Mumbai.

Hilton’s Salgaonkar suggests that creating a single window for all approvals, with a time-bound system of granting them, will induce efficiencies and economies for rapid hotel growth and development.

Manik Kapoor, Director of Gola Sizzlers, Cafe Hawkers, and Sambar Soul Restaurants suggests a revamped liquor licensing process, coupled with reduced fees is absolutely necessary.

“The government should advocate reasonable and consistent liquor tax rates nationwide to support the industry,” Dhingra adds.

Promotion of eco-friendly and sustainable practices

The Ministry of Tourism formulated the National Strategy for Sustainable Tourism in 2022, in order to ensure inclusive, resilient, carbon-neutral and resource-efficient tourism, while safeguarding natural and cultural resources.

Salgaonkar suggests that the government and hospitality industry should work together on these lines to focus on allocating funds to promote eco-friendly accommodations, tourist sites and introduce incentives for industry players aligned with the United Nations Sustainable Development goals.

“Over-promoting destinations that kill the potential of the location and harm the environment should be avoided,” he says.

“Promoting eco-friendly practices and responsible tourism can attract conscious travellers and improve the long-term sustainability of the sector, potentially leading to new job opportunities in eco-tourism and related fields,” says Balasubramanian A, Vice President at TeamLease Services.

Similarly, Parulekar adds that single-windsor regulatory and environmental clearances will increase the ease of doing business in the hospitality sector.

Recommendations

A few stakeholders put forth other recommendations as well. For instance, Singh of Novotel Goa believes special training programmes for the hospitality workforce should be implemented for improved quality of service and overall satisfaction of customers.

Parulekar believes there should be a dramatic rise in allocation of funds towards Vande Bharat trains to unlock destinations across the country, for aspiring Indians wanting to explore India, with dignity in travel.

“A greater focus on the industry’s revival (from COVID-19) is required, which can be done by implementing an e-visa waiver for tourist visas, and domestic income tax travel credit for Indian citizens and Indian companies,” suggests Nishant Pitti, CEO and Co-founder, EaseMyTrip.

According to Rungta, the affluent population is expected to grow multifold, and will be directly linked to the growth of the hospitality industry in the next two years. “We are hoping for support from our government to give us the boost needed to keep up and contribute to nation building,” he ends.

(Illustrations by Sharath Ravishankar)

Edited by Megha Reddy