Instant delivery players will need to go the extra mile to survive

The world is moving at a faster pace each day, and getting what we want quickly is the mantra of our times. This is most evident in the way we shop and conduct business. The past couple of years has seen the rise of hyperlocal services, with companies like Grofers and TinyOwl emerging. A number of companies have come up now that are becoming logistics partners to these hyperlocal players and even to more traditional e-commerce companies.

Manish Porwal, Business Development Manager at logistics data startup LogiNext Solutions, says: “Just to create that mind share as well as marketshare, they have to tie up with efficient last-mile delivery companies. Offers for delivery in 60 or 90 minutes may not be possible if they try to do it themselves.” According to consulting firm Technopak, India’s e-commerce startups spend as much as 30 per cent of their net income on logistics.

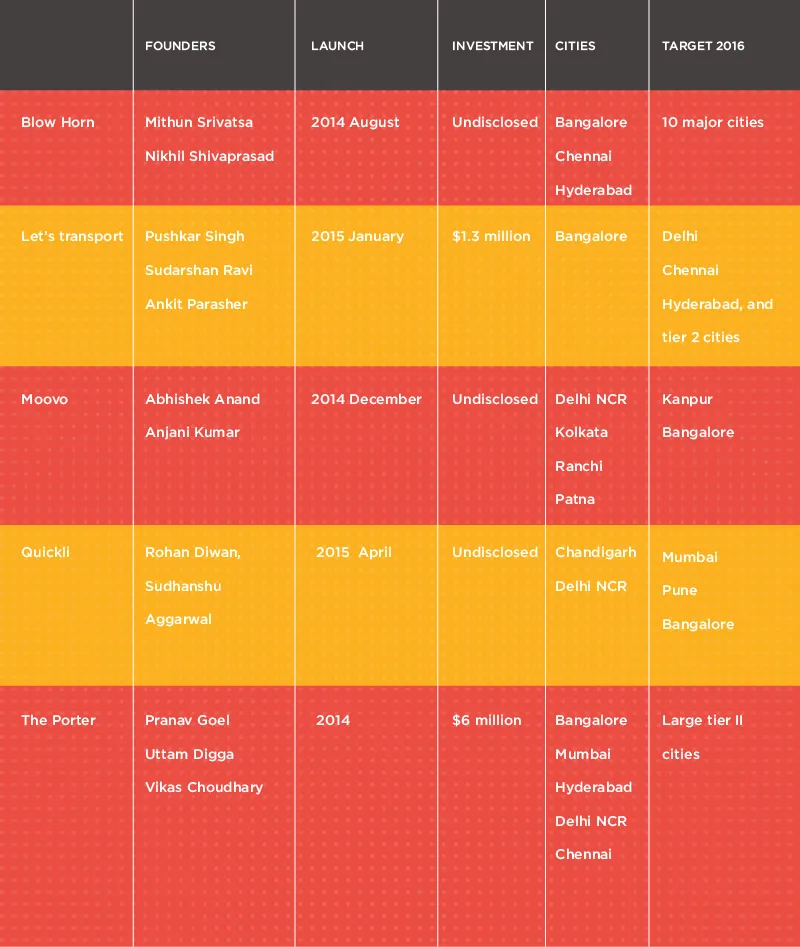

The logistics sector in the country, particularly the intra-city model, has been largely unorganised; but startups have managed to make strides towards organising the sector. The arrival of over 15 online logistics marketplaces such as The Porter, Blow Horn and Moovo in the last 18 months has eliminated the middlemen in sub-contracting.

Following the marketplace model, they aggregate driver-owners of trucks and mini trucks, and provide customised services for delivery of industrial supplies, e-commerce supplies and perishables, as well as relocation. Approximately $37 million was raised as funding in 2015, in the sector. However, while the market is large enough for multiple players, not all are guaranteed growth.

Necessity of inter-city ops

Experts opine that just focusing on intra-city operations could be limiting for these companies. According to Manish Saigal, Managing Director (India), Alvarez and Marsal management consultancy, investors tend to be sceptical about the scalability of the intra-city on-demand logistics sector. “Intra-city services have limited opportunities, whereas inter-city is the promising sector. But it takes significant funding, great operational capabilities and more people on the ground to scale the business in inter-city space,” he added.

Anjani Kumar, Co-founder of Delhi-based Moovo, agrees that commissions are quite low in intra-city logistics services. “But the inter-city market has a much bigger ticket size. Our gross merchandise volume (GMV) from the inter-city space is twice what we get from intra-city,” he said. According to him, driver and customer acquisition is basically the same; only offline operations are different. Moovo is soon launching big trucks for the inter-city market in Kanpur, and Bangalore for intra-city services. Bangalore-based Let’sTransport is also planning to grow its fleet size and diversify vehicles for inter-city experiments.

What lies beyond the metros

A major hurdle that online logistics platforms have to overcome is the reluctance of traders outside metros to use technology in their traditional businesses. While it may take a couple of years for these players to establish themselves in tier II and tier III cities, various other factors stand in the way of their entry.

Manish believes that as technology adoption is likely to be slower in these areas, one has to provide good-quality vehicles and service at the same rate as the local vendors these businesses are used to. Rohan Diwani, Co-founder of Quickli, however, says that tier II cities will not gain prominence for the next two years, although logistics will mature in tier I cities. “Hyperlocal is about instant gratification. Delivery at the last moment is essential in metros, whereas in tier II and tier III cities, the pace of life is slower,” he says.

But Pranav Goel, Co-founder of The Porter, begs to differ. He says: “Tier II and tier III cities have bigger markets. We want to dominate three or four major cities before going tier II though.” The Porter caters to Amazon, ITC, Delhivery, Roadrunnr, and Furlenco among others. Let’sTransport, whose clients include Big Basket, Bisleri and Grofers, also has similar plans. Pushkar Singh, Co-founder, says, “A market exists in tier II and tier III cities. For our expansion, we are doing surveys to figure what kind of industries each city caters to.”

Pooling for optimisation

Profitability comes with optimisation of resources. Rohan believes that optimisation of [space in] delivery trucks is the future of logistics. Quickli allows clubbing of orders for lower prices. They deliver to SMEs, grocers, pharmacies, and restaurants including Subway and KFC, and observe a monthly growth of 20 per cent in revenue.

But Pushkar says that since their customers are not always receptive to the idea of pooling, Let’sTransport is focusing on time-based optimisation to reduce idling time. “We understand the movement [of our delivery goods] across the city, and then deliver the data in consumable form to the drivers,” said Pushkar.

However, Mithun Srivatsa, Co-founder of Blow Horn, believes that although optimisation technology is already built in, customers do not care about full truck loads. According to him, what matters is reliability. “Even mini-truck customers like SMEs don’t care; Amazon and Flipkart never tell you that the truck should be fully loaded, but to be on time. Optimisation should come in the form of reliability,” he says.

Since the intra-city market cannot afford one vehicle per consignment, Moovo prefers load pooling. “Many logistics companies manage part truck loads, but they have to maintain a warehouse. We will be doing only full trucks for the next 18-24 months,” says Anjani. Currently, Moovo gets 12,000 orders per month from its customers including Flipkart, Snapdeal, Gojavas, and Delhivery.

Car aggregators enter the fray?

After Ola’s launch of its grocery delivery service last year, it won’t be a surprise if taxi aggregators enter the on-demand logistics sector. A few months ago, it was reported that Ola will soon enter the on-demand delivery sector. In fact, Dhruvil Sanghvi, Co-founder of LogiNext, is sure that Ola and Uber will enter this market soon. “They have the resources and technology to do it. With more capital, they have better chances to succeed since they can experiment,” he said.

Transportation expert Jaspal Singh, partner at Valoriser Consultant, believes that the entry of these players will help boost the on-demand delivery business and bring more technological innovation. He says: “With a big customer network and good supply, these companies can offer a good platform to retailers and other companies to deliver their goods quickly.” However, he adds, cost and speed of delivery will be challenging.

Rohan of Quickli believes that unlike in personal transportation, where there is no guarantee for a cab, in logistics, a business is depending on you. “You have to provide ultimate guaranteed services. That’s a different ballgame altogether.” Mithun of Blow Horn also says that though Uber and Ola have the necessary infrastructure to handle certain types of load, technological requirements in logistics are different.

Competition: rising market & newer technology

Getting their technology right is crucial for the on-demand logistics players. Delivery management platforms are gaining prominence every day. “The supply chain needs to get mapped out; you need tracking of bookings, confirmation of deliveries, updates on your supply chain…all of which demands real-time monitoring,” Pushkar says.

Dhruvil of LogiNext says that before spending crores on technology, startups need to have the talent and understanding to solve issues in the sector. “We made tech a commodity so everyone can use it and optimise the opportunity,” he said.

Training driver partners to adapt to their technology is another major task. Rohan says: “But skill development startups like Kickstart Ventures have been helpful in getting the right talent pool. They hire and train drivers from rural areas to make them operations-ready.”

But the role of technology seldom goes beyond booking. Anjani believes that loading capacity, height, and weight should be automated as well. “We are currently working on a system to automate details like how many goods were present initially so that if something goes missing the driver is not liable.”

YourStory take

With so much potential, the on-demand logistics sector is sure to grow, although it could do with some more funding. If the industrial growth the country has seen in the past two decades is any indication, India will soon need more players for its logistics needs. Besides, with hyperlocal startups coming up every day, the industry is bound to get a boost, as outsourcing the delivery process is also essential to manage surges better and have an even delivery spread.

A sector that was locally driven and unorganised for the longest time is gradually transforming with increased transparency and reliability. Yet, technology adaptation by suppliers has a long way to go. Understanding the customer psyche and offering customised solutions is what will separate the champions from the also-rans. New business strategies will nurture the industry to deliver more winners – especially if they can provide a one-stop solution for inter- and intra-city services, as well as technology to automate the whole process. They say slow and steady wins the race; but in logistics you need to be steady and as fast as possible.