Dear PM Modi, startups are feeling 'aswasth' due to your Swachh Bharat cess

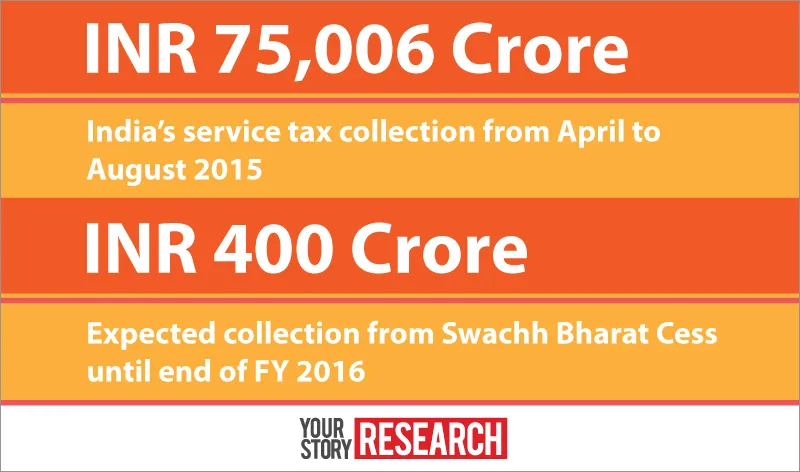

Indian startups got a sucker punch when the government announced the implementation of Swachh Bharat Cess of 0.5 per cent, effectively making service tax 14.5 per cent from November 15.

The cess, which could have been up to two per cent according to the Union Budget, might seem low. But startups, especially those in the consumer space, are already loss-making entities and even 0.5 per cent additional tax can have a direct impact on bottom lines. It is no wonder, then, that those heading fast-growing startups are upset.

Hurting bottomlines

“The cess hurts,” says Saran Chaterjee, CEO of hyperlocal home services firm Housejoy. “Even 0.5 per cent has an impact. We have a marketplace model and the service tax is on our commission. There will be negative pressure.” Housejoy links service providers ranging from plumbers to fitness trainers with customers through its platform and gets about 4,000 orders a day across nine cities. The Matrix Partners-backed company has ambitious plans and is targeting to be in 25 cities within 12 months.

There is also a concern that the government could increase the cess to two per cent as mentioned in the budget. “If it increases by another 1.5 per cent, the impact will be huge. I am hoping there will be a reprieve,” says Saran.

Gross margins in the fledgling hyperlocal industry are around 20 per cent and vary according to category. But these venture-funded startups are providing discounts and spending heavily on marketing, leading to negative net margins.

Price is an important weapon in a startup’s arsenal to attract customers, and additional taxes or a cess complicate matters. “As a startup, we want to broaden our customer base. We might not be able to pass on the additional charge to our customers,” says Navneet Singh, CEO of hyperlocal grocery business PepperTap. “We charge Rs 50 as delivery fee and this includes service tax. We need to take a decision on whether we absorb this or increase the rate.” For the moment, PepperTap, which operates in 17 cities and gets about 22,000 orders a day, has kept the delivery charge at Rs 50.

For some service providers, there is no choice but to pass on the cess. Gaurav Jain, Founder of quick service restaurant chain Mast Kalandar, says the government should have differential taxation on services used on a daily basis by customers. “We are in the value business and many of our customers eat at Mast Kalandar at least thrice a week. Such a customer is sensitive towards any change in prices, however slight,” he says. The chain has a network of 70 outlets and is targeting Rs 80 crore revenue this fiscal.

This view is echoed by Amuleek Singh Bijral, Founder and CEO of Chai Point. “This impacts our attempt to make Chai Point part of daily life. We are promising quality chai at affordable price with bells and whistles like online payment. The cess does not help us,” says Amuleek, whose company serves 1.5 lakh glasses of chai a day. The company has about 200 corporate clients and runs 75 stores.

No reprieve

Now, under the service tax regime, there is something called CENVAT Credit. A company that is collecting service tax is also paying tax on services like the rent it pays for its office or outlet. The tax authorities allow service providers who also pay service tax to get credit for the tax paid, which is CENVAT Credit. “For Swachh Bharat Cess, a service provider cannot take credit,” says Alok Patnia, Founder and CEO of Taxmantra, a provider of taxation, accounting and financial solutions to individuals and businesses.

Also, the cess has to be shown in the book of accounts separately and has to be remitted separately as it is to be used only for the Clean India initiative. This adds to the headache for startups.

For e-tail companies, the problems are different. Since they are not providing a service to consumers, there is no service tax applicable. “But we pay service tax on all services we avail, like Facebook and Google marketing. At our scale such costs run to a few lakhs. So the impact of the cess is significant,” says Shivani Poddar, Co-founder of online fashion brand Faballey. For instance, PepperTap’s sister concern NuvoEx, a reverse logistics company that counts Snapdeal, Flipkart, Paytm, ShopClues and others among its clients, is passing on the cess to its clients.For larger companies like Flipkart, Snapdeal and Ola the impact could be even higher considering the scale of their operations and the scale of their losses. However, Flipkart declined to comment and Snapdeal and Ola did not respond to detailed email queries.

Incentives and accountability

Entrepreneurs also suggest that an incentive system will be more effective. Chai Point’s Amuleek says their Bengaluru operations do not rely on the municipal authorities for waste management. The tea and other wastes go to the company warehouse, where it is sorted. “Farmers from Doddaballapur collect our organic waste, which is very good for the vineyards there,” he says. “Government should give tax sops for such players, so others also follow suit. That will help (the Swachh Bharat campaign) directly.”

Faballey’s Shivani, whose firm’s gross merchandise value stands at over Rs four crore a month, says the government should consider a slab system for companies, just like there is a slab system in Income Tax. “Smaller companies with lower revenues should be exempt,” she says.

Others want to see results. “I am all for the Swachh Bharat mission. But in our country, a lot of things have been tried, a lot of money has been spent, but we have not seen results,” says Suchi Mukherjee, Co-founder of women-focussed fashion e-tailer Limeroad. She points out that there have been numerous attempts to clean River Ganges and the efforts have come to nought. “The government needs to publish how the incremental tax has helped. Otherwise you are just penalising a whole bunch of people,” she says.

GST—the only hope

With the government making its intention clear to discuss the Goods and Services Tax (GST) during the ongoing Winter session of the Parliament, there is hope that GST will be implemented soon. “GST will overtake all the indirect taxes, including service tax and VAT and the rate is expected to be between 16 and 18 per cent,” says Taxmantra’s Alok. He says under the GST regime, any tax paid by companies for services received can be adjusted against tax received from clients. “GST will be better overall; it will be the game changer,” he adds.

Unfortunately, until GST is implemented, startups will have to deal with the stress of the new cess.