Why should startups care about the Budget

Union Budgets have always been hotly debated, even before they are presented. While the Budget has an impact in the way the government will spend on different sectors, many in the startup community are not interested in the announcements that the Finance Minister, Arun Jaitley, will make on February 29th.

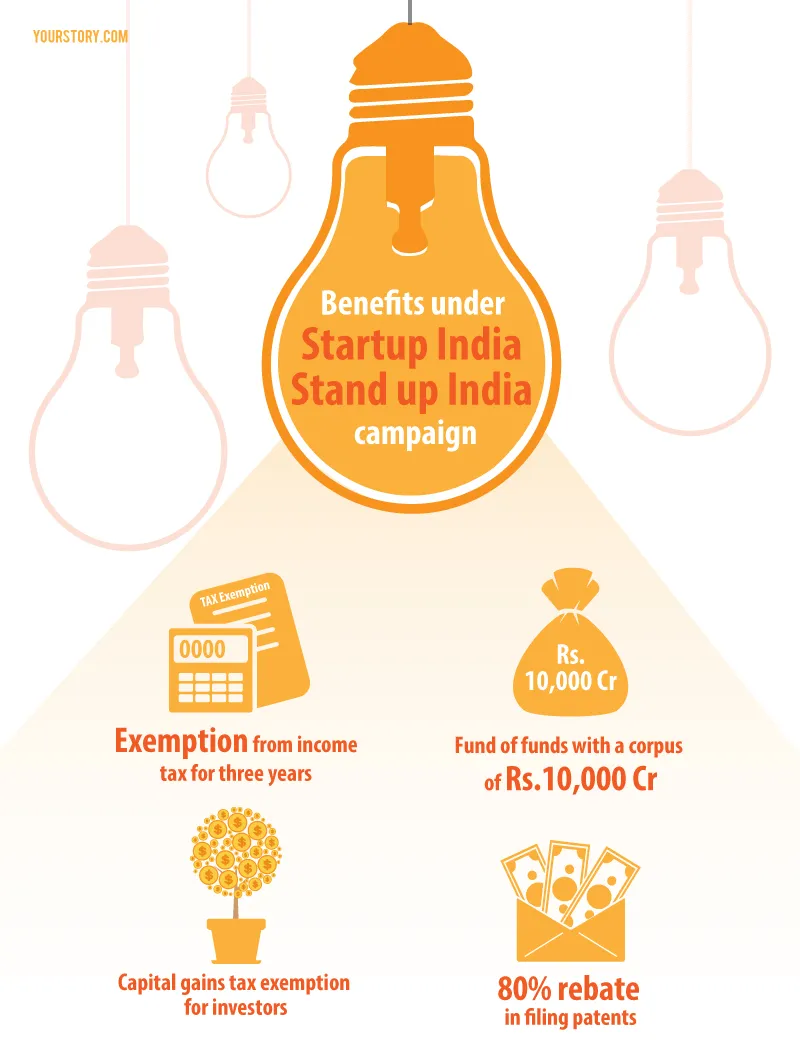

However, there are those entrepreneurs and investors as well who are keenly awaiting the Budget as announcements in areas like tax will have a direct impact on the startup community. They say that the ecosystem, which got a lift in spirits from the Startup India Stand up India campaign announced last month, could do with more benefits in the coming financial year. Topping their list of expectations is the realisation of the policies announced already. Although politics and bureaucratic woes have delayed formal procedures, especially in the passing of the Goods and Services Tax (GST) Bill, entrepreneurs and investors are hopeful of an easier environment.

Although startups have changed the face of India through innovation with limited support from the government, there are several ways in which the government can support them. In fact, Saahil Goel, Co-Founder & CEO, Kartrocket, says that last year's announcement of the startup fund, and initiatives taken to boost SMEs and MSMEs, encouraged more entrepreneurs to set up their e-commerce stores, leading to 5x growth in their revenue last year.

Whether it is infrastructural issues like poor connectivity or the ridiculous number of taxes associated with starting up, the entrepreneurs YourStory spoke to echoed similar concerns regarding the Budget. Here's why the Budget is important for all startups and investors:

Will they, won’t they?

The Startup India Stand up India campaign was no doubt a great initiative, but execution is key to its success. Adhil Shetty, CEO and Founder of BankBazaar, says: “A clear and measurable timeline for its implementation in the Budget would be great. The government’s plan to support existing incubators and set up new ones should not remain on paper but be reflected in the Budget.” He added that the implementation of the credit guarantee mechanism for funding startups that was announced is also very crucial, especially in smaller towns and cities where there are no VCs or angel investors.

There is reason to be worried here. The Public Procurement Policy (PPP) 2012 that calls for PSUs to purchase 20 per cent from MSMEs became an on-ground reality only in April 2015. R Narayan, Founder and CEO, Power2SME, says: “As a result, PSUs’ procurement from MSMEs has doubled. This has certainly provided the required boost in the SME space.”

According to Samar Singla, CEO and Founder, Jugnoo, previous budgets have been more of a miss than hit for startups. The government needs to give more clarity on how the action plan announced during the Startup India, Stand Up India Campaign will be implemented.

But not everyone believes that implementation of incentives alone can make a difference. Narendra Sen, Founder of Rack Bank Data centre, says that it is flexibility on licensing, reduced timeline for the processes, and single-window clearance that makes business easier. “Debt-free loan quota from financial institutes should be increased. Loans without collateral should also increase to Rs.5 crore at least, as the current Rs.1 crore is just not enough,” he added.

Money power for angels

Fundraising and taxation have always remained key areas of concern for startups. Naturally, entrepreneurs are keeping their fingers crossed for a more favourable environment for investors. Kunal Bahl, CEO of Snapdeal, says: “We hope that Budget 2016 will continue the task of creating a favourable, predictable and investment friendly climate for global funds seeking to participate in India’s growth story.”

But government actions so far have left many confused. Nidhi Agarwal, Founder and CEO, KAARYAH, says: “It is an irony that on the one hand, the government wants to give a tax holiday in the initial three years, and on the other hand, heavy losses incurred by startups are not allowed to be offset against future profits due to changes in shareholdings.” She hopes that the Budget has provision for easy access to capital and allocation of resources.

Samar of Jugnoo says that the government needs to focus more on encouraging investments in startups and making norms easier for venture capitalists to invest in startups. Adhil of BankBazaar recommends a waiver on service tax on similar grounds.

According to Samir Kumar, Managing Director, Inventus Capital Partners, the government should clarify the rules on taxing angel investments below fair market value. “They need to bring capital gains on sale of startup stocks on par with that on listed stocks - that would be a great incentive for investments into startups,” he added.

While they appreciate the waiving off of capital gain tax, most entrepreneurs are worried about the angel tax restraining their possibilities. Samar of Jugnoo says: “We are hoping for some easing of resolutions on Section 56, which taxes startups on investments they receive from angels if it is above fair-market value. Also, reducing taxation on ESOPs (at the time of exercise and not at the time of cash realisation) can be a major policy to boost startup opportunities.”

Taxing dilemmas

There is a saying that ‘nothing is certain but death and taxes’. The startup ecosystem is no different. With states mandating separate taxes, entrepreneurs are suffocating. Many like Navneet Singh, Co-founder of PepperTap, believe that the implementation of nationwide GST will simplify the entire tax structure, cut business costs, and ensure more revenue. “We are looking for simpler processes, easy regulations, faster clearances, and less red-tape,” Navneet said.

The GST scheme was supposed to be implemented on April 1, 2016, but it may get delayed since the NDA government does not have a majority in the Rajya Sabha, where the Bill is stuck now. Consensus between the states is essential to pass the Bill in the Rajya Sabha and 2/3 of state legislative assemblies. But Punjab and Haryana were reluctant to give up purchase tax; Maharashtra was unwilling to give up octroi; and all the states want to keep petroleum and alcohol out of the ambit of GST.

Investors strongly believe that GST will simplify the whole tax structure. Shubhankar Bhattacharya, venture partner at Kae Capital, also believes that GST will enable commerce. “Since many key product categories are likely to have a beneficial price/cost impact, it could create a win-win in terms of driving demand from customers without the need for excessive discounting from merchants,” he says. Samir of Inventus Capital agrees. “Clarity on GST is an absolute must for startups in the software product space, as there is currently no clarity on whether they should pay service tax, or value added tax (VAT),” he says.

For startups as well as SMEs, banks could become a favourable option if it were not for parameters such as a positive P&L statement and collateral availability that put many young businesses outside the eligibility bracket, says Narayan of Power2SME. He recommends performance incentives for SMEs in terms of rebate on direct tax and separate rates for SMEs for VAT, Service tax, Transportation tax, and State tax, among others.

Implementation of GST will make it particularly easy for e-commerce players to raise funds. Nidhi of KAARYAH says: “Service charges paid by e-commerce companies to market places attract service tax as well as sales tax under the current laws. We'd like to see some changes there, especially as marketplaces onboard small, new retailers like us.”

Uniform taxation laws across the country is the key factor for Kunal of Snapdeal. “It will significantly ease tax compliance for businesses and benefit the government by bringing in easy tax administration and greater transparency," he says. He believes that the movement forward in indirect taxes will help align taxation with contemporary business models, and will resolve varying interpretations of VAT/CST and service tax.

Internet and Better routes

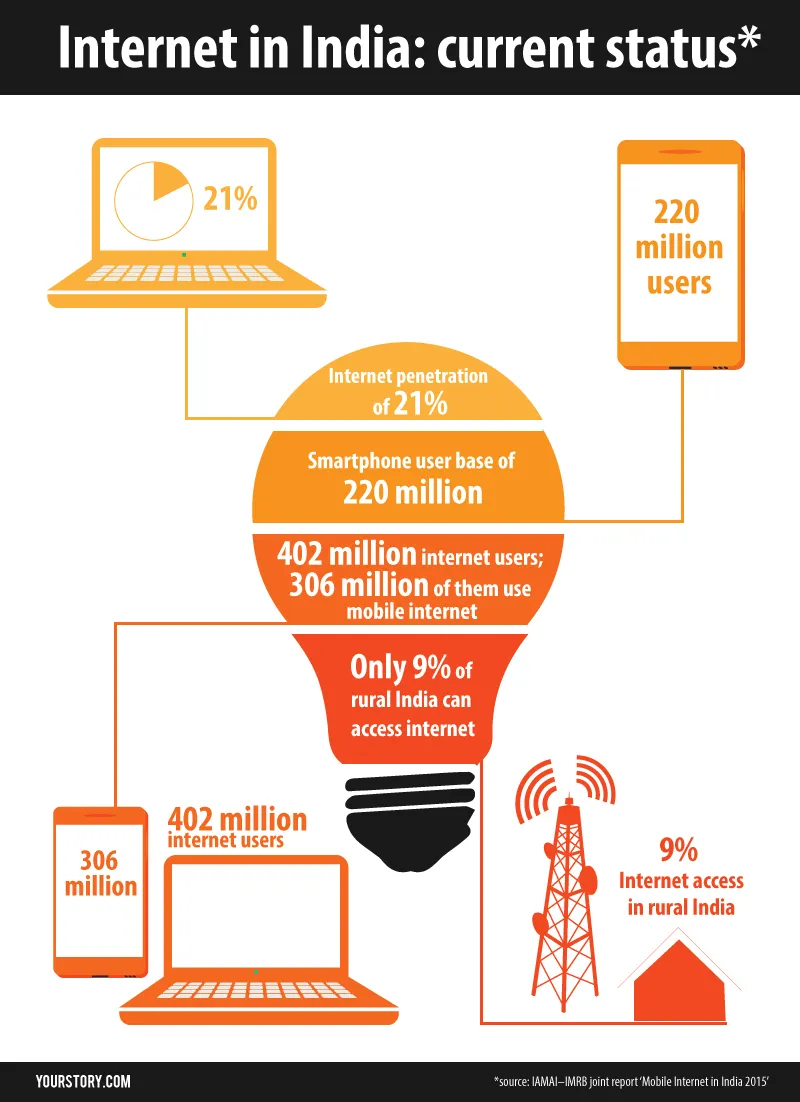

For any country’s economic development, Internet connectivity is as significant as any other parameter. Unfortunately, despite a much-celebrated Digital India campaign, this is a constant headache for tech-based startups.

According to Shankar Nath, Senior Vice President, Paytm, a high bandwidth is crucial. “We would also like to see tax breaks on budget smartphones, which support vernacular languages. Tier II and III cities and rural India thrive on smartphones, and have contributed significantly to productivity. The more the smartphone penetration, the higher the levels of entrepreneurship,” he says.

Internet coverage seems to be the ultimate factor for growth of startups beyond metro cities. Shubhankar of Kae Capital says: “Given the low penetration of high-speed mobile data outside of Tier I cities, subsidised Internet data usage could substantially speed up adoption in Tier-II cities, thereby opening up the market potential for such startups, which then become attractive investment opportunities.”

Saahil of Kartrocket, also believes that offering tax benefits and incentives could change the landscape of Tier II and Tier III cities. Vani of Kalaari Capital also welcomes tax credits/ exemptions for setting up startups in Tier II cities. “More than tax incentives, government should focus on setting up startup workspaces in Tier II cities, providing access to distribution channels, facilitating innovation, building industry outreach, facilitating periodic mentoring of budding entrepreneurs, and providing fast Internet connectivity,” Vani added.

Hope for future

It is undeniable that startups will be affected by the Union Budget at least partially. At a very macro level, policies and allocations defined in the Union Budget also have an effect on how attractive India appears as an investment destination to the larger funds based abroad, says Shubhankar of Kae Capital. “Over the last two years in particular, we have had significant inflow of capital from large foreign institutions, hedge funds and VCs into early-stage firms, and this could be attributed to the positive sentiment around India, which might, at least in part, be based on the Union Budget's provisions,” he says.

According to Aditya Vuchi, CEO of Zippr, procurement processes for long-term projects like Smart City should embrace strategies like the Swiss Challenge methodology – in which government contracts are awarded to private players based on merit- enabling startups with innovative solutions to compete against larger incumbent enterprises and provide the best offerings. “It would also help to reduce unnecessary statutory compliances such as bank guarantees and balance sheet support that are now mandatory in most government initiatives, regardless of the need for such requirements,” he says.

As Mithun Srivatsa, CEO of Blow Horn, says, some have social impact as a goal, some have an eagle eye focus on returns to shareholders, others are focussed on scale over everything else. Each path needs encouragement as they have the capability to improve the ecosystem as a whole.

Graphics by Aditya Ranade