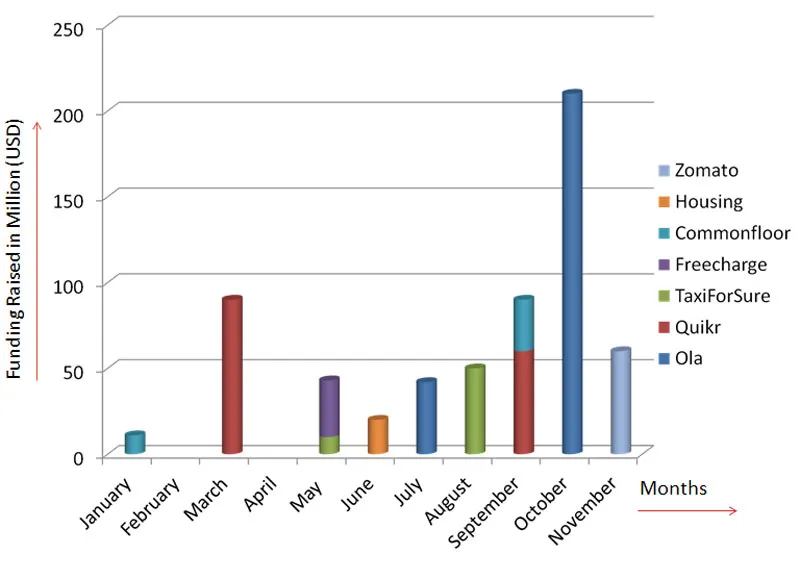

Top 10 service based e-commerce investments in India in 2014

While online marketplaces and e-tailers (selling physical goods) secured the biggest chunk of investor’s money in the e-commerce space, investment in service based e-commerce (not selling physical goods) also picked up in 2014. The top 10 investments in the space attracted over $600 million fund infusion across companies like Ola, Quikr, Commonfloor, Housing, and Freecharge among others.

Cab rental startups Ola and Taxiforsure together raised more than $300 million while real estate portals Housing and Commonfloor secured over $60 million. Online classifieds major Quikr alone raised $150 million in 2014.

Here’s YourStory’s list of the top 10 investments in Indian e-commerce (not selling physical goods):

- Ola (earlier known as Olacabs) raised $210 million in its Series D funding round led by SoftBank Internet and Media, Inc. (SMIC) and existing investors, Tiger Global, Matrix Partners India and Steadview Capital. At present, it’s the largest cab-booking app in the country with over 33,000 cabs on the mobile app available for customers to book from.

- Online and mobile classifieds company Quikr secured $90 million funding round from a group of investors led by Swedish investment firm Investment Kinnevik. This was also the first direct investment in the country by Kinnevik which is a family-run listed investment company with a market value of $10.6 billion.

- The third big ticketsize investment in service based e-commerce was also raised by Quikr. The Mumbai-based company raised $60 million funding round led by Tiger Global Management along with existing investors Kinnevik, Matrix Partners India, Nokia Growth Partners, Norwest Venture Partners, Omidyar Network, and Warburg Pincus, including eBay Inc.

- Online restaurant search and discovery platform - Zomato secured $60 million at a post-money valuation of $660 million in a round jointly led by Info Edge (India) Limited and Vy Capital, with participation from Sequoia Capital. This takes Zomato’s total funding to over $113 million.

- Mumbai-based online taxi booking platform Ola secured Rs. 250 crore Series C investment from Hong Kong-based hedge fund Steadview Capital and Sequoia Capital. The round was also participated by existing investors Tiger Global and Matrix Partners India. The round also pushed Ola in Rs.1000 crore valuation league.

- Bangalore-based online taxi aggregator Taxiforsure raised its series C round of funding to the tune of $35 to $50 million led by Palo Alto, California-based Sameer Gandhi, Helion Ventures and Bessemer Venture Partners also joined the round in August 2014.

- FreeCharge, India’s leading online platform for recharge, utility payments, promotions and couponing, raised a series B funding of $33 million in September this year. Existing investors Sequoia Capital, along with Sofina and RuNet took part in the round. At present, the company has more than 10 million registered users.

- Property listing website CommonFloor snapped-up $30 million Series E funding round from its existing investor - American hedge fund Tiger Global Management. CommonFloor was founded by Sumit Jain, Vikas Malpani and Lalit Mangal in 2007. The firm recently acquired Flat.to and is currently in a battle with other realty websites such as Housing.com and traditional ones such as 99Acres and MagicBricks.com.

- Online real estate startup Housing.com secured Rs.115 crore funding lead by Helion Venture Partners and Qualcomm Ventures. Their existing investor Nexus Venture Partners also participated in the round that valued Housing at about Rs 300 crore. While Helion has pumped in Rs.48 crore, Nexus has invested Rs.43 crore. The rest came from Qualcomm.

- Real estate portal CommonFloor raised Rs.64 crores in a new round of funding round led by Tiger Global and Accel Partner. The company plans to utilize the amount raised to develop their product further, build on its research expertise in the real estate domain and to fuel growth through new marketing initiatives.

- Bessemer Venture Partners led the $10 million series B round in Taxiforsure (TFC). The round was also participated by existing investors — Accel Partners, Helion Venture Partners and Blume Ventures. The company has been using funds to foray into 15 new cities (mostly in tier II and III towns).