TiE Bangalore showcase: meet 7 startups riding the fin-tech wave

When will bitcoin take off in India? Will Indian consumers entrust their wealth to financial advisors on marketplace sites? Is there a big enough market for a mobile tool to help manage business expenses?

For two hours, seven entrepreneurs pitched their ideas and offerings to an expert jury at TiE Bangalore’s first startup showcase of 2016, in the fin-tech sector. Free to the public, the event drew over 120 attendees, and the discussion carried over long into the networking session. (See also YourStory’s coverage of TiE Bangalore’s earlier startup events here.)

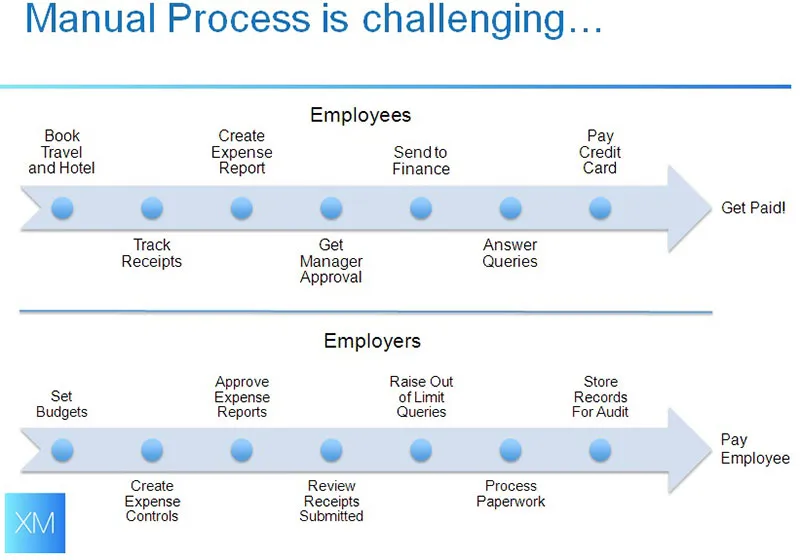

1. XpenseManager is an on-demand expense management platform which lets employees log in and track expenses such as travel reimbursement claims via mobiles. The tool brings in more convenience for employees over existing paper-based approaches, and helps managers track expenses and set spending policies.

Founder Deepa Ramanujam cited data which showed that 56 per cent of mid-market companies surveyed say they have limited visibility into travel and expense spending, and 35 per cent report non-compliant travel expenses. A handful of customers have already been roped in for early stage rollout.

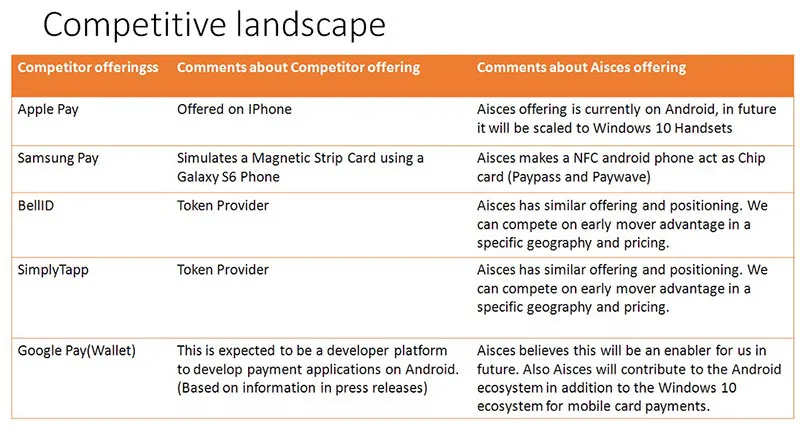

2. Aisces is a cloud-based mobile payment platform based on host card emulation (HCE) and tokenisation. The founder, Anuj Pachoree, is a B.Tech. from IIT BHU and PGSEM from IIM Bangalore, and was earlier with Ezetap and Samsung.

Banks in India currently issue cards in the plastic medium; Aisces provides a mobile app along with a cloud-based token vault to make this offering virtual. This can be used for applications like ticketing and loyalty programmes. Using Aisces, an Android phone can effectively act as a NFC contactless debit/credit card.

Users are charged a monthly rental of Rs 180 per card. In India, RBI has issued a directive supporting adoption of contactless cards, and SBI and ICICI have already entered this space. Anuj claims there is good growth and acquisition potential in this sector, eg. LoopPay was acquired by Samsung, and Softcard was acquired by Google.

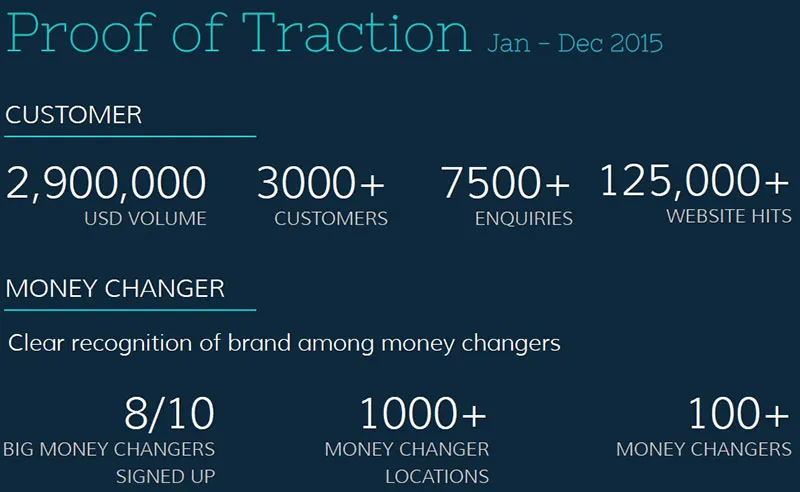

3. FxKart is an online foreign-exchange platform connecting forex customers and moneychangers. Customers can choose moneychangers based on nearest, cheapest and delivery time filters. The platform provides transparent bidding tools for customers to view and choose the best offers from moneychangers.

The market is highly fragmented in India, with over two thousand money changers. The target audience is not the large corporates but SMEs, students and independent travellers. An estimated 300,000 Indian students travel abroad each year, out of 18 million travellers departing from India.

FxKart claims its competitors Nafex and BookMyForex do not offer features such as multiple quotes. Its CEO Abdul Hadi has over 10 years of business advisory experience in Ernst & Young and PWC.

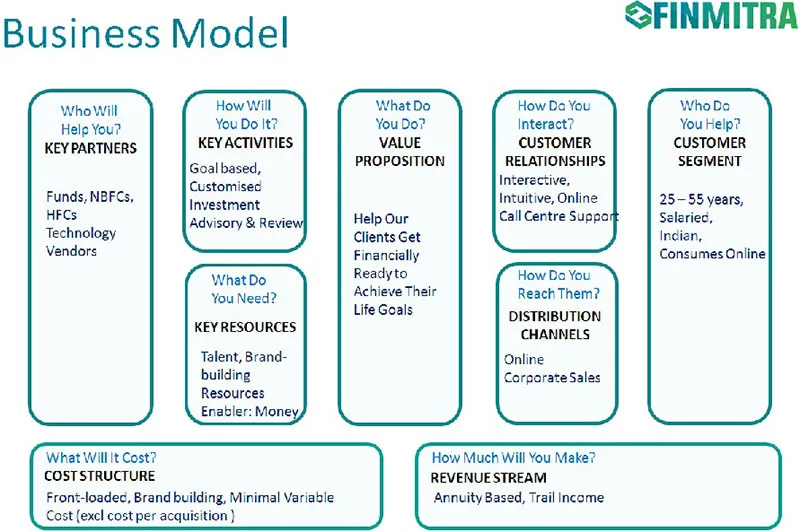

4. FinMitra is a goal-based financial advisory and management services firm. It helps individuals set financial goals, discover their risk profiles, and find the best investment portfolios in terms of mutual funds and fixed deposits.

The site is going live this month, and will use analytics to conduct portfolio reviews and offer performance alerts. Market drivers are increase in average household income, increase in financial awareness and a favourable investment environment. The target market is the current pool of about 40 million individual investors in India, estimated to reach 60 million by 2020, according to co-founder Bhargavi Sridharan, an SPJIM graduate who was earlier with Tata Steel and TISS.

5. OnUs offers a cashless payment service in relatively closed environments where the payments are faster, secure and easier to handle. These include college campuses, corporate canteens and hospitals. Typical purchase items include food, stationery and transport, where purchase amounts are less than Rs 200.

Typical credit cards and mobile options may not be suitable here due to reasons of time and cost per transaction; top-up tap-and-pay cards are the best option. OnUs claims to be doing two lakh transactions a month, expected to increase to 3.5 lakh transactions in February.

The founding team includes K.S. Ravi Shankar who was formerly with WoodStock Ambience, Modi Xerox and Wipro; G.G. Srinivas, formerly with ABN AMRO, Kotak Mahindra Bank and Standard Chartered Bank; and Hari Haran, formerly at SCB Singapore and Barclays India.

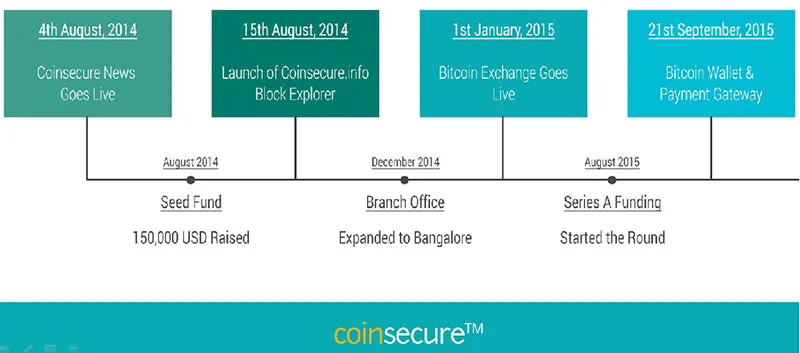

6. CoinSecure, founded by Mohit Kalra and Benson Samuel, is a bitcoin platform for trading and exchange in the India market. It aims to reduce the hurdles customers face in Indian rupee compatibility and block chain access.

CoinSecure’s development centre is in Bengaluru, with the head office in Delhi and marketing office in Mumbai. Its offerings include a bitcoin wallet and exchange. Coinsecure.info allows users to search the bitcoin public ledger or blockchain in realtime. For customer education, the company has launched a series of online tutorials.

Bitcoin is not illegal in India, clarified COO Jincy Samuel. In addition to the consumer sector, other use case scenarios include Internet of Things (IoT), where bitcoin can be used by devices to charge for data in nano-transactions.

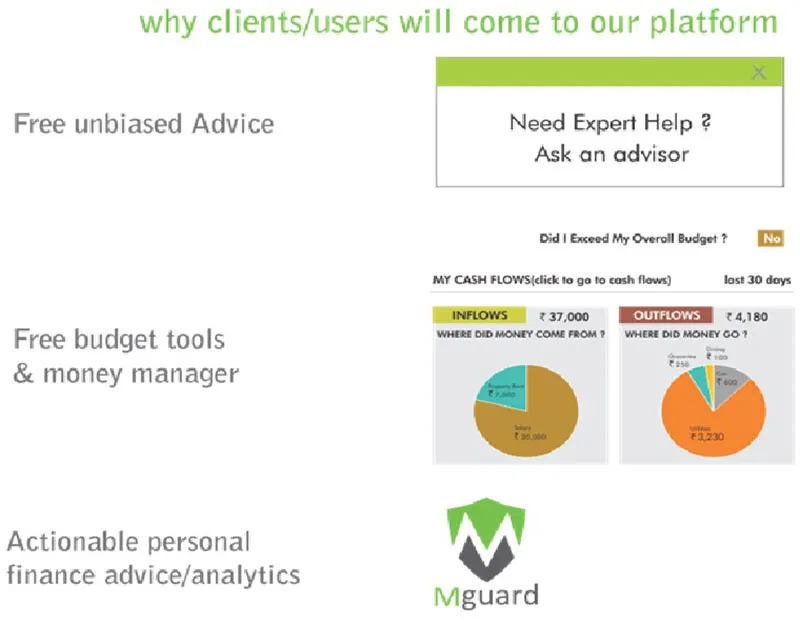

7. MyMoneySage is a CRM platform for financial services, and is targeted at individuals as well as financial advisors. Advisors can manage their clients efficiently and get visibility among the investor community, said founder Kishorkumar Ballipalli.

Investors can get advice on managing their money, with tips on savings and budgets. The platform offers visualisation and alerting tools for investors, along with periodic reminders and actionable insights.

Discussion

While this was a startup showcase and not really a competition or awards event, the jury asked a range of incisive questions (see also my Startup Question Bank from the Anthah Prerana startup competition and Tips for Successful Pitches). The jury members were Arvind Tiwary, CEO of SangEnnovate; Suryaprakash Konanuru, CTO at Ideaspring Capital; Parag Dhol, Managing Director at Inventus Capital Partners; and Ganapathy Venugopal, CEO of Axilor.

Here is my pick of 10 questions from the wide-ranging discussion, which will be useful for other fin-tech startups entering this space as well.

- What regulatory changes may pose a challenge to your model?

- How are you dealing with risks of security breaches to consumer and merchant devices?

- How will your startup compete with the larger banks when they enter this space?

- How are you addressing consumer concerns over data privacy and parental control?

- How will you keep per-transaction pricing low and yet attain profitability in a sustainable manner?

- How effectively does your platform integrate with back-end systems in large banks and finance companies?

- Can you make this process even simpler for the end consumer?

- How will you cover up for lost devices or forgotten passwords?

- What kinds of new algorithmic insights are you capable of generating?

- Your model assumes individuals are rational creatures, but how will you deal with the more common irrational behaviours?

With India set to become one of the largest Internet and mobile markets in the world, the potential for profits in fin-tech seems alluring for a wide range of startups. Success will come to those who can successfully answer the tough questions such as the ones posed above, ride the regulatory changes, time their offerings to the right audiences, and build out their teams for high-growth trajectories.

Feature image: shutterstock