Cash-rich e-commerce logistics companies target India’s heartland for growth

It was a proud moment for Vijay Ghadge, Chief Operating Officer of GoJavas, when his e-commerce logistics company started delivery services in Karad, a town in Maharashtra. Kara happens to be Vijay’s birthplace.

E-commerce focused logistics companies have been focusing on small towns like Karad in the last few months, as these locations are the new drivers of growth for online retail.

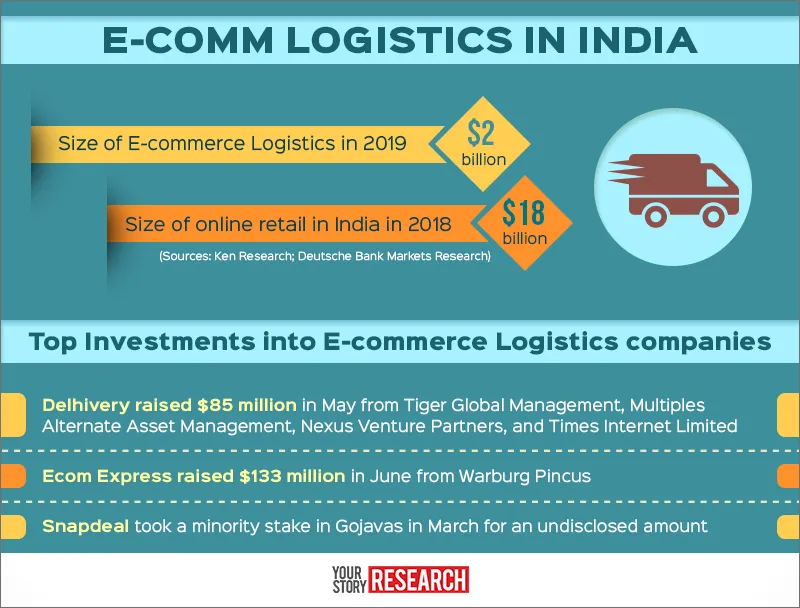

Delhi-based GoJavas, in which Snapdeal acquired a stake this year, launched operations in Karad in April and the numbers have already picked up. GoJavas delivers about 250 packets a day in Satara district, which includes Karad.

It is not very often that a nascent industry sees such a confluence of demand, intent to supply and even investment like e-commerce logistics is witnessing right now.

There is demand from every town in India, big or small. All that is needed is opening up deliveries to these locations

says T A Krishnan, Chief Executive Officer of Delhi-based Ecom Express. Companies like GoJavas, Ecom Express and DTDC’s e-commerce logistics arm DotZot are making full use of this opportunity. Another major e-commerce logistics startup, Delhivery, declined to share details for this article.

The growth of e-commerce logistics is directly linked to the fortunes of the online retail industry. It is estimated that online retail will be an $18-billion industry in India in 2018 and e-commerce logistics will be a $2-billion industry in 2019. This number will only grow when online retail becomes, according to a Goldman Sachs report, a $220 billion market in 2030.

Expansion to small town India

Growth for online retail will be increasingly driven by the smaller urban centres like Naharlagoan in Arunachal Pradesh and Biharsharif in Bihar, which are each receiving over 2,600 deliveries a month. Tier-II and III cities and towns are expected to contribute to more than 350 million e-tailing shipments in 2018, according to a white paper put out by advisory services firm Alvarez & Marsal in December.

Sanjiv Kathuria, Chief Executive Officer of DotZot, which has a reach of over 8,150 non-metro pincodes across India, says:

I look at it this way. If my e-commerce clients want to sell to a certain centre we will make it happen

Ecom Express’ Krishnan also says that they take their cues from clients and the demand they see. “When we see demand in a certain centre, we open that centre up and service adjoining locations as there will be demand from there as well,” says Krishnan.

Vijay of GoJavas says it is a chicken-and-egg situation. “If you start servicing a centre that was not covered you will see instant demand,” he says. GoJavas has a presence in over 320 cities and towns in India and has revenue of over Rs 200 crore. Ecom Express, which declined to reveal its current revenue, has at least one office in 340 cities and towns.

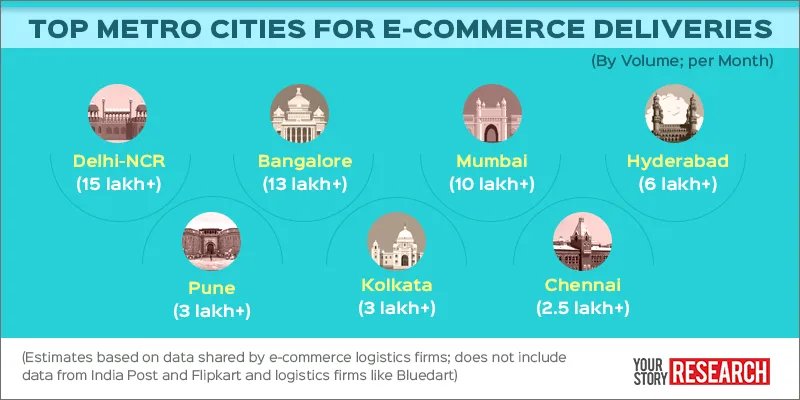

This is not to say that metros are not important markets, far from it. The large cities are still the biggest markets as seen in the graph below.

Why small towns make sense

While these are the largest markets, they also happen to be the most crowded as every logistics firm covers the metros. A strong presence across large swathes of small-town India or even specific regions is becoming a point of differentiation for these firms.

“We are the only operators in many of these locations apart from India Post. So whatever demand anyone gets, it has to flow through us,” says Krishnan. The demand from these locations is not sporadic and is consistently growing. Krishnan gives the example of Ongole in Andhra Pradesh. Ecom Express launched operations in Ongole in August and the daily load has crossed 900 a day. Ecom Express now covers every pin code in Haryana and Goa. With more locations getting launched, the following tables could soon see changes.

Cost of expansion

A chunk of the investment raised by these firms is being deployed for expansion to these centres. Since many of these towns are virgin territories for e-commerce, cost of reaching these markets are higher. Launching operations in smaller towns is more expensive by over 35% compared to starting operations in a metro or a big city.

Setting up infrastructure, the need to cover relatively larger distances from a single centre and lower volumes increase the cost. However, these locations are serviced by surface transport like road or train, unlike big cities that are covered by air, as the need to deliver in a very short period is not very high. This metric is relatively lower for small centres.

But the greater cost is that of risk and control. Some of the locations are in sensitive or crime-infested zones. An e-commerce logistics company said their Imphal service was shut for days recently due to a bandh. In Itanagar, customers have to come to the office to collect parcels as safety of delivery personnel could get compromised when out on the road. The company did not want to reveal its identity due to the sensitive nature of the issue.

CoD—boon and bane

While at least some segments of the metro consumer base have moved to payments before delivery, in the smaller cities and towns cash-on-delivery or CoD is still king. Vijay of GoJavas says:

We have seen orders jump in many locations when we start CoD. The tier-II numbers are understated as CoD is still not there in many places.

DotZot’s Sanjiv agrees that CoD is the number one driver of growth in small town India. CoD accounts for 45% of e-commerce transactions, according to an Assocham report released earlier this year. According to industry executives, in non-metro centres this number is much higher. In some centres all transactions fall under CoD.

While CoD has opened up markets, ensuring safety of cash and personnel becomes an important consideration. Remitting the cash from these locations to the main regional offices on a regular basis—daily is preferred—is another challenge in areas with low banking penetration.

Alternate models

These challenges will result in the creation of alternate models of delivery in these locations, says DotZot’s Sanjiv. There are talks of locker boxes being setup. Last year, fashion e-tailer Jabong piloted ‘NextDoor’ service, where customers were allowed to pick up their orders from a nearby coffee shop or petrol station in locations like Murshidabad in West Bengal and Chandausi in Uttar Pradesh.

DotZot is piloting a closed-user wallet service for its franchises through which they can transfer money. “We are also appointing associates of our franchisees who will do the delivery, like what micro finance companies have done,” says Sanjiv. “This market will need to be disrupted by such alternate delivery models.”