E-commerce lessons from Snapdeal: find out what 2016-17 has in store for the company

Snapdeal has had a track record of keeping things, well, snappy. Although the nine-member club of startup Unicorns in India has two other e-commerce players- Flipkart and ShopClues - Snapdeal paved its own way for innovations in products, logistics, merchant programmes, offers and festive sales. Last year, its acquisitions and high-profile recruitments made news. So did various new strategies, such as omni-channel distribution, vernacular content, one-hour delivery etc.

There is a 35-40 percent growth per year of online shoppers; but the future of e-commerce will be determined by whether it can be sustained in a profitable way. In the coming fiscal, Snapdeal will be focussing on its categories in depth rather than breadth, and services beyond merchandise.

Knowing the customers’ psyche

The success mantra for any consumer-facing business is knowing the segments in which customers face a lot of friction. Removing the friction by integrating online and offline channels in unconventional areas, such as real estate, was exciting for Snapdeal. “We offered best properties and prices from real estate players rather than from brokers,” says Rahul Taneja, Vice President, Category Management, Snapdeal.

Bringing motor vehicles into an online marketplace also worked for the company. “The idea came from the sellers themselves. Of course their footprint cannot match an online player’s,” he adds. Leveraging the opportunity, Snapdeal has partnered with TVS Motors and Hero Motors for their entire range.

Foundation in 2015

Being a pure-play marketplace has definitely worked for its advantage – information gained from the experienced sellers made Snapdeal take risks few would dare to. Although industry experts raised their brows when it launched luxury yachts, motor vehicles and houses on its platform, other platforms followed suit in no time.

Constantly investing in data analytics worked well for Snapdeal in getting an idea on trends. Around July last year, it started receiving a rising demand for air purifiers. By November 2015, it was higher in demand from Delhi-NCR. “Through the air pollution data we accessed, we could build the product segment of categories,” says Rahul.

The road less travelled

In the coming fiscal year, Snapdeal is bringing competition to vertical players. To offer good experience for customers buying furniture, it is innovating on the user interface and will offer installation services. “India is not a DIY country like the US. So such interventions will provide an outstanding customer experience,” Rahul says.

Marketplace model allows the company to bring in a large number of merchants – from traditional furniture manufacturers in Jaipur, to bean bag sellers – to secure the supply side. However providing services in an e-commerce marketplace platform is a relatively new business model. Angshuman Bhattacharya, Managing Director, Alvarez & Marsal, says that such services require wide vendor networks that are consistently available. In the services segment, e-commerce players will have to compete with unorganised and local service providers.

He adds: “Gestation period is long for services, and will need more investment. Adoption might not be an issue but execution will be a challenge.” He believes that turning profitable is challenging for such manpower-oriented businesses. But in the long term, he notes that it is a good move to add such services –as it helps bring more shoppers online and engage them.

Beyond expectations

Snapdeal also plans to focus on services such as phone bill payment, installation works etc. “We are figuring out individual cases and working on them at different points of time,” says Rahul, adding that there is a lot of potential in it as, currently, only less than 5 percent transactions are done online. Acquiring phone recharge platform FreeCharge was a step in this direction.

Rahul says the company is witnessing larger percentage of transactions without discounts. “As it is, discounted goods are not a huge part for us. Consumers care about credibility, variety of choices and access to those goods,” he adds.

But this is not the end of discounts in Snapdeal. Anand Chandrasekharan, Chief Product Officer, says: “Discounts will continue, but without any special products exclusively on their app [unlike other players].”

With rising number of customers from Tier II and III cities, Snapdeal will add more categories such as branded fashion apparel and beauty care products that customers from those areas cannot access otherwise. It is also investing in consumer awareness through advertising television and print media to reach out to wider population.

App and mobile sites

Thanks to the luxury of personalisation, mobile apps have high conversion rates in e-commerce. Hence, it is essential to overcome the friction of having to get the customers to install the app. “Customer acquisition is difficult here; but retention not too hard. A loyal customer base is possible via apps,” says Anand.

Although apps are the fastest growing platforms in terms of transactions, quite a large number of people still transact on web. But in a mobile-first country like India, the larger section of population access Internet only via mobile, and not all smartphones provide enough space for multiple apps. “So, while we are investing in increasing the number of app users, we want to give consumers options to buy from our platform on web as well. They interact more on our user-friendly mobile website. Navigating through Snaplite (mobile site) is as easy as on an app,” says Rahul.

More competition, no chill

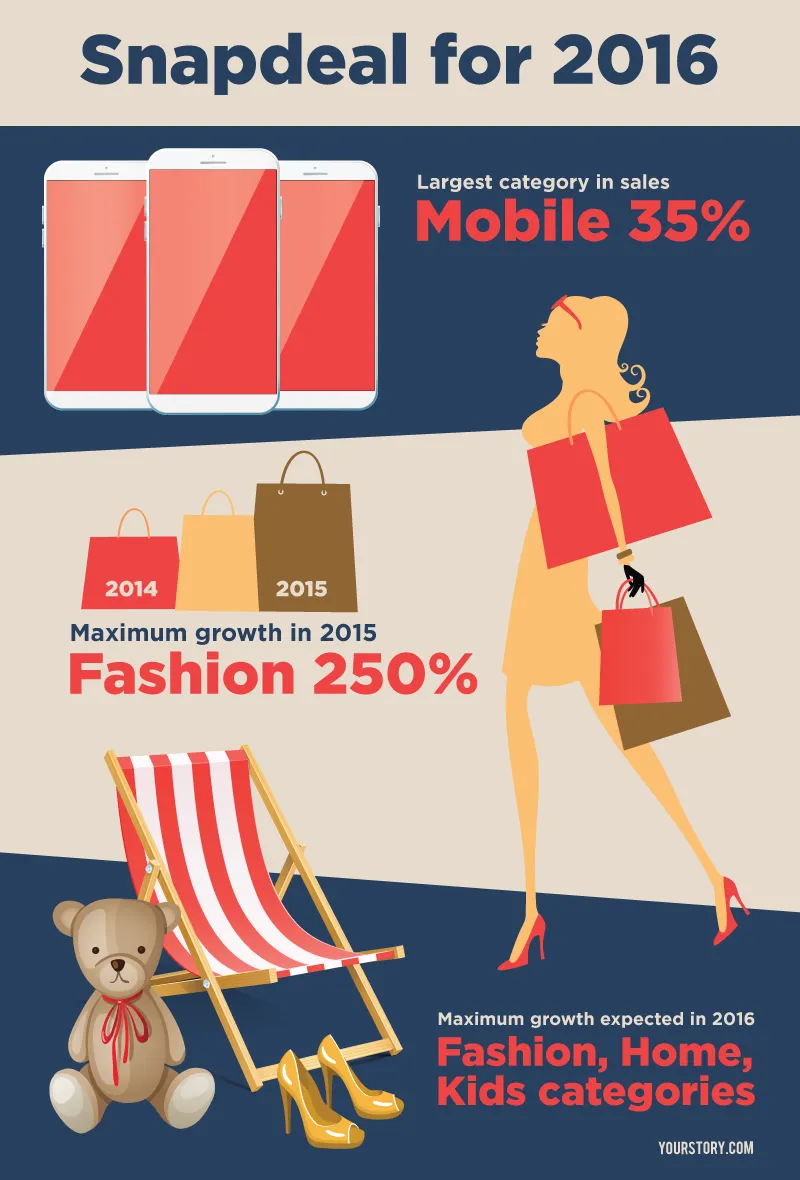

Snapdeal’s categories of focus in 2016-17 are home and fashion – and for good reason. Flipkart, its largest competitor, made a statement when it acquired fashion portal Myntra in 2014. Although mobiles were Snapdeal’s best-selling category in 2015, large appliances have been the forte for both Flipkart and Amazon. To gain an edge in customer satisfaction, however, Snapdeal is working on the tech and supply chain side to ensure delivery in promised time.

Having repeatedly stated that GMV is not its centre of attention, Snapdeal has been building its customer base as widely as possible. But, despite all the investments, e-commerce will have to be profitable one day. Angshuman believes that to maintain the growth momentum while turning profitable needs patience. “But the flip side is that industry players will need more funding; and with global economic uncertainties, access to funds could be more difficult,” he adds.

It looks like the future may not be too easy for e-commerce globally. Will Snapdeal make a deal?

Graphics by Aditya Ranade