Funding round-up: deal value skyrockets on the back of growth deals

Radhika P Nair

Monday November 23, 2015 , 3 min Read

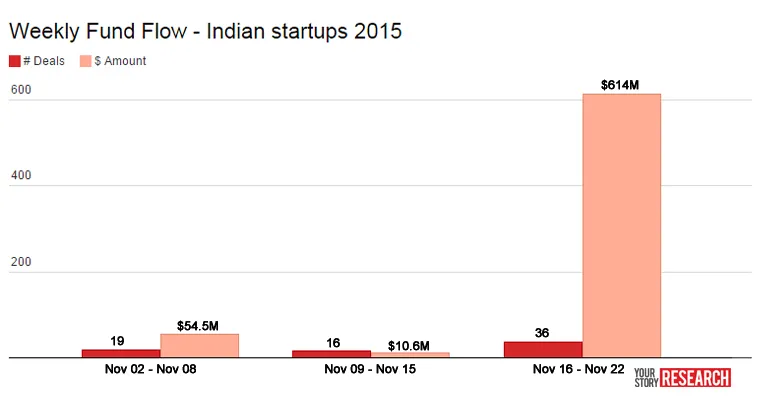

The third week of November has shown quite clearly that ‘good’ companies can raise large sums of money even when the overall market sentiment is negative. Investors poured over $614 million across 36 deals between November 16 and 22.

So, what about all this talk of a potential slowdown in funding? “If it is a good company they will find funding. Companies like Ola, which are market leaders, will not face trouble when raising funds. But me-too companies – yet another e-commerce, yet another grocery company – is where the trouble is,” says Raja Lahiri, Partner at Grant Thornton India, a financial advisory firm.

Eleven companies raised funds of over $1 million each. But one company is responsible for much of the deal value during the week under consideration. Ola, which has shown its mettle against global taxi booking behemoth Uber, raised a whopping $500 million from Baillie Gifford, an Edinburgh-based investment management firm, Didi Kuaidi, Ola’s counterpart in China, and existing investors DST Global, Falcon Edge Capital, Tiger Global, and SoftBank. This is Ola’s sixth institutional round of funding. The Bengaluru-based company is building an enviable capital war chest to power its battle with Uber in India. In April, it raised $400 million and before that $210 million in October last year.

The second biggest investment was into online marketplace for ethnic products Craftsvilla, which raised $34 million from Sequoia India, Lightspeed Venture Partners, Nexus Venture Partners, Global Founders Capital, and Apoletto.

Top deals (over $ 1 million; November 16–22)

It is interesting to note that seven of the top 11 deals consist of Series A or pre-Series A investments. However, companies like StyleTag, CashKaro, and MindTickle are over two years old and have already created a strong market presence.

Overall, only 26 companies shared investment details and of this only three deals were Series B and beyond. The rest were early-stage deals. This is in line with the dominant trend in the past many months. Investors have placed a number of early-stage bets this year. Raja says that 2016 will be an interesting year as many of the companies that raised first round of funding this year will be on the lookout to raise follow on funding. “Investors will take a call based on performance,” says Raja. There was only one acquisition this week – healthy dining restaurant chain Sattviko acquired food delivery startup Call A Meal.