Rocket Internet to go for an IPO in Germany by the end of 2014

After the consolidation of five of its global e-commerce services into one single entity, Rocket Internet has now confirmed its aim to go for an IPO at Frankfurt Stock Exchange, Germany in 2014.

The parent entity – GFG would comprise of Latin America’s Dafiti, India’s Jabong, Russia’s Lamoda, Southeast Asia’s Zalora and Middle East’s Namshi. Though these businesses are stretch across five continents, Rocket Internet team shall keep retaining different business models across each market. The company would file for an IPO officially before the end of this year.

According the official statement issued, this offer is expected to consist solely of new shares from a capital increase while all earlier shareholders of Rocket Internet will remain invested and won’t sell any shares as part of the offering for at least next 12 months.

As per the rumours, Rocket Internet is expected to float close to 15% stakes in the IPO for a valued at $1 billion.

After starting in 2007, Rocket Internet has been scaling very fast and today has reached to more than 100 countries with a workforce of 20k people across different businesses. The company has been making efforts to make its mission of ‘to become the world’s largest Internet platform outside US and China’ come true one day.

It’s expected that Rocket Internet would use the IPO earnings to fuel its future growth through the launch of new businesses and providing further equity capital to its network of companies.

In the last two weeks Rocket Internet had a blast – the valuation spiked up by $1 billion

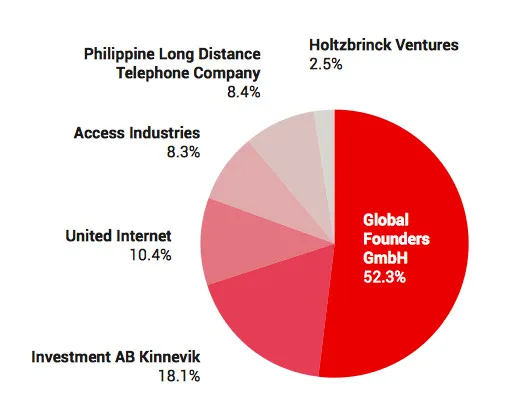

Currently, Rocket Internet shareholders includes Global Founders, Kinnevik, Access Industries, Philippine Long Distance Telephone Company, United Internet and Holtzbrinck Ventures and some of their affiliates. In August, PLDT joined Kinnevik and Access Industries as the third external investor, let’s see who has diluted and how much.

Before the new round of funding, Rocket Internet had three major investors – Swedish Kinnevik used to hold a 24% stake, while Len Blavatnik’s Access Industries used to own 11% and the Samwer brothers’ investment company Global Founders used to maintain a cool 65% stake.

After the fresh injection of investment by Asian PLDT in the European Rocket Internet, previous share holders have diluted their holding as the following.

Principal investor Kinnevik owned a 21.5% stake in Rocket Internet diluted from 24%. Philippine Long Distance investment (PLDT) owns 10%. Access Industries is down from a 65.2% ownership stake to a 58.7% stake owns a 9.8% stake. The Samwer bros equity stake in Rocket Internet has declined to roughly 59% from 66%.

Interesting times unfolding in e-commerce globally. Can this be a potential threat to e-commerce players in India?