Flipkart and Amazon set to overtake retail giants

Sanjeev Mukhija is an apparel manufacturer who harboured dreams of launching his own brand in 2012. Back then online commerce was just about hovering somewhere above the retail space. But Sanjeev, ever the entrepreneur, decided to take the riskand launched his brand 'Breakbounce' on Myntra. Three years later, his brand’s exposure to e-commerce has made him consider setting up physical stores too.

“As a manufacturer, e-tailing has given us a major push. But I believe both physical retailing and e-tailing will co-exist,” says Sanjeev. He adds that for a wider reach and brand recognition, e-commerce is a greater platform at certain price points. This year will perhaps be the one of the e-tailers taking on big-box retailers.

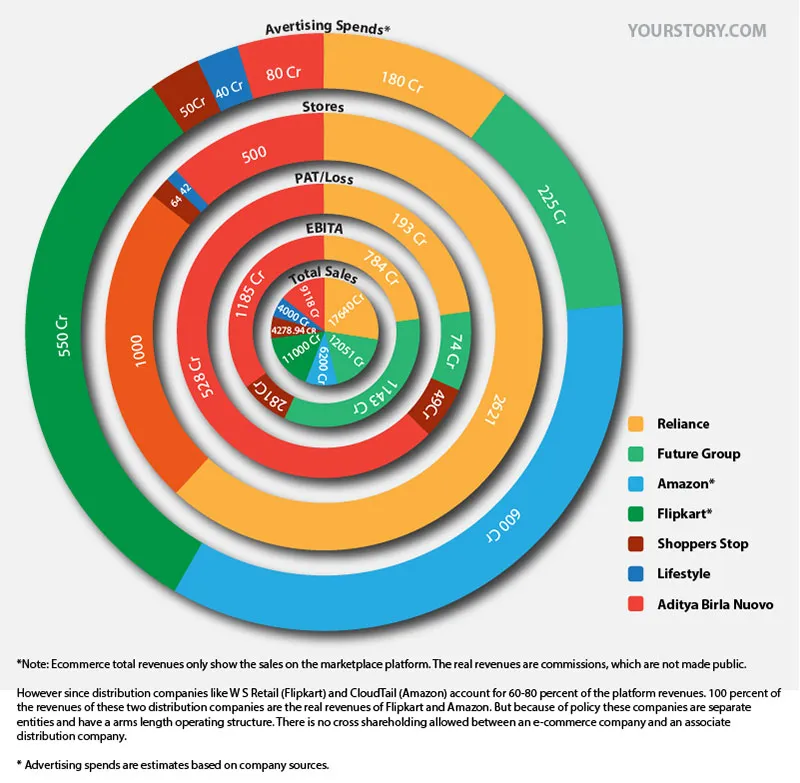

But organised retailing has been a difficult proposition in India. According to a report by Ernst&Young, the organised retailing pie, which includes new entrants—our fund-laden e-commerce players—form only 10 percent of a total market size of $550 billion. Let us not get into why organised retailing is not growing as fast as it should be, but look at the revenue figures in the charts. One finds the top e-commerce companies are actually closing in on the revenues of brick-and-mortar players. Flipkart has already registered revenues of more than Rs 10,000 crore on its platform. Amazon India too has been closing in with revenues nearing $1 billion sales. Thanks to these companies' big-bang sale days, the traffic for items such as low cost apparel, footwear, mobile and other electronic items have moved online. While brick-and-mortar retailing has grown by 10 percent, it is nothing compared to the 250-percent growth numbers that e-commerce companies are experiencing.

Harminder Sahni, Co-founder,Wazir Advisors, a retail consultancy, says,

Brick and mortar completely missed the opportunity of the online revolution.

However, Harminder adds that it will be sometime before organised retailing would become 20 percent of the total retail market in India. Several senior analysts like to say that by 2020 the market size would be worth over $1 trillion, and e-commerce is expected to be close to a third of that 20 percent, which would make it alone a business worth $70 billion. Big-box retailers need to wake up to the change happening in major metros and Tier-Itowns. Currently,though, e-commerce is not more than 1.5 percent of the retail market.

Consulting companies are already optimistic about e-commerce beating big-box retailers this year. Arvind Singhal, Chairman,Technopak, an advisory firm, believes that e-commerce biggies will certainly overtake physical retailers, including Reliance and Aditya Birla Group. Flipkart claims $5 to 6 billion and Snapdeal claims $3 to 4 billion in Gross Merchandise Value (GMV).

"If that kind of business is going through their portals, the top three or four retail businesses in India in 2016 could be the online players. I would include Paytm also. These four will bring in $2 to 5 billion or more as GMV this year," he says,adding that it's more difficult for physical retailers to grow, since they need retail space and capital inputs. The brick-and-mortar retailers are restrained by Foreign Direct Investment (FDI) and retail policies.

Satish Meena, Analyst,Forrester Research, says,

Cash is expensive for big-box retailers. They are funding their business with free cash flows or debt.

But let us put GMV in perspective: it is a number that does not take in to consideration the discounts, the returns and orders cancelled. So, when e-commerce companies quote these numbers one need not necessarily panic.

But here is how e-commerce and big-box retail would compete with each other this year:

Supply chain and warehousing

The supply chains of both these businesses are different. Big-box retail has already built a supply chain, which ends with the transaction closed between the shop and the customer. It uses warehouse to support this format. The total warehouse space leased by organised retailers is close to 50 million sq.ft. Future Group leads the pack with four million sq.ft. of leased space.

According to real estate consulting firm Knight Frank, India has one billion sq.ft. of warehousing space. The report forecasts that the demand will grow at a compounded annual growth rate of nine percent, to touch 1.4 billion sq.ft. of space built by 2019. In terms of investments,e-tailers are estimated to take the fight to organised retailing.

E-tailers are just about building the supply chain, which begins post the transaction. Around $1 billion of investment has gone into setting up warehouses for the e-tail industry. Real estate consulting firm CBRE's Indian Online Retail Driving Realty report states that almost 25 percent of the total warehousing and logistics space uptake across the country was by e-retail players.

“Their ability to use technology to understand customers and vendors will allow them to automate their warehouses quicker,” says Harminder of Wazir Advisors.

Convenience versus omni-channel retailing

When it comes to convenience,e-tailers have beaten physical retailers hands down. Cash-on-delivery is an Indian phenomenon and has become very popular. To beat this, physical retailers are investing in technology and are prepping all their stores to make deliveries on the same day, which is termed as the omni-channel world. Say a consumer orders a shirt from a retail app, the tech in the background figures out what store is closest to the consumer and whether it is the right fit. The delivery will then happen from the store. The technology must be foolproof,as the consumer’s location and inventory by store has to be mapped to perfection. The retailers also have to be prepared to take returns. Success of omni-channels will largely depend on brands. “A brand can’t think of adopting only one route in the current world of multi-channel retailing. It has to be present and available on all the platforms possible. So, yes we have strategies for brick-mortar and e-commerce,” says R K Jain, MD,Bonjour Group, which makes branded socks and leggings.

Raising money

Retailers are dependent on free cashflows. Unfortunately for them,FDI rules do not allow foreign investors to invest in multi-brand retail. The current rules allow 51 percent FDI in retail. But there is a caveat; the rules left it to Indian States to decide whether to allow or bar retailers with FDI raised. Working on a marketplace model, e-commerce has been allowed to raise foreign capital,as it allows Indian mom-and-pop stores to benefit from sales enabled by the platform. Flipkart has raised $3.2 billion, Amazon India has committed $2 billion to India and Snapdeal has raised $1.6 billion.

Money to be burned

The adspends are the highest among e-commerce retailers (see chart). Sources in the industry say that Amazon India and Flipkart spend more than Rs 150 crore per quarter to win consumer mind share, which seems to be their real estate. Meanwhile,brick-and-mortar retailers spent close to $14.7 billion on real estate alone between 2006 and 2012, according to a report by real estate consulting firm Jones Lang LaSalle. Sources estimate that the industry would have also spent around $5 billion on stock alone. However, many shut down their operations too. They expanded to 1,000s of stores before rationalising to a few 100s. Many, like Provogue and Koutons, shut shop because of debt burden. Subiksha, the grocery store, shut shop because it could not raise money to maintain its working capital. Only Reliance Retail, Shoppers Stop, Future Group and Aditya Birla Nuvo have survived of the about 30 organised retailers that cropped up. It is estimated that around $10 billion was spent on stock alone in the last decade.

End of the discounting wars

Today, customer acquisition has led to heavy discounting, which is managed by burning investor money. “This is not very sustainable and eventually they have to focus on bottom lines,” says Devangshu Dutta, CEO,Third Eyesight, a retail consultancy. This is where the brick-andmortar chaps are waiting patiently. When focus turns to profitability, or to at least generatingcash from operations, e-commerce companies could struggle. Perhaps 2016 is a year of reckoning when discounting will drop and realistic business models will be built by e-commerce companies.

YourStory take

Organised retailing is still going to take awhile to be a large part of the Indian market even after the explosion of e-commerce. If anything, there will be a battle to organise retailing. That said, e-commerce will perhaps dominate consumption, led by smartphones. Gartner predicts that there will be more than 340 million smartphones sold by 2017. For now, let us safely say that big-box retailers can learn a lot from e-commerce companies about using technology, and e-commerce retailers can learn the art of churning cashflows from big-box retailers.