For dummies: a basic guide to Mobile Wallets

Mobile wallets are making headlines these days. Paytm and Mobikwik, both of which offer semi-closed wallets, are the leading players in the sector. Telecom operators also offer this facility. Internationally, too, Apple Inc. is said to be introducing an iPhone wallet on September 9, which will have tie-ups with Visa Inc., MasterCard Inc. and American Express Co.

According to many experts, mobile wallets are going to be the next wave of change in the way people make payments.

Simply put, it is a virtual money wallet that can be used to make instant payments, same as with a physical wallet. It is an application stored in smartphones, which enables users to make payments for utility bills, book tickets, transfer money and other such transactions. It can also be used to make instant e-payments while shopping in physical stores or at e-stores.

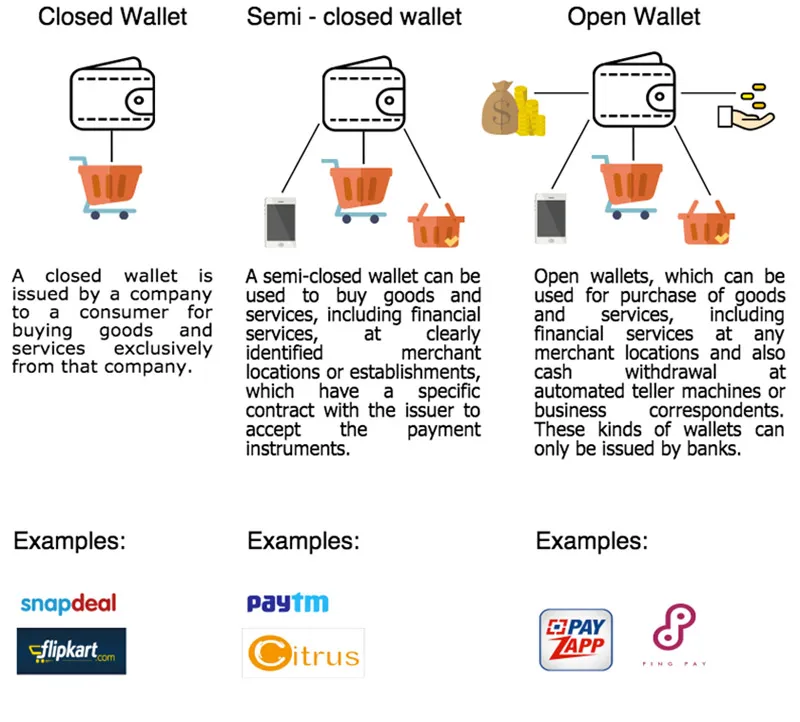

Three types of mobile wallets

Eligibility

Only banks are allowed to issue open wallets, as well as the other two types. NBFCs and other persons can issue only closed and semi closed wallets.

Permission from RBI:

Entities issuing closed prepaid payment systems do not require authorization from the RBI; they just need to inform the RBI.

Entities issuing semi-closed and open prepaid payment systems are required to take authorization from the RBI.

Law governing mobile wallets

The Payments and Settlement Systems Act, 2007 is the primary law governing payments systems in India, with the RBI as the body that supervises related matters. Section 18 of the Act empowers the RBI to make such regulations as may be required, from time to time, to regulate payments systems in India. In exercise of the same, the RBI has laid down guidelines for the issuing and operation of Pre-paid Payment Instruments. A MasterCircular consolidating all regulations on the same was put out on July1, 2014.

Other Requirements:

A company (that which is not a bank or a NBFC) seeking the RBI’s authorization should have a minimum paid-up capital of INR 5 crores, and a minimum positive networth of INR 1 crore at all times.

The Circular specifies anti-fraud mechanisms/standards and the level of Customer Due Diligence required based on the quantum of transactions involved. KYC norms and Anti Money Laundering norms as relevant would continue to apply to pre-paid instruments. Importantly, these regulations do not cover any cross-border transaction and do not extend to any foreign exchange pre-paid instruments allowed by RBI under FEMA.

Image credit "ShutterStock"