To understand the perceptions (and biases) of Venture Capital funds in the country, YourStory conducted a survey of startups a few weeks ago. We tried to analyze how startups and entrepreneurs perceive VCs (and not Angel Funds), how they work and what their perceived priorities and methods are. The results are quite interesting, and we'll share them over the course of this series of articles which will document the results of the survey.

The survey was conducted over the course of 2 weeks in July. Entrepreneurs from across the country were invited to respond to the survey. We asked entrepreneurs from across the spectrum – those that are currently looking to raise money as well as those that already have VC funding, those that are in seed/early/late stages and across sectors like e-commerce, healthcare, mobile, enterprise and more – to share with us their perceptions of Venture Capital funds.

It is important to remember that these are perceptions of entrepreneurs, and do not necessarily reflect the actual data of investments made by Venture Capital funds in India.

To start things off, lets look at how entreprenerurs perceive VC investing.

Factors VCs consider while investing

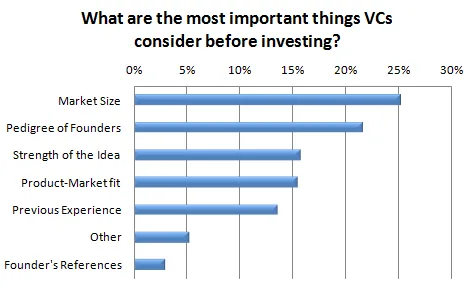

We asked startups, “What are the top 3 things you think VCs take into account before investing in a tech startup?” The number one response was Size of the Market the product is targeted to, with 25% of the respondents saying that was the most important factor. Interestingly, ‘Pedigree of Founders’ was a close second, with 22% of respondents agreeing with that statement. ‘Strength of Idea’ with 16% and Product-Market fit with 15% were the next two factors that entrepreneurs perceived were the most important criteria that VCs used to make decisions.

Advantages of VC Money

Next, we asked startups what the biggest advantages of VC investment were, apart from the money itself. Contacts in the Industry and Increased Visibility in the market were the top two factors that startups found most valuable.

But when we broke down the responses to the question among startups that already have received Venture funding, the responses changed quite a bit. The ability to easily hire employees was the #1 advantage that funded startups picked, which was ranked only #4 among all respondents.

Disadvantages of VC Money

When we asked about what the biggest disadvantages of VC money were, all factors came out more-or-less equal. The very interesting thing, though, was that if we consider the responses of only those startups that already have venture funding, an overwhelming majority picked “Too much equity dilution” as the biggest problem.

This is a surprising result. While startups are eager to accept venture funding to help grow their businesses, once they accept funding, there is a lot of remorse around the fact that too much equity was diluted during the fund raising process, almost like the classic “Winners Curse”.

This is part 1 of the series of articles exploring the perceptions of VC investments in India. To get full access to the report, please send an email to [email protected]