Is the classifieds market 'winner-takes-all' in India?

I have always believed that India is not the place where classifieds marketplaces can achieve winner-takes-all position in a hurry. In other words, anyone who created an India strategy with this philosophy would have to wait for a long time and without any certainty.

To illustrate this, I will take you through an interesting journey revolving around two routes: A theory route and numerical route. Please note that all data is sourced from publically available information and hence I have used plausible assumptions to the best of my knowledge.

So let’s start with the theory route of establishing that it’s not a winner-takes-all market for classifieds in India.

The theory route:

To be a winner-take-all the market should qualify broadly these four requirements:

1. Multi-homing costs high for users

2. Cross side network effect to be strong (great if same side network effect is also strong)

3. Users do not have great need for differentiated offerings

4. Natural monopoly

Let me explain each point:

a) Sellers in India should not mind posting the same ad on OLX and Quikr simultaneously. There is no high cost (in terms of time or money) incurred, and actually since they want to sell their products fast they would hope to get better reach by selling on both platforms simultaneously. So multi-homing, or in other words, selling on more than one platform does not entail a higher cost/effort for a seller.

A true marketplace is a treasure of long tail products and hence there is always a pleasure in discovering items around your neighborhood. That’s precisely why buyers can also search on both platforms easily to find what they need. Hence right now for buyers too multi-homing is not a problem.

(The only exception will be when one of these platforms show a massive and sudden growth to garner 70% of all products sold on classifieds platforms. In such a scenario, buyers may trust only one platform, the way we trust Google (as a search marketplace) today over any other search engines).

b) Yes, there is a cross side network effect (more buyers attract more sellers and vice versa) working, but it is doubtful if it’s very strong.

However, same side network effect is not so great. More sellers need not attract more sellers. Hence cross side network effect is critical, but both parties have not been able to create any strong network effect yet.

Given that we hear tall tales about 200% growth annually or adding 2M listings per month, the total number of listings and listers should have been five times the size that we see. But in reality the growth has been slow and it seems that the rate of expiry of listings is more than the rate of additions. Please also realize that a significant portion of whatever growth we see comes from categories like Jobs, Real Estate and Services which are not truly C2C in nature.

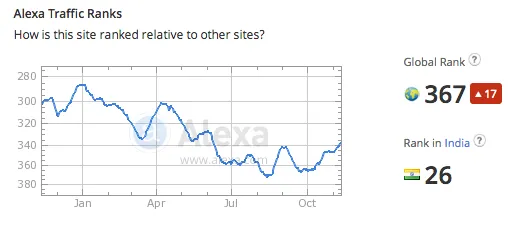

OLX graph shows a gradual downwards dip in Alexa over last six months. Why?

Quikr graph in Alexa shows ups and down. Why?

In fact, from the Alexa chart and associating it with my own viewership of TV ads, I fathom that when a platform pauses TV ads, the traffic goes down and when it resumes TV ads, the traffic goes up. If there was a strong network effect, you would see a more consistent graph.

c) Users need a differentiated experience for many categories that both OLX and Quikr have populated mindlessly.

Why would a user post matrimony ad without any privacy on an OLX or Quikr? (OLX removed matrimony a few months ago).

Why would anyone search a job or post a profile without any tools or richness of experience on OLX and Quikr?

People need richness of experience for specific categories where privacy is required or a large sum of money or trust is at stake (like jobs, real estate or matrimony).

And that is why despite the classifieds platforms investing huge amount of money on TV, they have posed absolutely zero threat to Naukri or 99acres or Shadi! So, yes, users need a differentiated experience and that’s why there is little scope for a winner-takes-all environment.

In fact, players like Just Dial are showing a tremendous growth in the services classifieds vertical with over 200M local queries last year up from 120M a year or so ago.

- Of course, there is no natural monopoly at play here.

Given that there is no government hold or sanctions, and that both parties are equally strong and visible across most parts of India, there is no natural monopoly at play here.

Since theoretically all four conditions are not met, India certainly is not a market for winner-takes-all.

Now let’s see some numbers and this is going to be interesting.

A. We are comparing USA and India with almost equivalent volume of internet users.

About 60M people (25% of US Internet audience) use Craigslist (by usage my understanding is people indulging in buying and selling and not UVs).

I am assuming that one person sells two items on an average on Craigslist every month, so that’s 50M sellers on Craigslist.

In India, if I assume that there is a 20% overlap in listings of OLX and Quikr and that one seller sells one item per month, then the total number of sellers on OLX + Quikr are about 7M per month.

Similarly, assume that 75% of all products on OLX and Quikr are sold out (approx. 6M buyers). This gives us a figure of (7M + 6M) 13M users of online classifieds in India, which is approx. 5% of all Internet users in India.

So, the rest 95% users are not using classifieds and hence there is a large scope.

B. Let’s look at the huge opportunity ahead via another example:

Let us assume that 50% of traffic on any classifieds platform comes from organic search. (Given that classifieds spend so much on TV this should trigger an even higher traffic from organic search).

Now total searches in India are to the tune of 13B per month. (India has approx. 6% of global search queries).

About 25% of this should be local search: 3.25B*

We can assume that 75% of all clicks on searches are on organic links: 2.4 B clicks or visits.

Given that both OLX and Quikr combined have about 55M UVs**

And even if we assume that each of them get three visits per UV that makes the total visit volume to: 165M each month. And as we said earlier, 50% of this is assumed via organic local search, i.e. 82.5M.

So out of 2.4B organic local clicks on searches, only 82.5M reach OLX and Quikr. That’s less than 5% of local organic searches resolved by both OLX and Quikr put together. The rest 95% clicks are still unresolved or are going to verticals and some other places like JustDial etc.

1. There is a clear indication the classifieds in India are not a winner-takes-all market, and at least 90% of the market is still waiting to be reaped. (Even after half a decade or more or presence of these platforms and huge TV investment).

2. TV advertising is the biggest blunder because it has not helped any player get near a dominant position or onboard a larger chunk of the Internet ready population. Here’s a simple exercise: Ask your friends how many have heard of any classified brand names. Then ask if they have ever sold or bought anything? Comment your answer in percentage terms.

3. We should expect one or two more players coming in. Schibsted, Avito and the likes could be on their way.

- We can hope for more acquisitions.

- We can also hope for new verticals to be launched by horizontal platforms (via acquisitions or new launches).

- We can hope to see more improvement from product teams in classifieds platforms. They will and they should shift focus from PVs and traffic, to liquidity/traction, better categorization, better hyper localization and content quality.

- We can hope to see a major focus on neighborhood marketing as opposed to mass media marketing.

About the Author:

Saurabh Pandey is the CEO of an award-winning social media agency dotConverse and has over 15 years of experience in companies like Google, Airtel, Ibibo and OLX. These are personal views of the author and are based on public sources of data. He writes regularly on his blog, www.atomthought.com and can be reached at [email protected]