MoneyIvy- Assistance for Your Personal Finance

Founded in February 2012 by two ISB alumni and an IT veteran, MoneyIvy gives solutions for personal loansLet’s face it. Finances can get really tight sometimes. It doesn’t matter if you are a thriving individual or a growing business. At some time or another, we will all run into the same sort of problem. And to safeguard oneself, one will need financial assistance.

Today, consumers, particularly in urban and metro areas, have higher disposable incomes and are open to taking loans to meet their lifestyle needs and buying insurance to secure their future. However, with the increasing number of over-eager lenders and insurance companies, consumers are also faced with the daunting task of choosing the right product since the decision usually has a long term impact on domestic cash flows.

“MoneyIvy eliminates this information asymmetry and aids the decision making process for the customer through its cutting edge aggregator portal which disseminates even fine print information on each product and delivers real time eligibility and pricing quotes based on each customer’s individual profile and requirements,” says Surajit Das, one of the founders of MoneyIvy. The company will, as it claims, make it easier for customers to choose a loan deal that is most beneficial in the maximum number of ways.

The core team at MoneyIvy has three people; Prashant Krishnan and Rajesh Joshi besides Surajit himself. “One of the best things about the MoneyIvy founding team is that it blends technology, operations and financial domain knowledge very well,” says Surajit.

All three of these attributes are brought to the table by Surajit, who holds an MBA in Finance and Marketing from Indian School of Business (ISB). Prashant, the finance whiz of the team, is an MBA graduate in Finance from ISB, Surajit’s batchmate. Rajesh, who is the brains and sweat behind the technology platform, holds a B. Tech in Electrical Engineering and a Post Graduate Diploma in Advanced Computing apart from bringing 8 years of experience in the IT industry.

Talking a bit about the preliminary research that was put into the venture, Surajit says, “Considering that the opportunity cost for the founding team was fairly high, we had to conduct exhaustive research to convince ourselves that the business model is viable. We have validated the business model both through primary research and secondary market research.” Primary research was done by interviewing contacts in the industry and secondary research was based on statistical data released by the RBI.

It is a fact that the Indian online customer is most often reluctant when it comes to paying for online services. “At MoneyIvy, our plain simple philosophy is to ensure that customers save. With this mantra, we have kept our services completely free for retail customers. In fact, we also offer a ‘cash back’ to our customers from time to time to bring down the processing fee expense which is considered to be a burden by most customers when purchasing a financial product,” Surajit says referring to his revenue model.

MoneyIvy has interesting features like ‘Group Deals’ which ensure more savings for the customers.

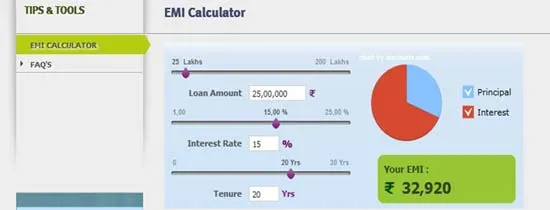

Also, to help one out with tedious calculations, the site has some pretty useful tools like the EMI calculator:

Talking about how MoneyIvy would be marketed, Surjit says, “Our business model is based on online lead generation integrated with an offline fulfillment process. At present our marketing initiatives are targeted at the online customer and there is a heavy reliance on ad words. Over a period of time, as our SEO kicks in, we expect organic search to have an increased share.”

Needless to say, one of the most important aspects of the company’s business is their partnership with banks. There are basically 3 types of supply side partnerships that players in this space can enter into. “The first one is what I term bottom of the value chain where customer leads are multicast to financial institutions on a cost per lead (CPL) basis, irrespective of conversion,“ says Surajit. About the other important aspects, he adds, “Next in the value chain is what is termed as the ‘Connector’ model and at the top of the value chain is where MoneyIvy has positioned itself. We, today, have established direct distribution partnerships with most of the leading lenders in the country and operate as a channel partner / authorized DSAs (direct sales agents) for our partners.”

Pointing out some of the major obstacles they face, Surajit says, “The main systemic risk in this business is the reluctance of PSU lenders to participate in a competitive aggregator environment for whatever reason. The other challenge is to transition a customer from using our service only for information search into making the final product-purchase through us. Being an early stage start up with an unknown brand also brings the issue of credibility when the customer is on the verge of making a very important financial decision."

With brains from the best schools in India behind MoneyIvy, the product is at par with global standards and you can give it a try here.