Mobile internet revolution in India - Insights from the Avendus report

Vodafone inaugurated November by slashing its 2G rates by 80%, taking the rate down to 2 paise per kb. In its financial statements for the quarter ended September 30, 2013, Bharti Airtel reported mobile internet revenues at INR 1,503 crore, a growth of more than 100% Y-o-Y. These trends are reflective of the growing dominance of mobile internet in India, a theme that is explored in depth by investment banking and financial advisory firm – Avendus – in a recent report.

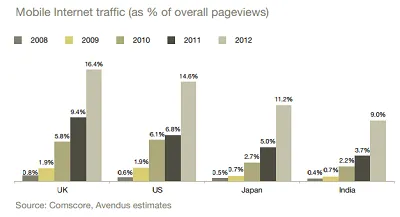

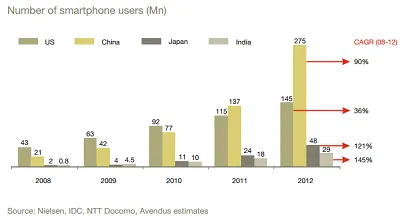

According to the report, 62.5% of the 2.4 bn global internet users use mobile internet. While PC shipments are falling (decline of 10.9% in Q2 2013), smartphones are expected to grow at a CAGR of 20% to reach 2.2 billion by 2015 and tablets are expected to grow at a CAGR of 33% to 369 million units by 2016. Globally, the average time spent on mobile (non-voice) now stands at almost 1.5 hours per day. 82% of Facebook's 1 billion monthly users access the platform through a mobile device, and 41% of Facebook’s revenues came from mobile in Q2 2013.

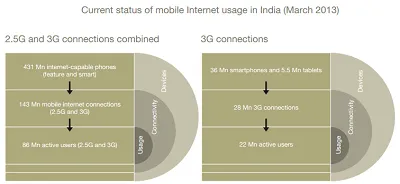

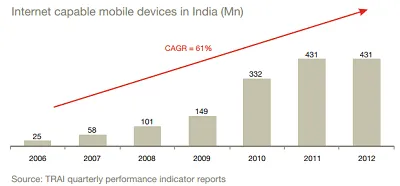

The trends in India, though lagging global benchmarks, are poised even more strongly towards mobile internet. Of India’s >160 mn Internet users, 86 mn access Internet using their mobile devices and mobile is the 1st experience of the internet for over 50% of Indians. While it took 17 years to hit 15 mn fixed line broadband users, there are already 22 mn 3G users in the last 3-4 years, in spite of the various issues faced in 3G connectivity. India already has over 36 mn smartphone users as against 60 mn PC users. However, the real play is coming from feature phones, which have taken the overall number of internet capable devices to 431 mn. Even as smartphones are becoming more accessible with entry level models starting as low as INR 4,000, feature phones will continue to dominate for the next few years.

By March 2013, India had 85.6 million active mobile internet users, which is 12.2% of total active mobile voice subscribers. 40% of Google searches in India are done on mobile and 30% of Facebook users are mobile-only. And it’s not only these internet behemoths that are seeing the traction. Within a year of launching its app, 25% of Bookmyshow bookings are taking place through the mobile app. For Cleartrip too, 20% of overall searches and 12% of bookings for Cleartrip come from its mobile app. The paid app market in India is estimated at INR 300 Cr, which says a lot for a country that has always balked at spending on the internet.

That said, monetization through mobile remains to be a tricky problem. From a consumer standpoint, MVAS addressed the payments issue but didn’t get much traction from content developers on account of service providers taking up 70-85% of revenue from the transactions. ‘Off-deck’ services – offered by content developers directly to consumers - are on the rise with third party app stores. Total paid app revenue from the iOS app store and Google Play in India crossed INR 150 crore in 2012, largely driven by “freemium” models and this number is expected to hit INR 2,000 crore by 2016. But payments remain a major issue.Reading through the report, I was left with some interesting thoughts and questions:

- I wonder if Indians are more accustomed to spending on their mobile phones. Nielson reported that 84% of all smartphone owners and 92% of feature phone owners in India have prepaid connections. This means that they are accustomed to frequent spending if not on - at least for their mobile phones - as opposed to PCs, where there is barely any recurring spend. Does this build a further case for m-commerce?

- The report throws up a very interesting statistic – with all this hype about mobile internet in India, 77% of the overall pages viewed on the mobile are actually driven by wi-fi connections! So maybe it is not so much about the ability to use the internet on the move but the ubiquity and ease of access on the mobile phone. I would go on to conjecture that a large number of PCs/ laptops are provided by employers and firewalls or not, the tendency is to see the PC/ laptop as a business machine. Hence, leisure browsing, leading to greater propensity of online purchasing is automatically biased towards mobile.

- RBI has restricted the use of talktime balance to a small number of services that it deems as being consumed on mobile devices. At the same time, there is a huge cash economy that exists in general. Will enabling this propensity for cash spending make a major impact? What if you could recharge your Google Play account at a physical dealer, just as you recharge your phone?

- Is there a larger opportunity in developing content for feature phones that is getting missed out? After all, more than 90% of mobile internet access is through feature phones.