What recharge is to consumers, accepting payments is to merchants!

Let me take you back to 2009–2010.

From 2009–10 onwards, we saw the meteoric rise of online mobile recharge companies. They gave the very impetus needed for consumers to try digital payments since the risk was low (avg. transaction was around Rs 100–150), existing ways to recharge a phone was cumbersome and it was a frequently repeated activity (2–4 times a month). Hence, convenience mattered.

This alone contributed to adding millions of transacting users who earlier were on the Internet browsing content, videos, news, music, networking etc. Once these set of users got used to paying online, they eventually graduated to making higher purchase across e-commerce, travel, food ordering etc websites with higher price-points as paying online became more predictable, reliable & convenient.

We are seeing same trend continue in case of small & micro merchants who are coming online to grow their business. Many get started on Facebook, Instagram, Pinterest etc to showcase their catalog or offerings and use it their primary web-store.

But accepting payments is still the biggest pain-point that one faces today since accepting online payments require you to manage a website or app, have technical ability to integrate APIs, physical paperwork — and that’s just the beginning.

At the same time, consumers are moving towards digital payment mechanisms with credit/debit card, net-banking, wallets etc. Hence, small & micro merchants can’t find a scalable way to accept digital payments.

Hence, our belief is that enabling small & micro merchants to accept online payment is analogous to consumers making an online recharge in India — more like a foot in the door. And that’s just a starting point…

This sweet spot led to our thesis behind Instamojo.com.

Accepting online payments is complex, time-consuming & opaque in India. It needs to change for good.

Moreover, it only caters to a few who are tech-savvy, large-scaled and have the ability to manage a website or mobile app to integrate APIs to accept online payments.

Around only 10,000 merchants are capable for enterprise grade payment gateways in India where tech integration is a pre-requisite to accept online payments. Their volume/scale is apt for payment gateways to support their cost structures. Anyone below doesn’t. And that’s the start of a big problem!

However, the broader market is anything but that. Billions of commercial transactions originate beyond a website/mobile app where a payment gateway is not available for consumers to pay at a checkout.

So API-driven payment gateways can’t cater to the broader merchant use-cases, because of 3 specific reasons:

- Most merchants aren’t technically savvy. Hence, existing method to accept online payments via APIs integrated in websites/apps won’t work.

- There’s ahuge trust deficit between buyers & merchants for infrequent transactions in India.

- Thecomplex, time-consuming & opaque process to start accepting online payments is the biggest anathema that’s plaguing adoption.

At Instamojo.com, we are constantly thinking about these 3 issues. We asked ourselves:

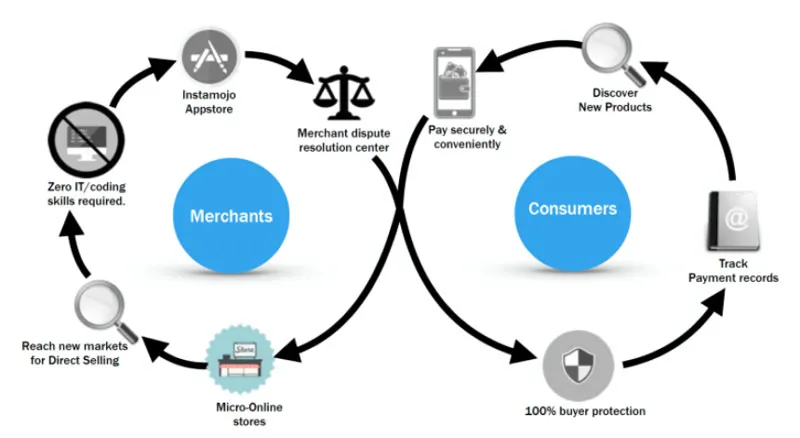

Can a closed-loop, DIY platform to accept digital payments for small & micro merchants with no IT or technical skills work in India?

Above question defined our market opportunity, value proposition and the product thinking that needs to go behind building the platform.

As a result, today Instamojo.com is the ONLY platform in India where accepting online/mobile payments is as easy & fast as operating an email account or writing a blog post. So that one can focus on what they do best while leaving the headache of running the enabling infrastructure to us.

Today, we have tackled much of the problems I stated above.

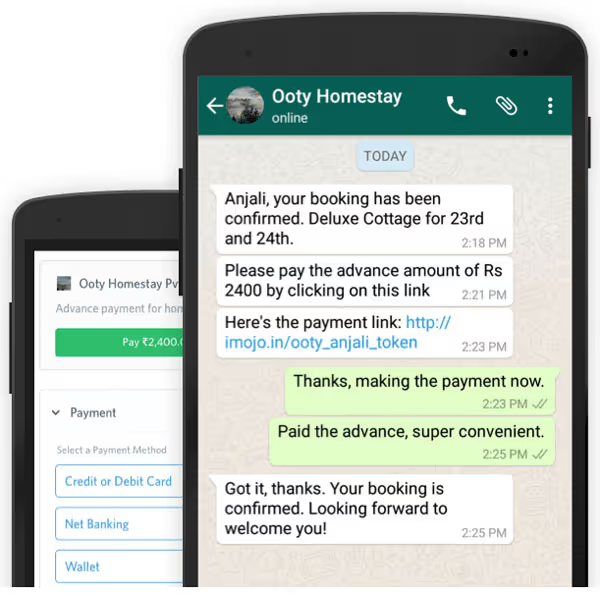

- Instamojo works for everyone, even on WhatsApp. You don’t need a website or an app. Or integrate APIs. You can just use WhatsApp, Facebook, or Email to accept online payments by sharing a payment link.

Accept Payments on WhatsApp by sharing a Instamojo Payment Link.

- Instamojo is your trust custodian — We provide 100% buyer & seller protection for every transaction using our IRAs (Internal Risk Algorithms). That means, if you use Instamojo to pay or get paid, you’re 100% assured that your money is safe & secure.

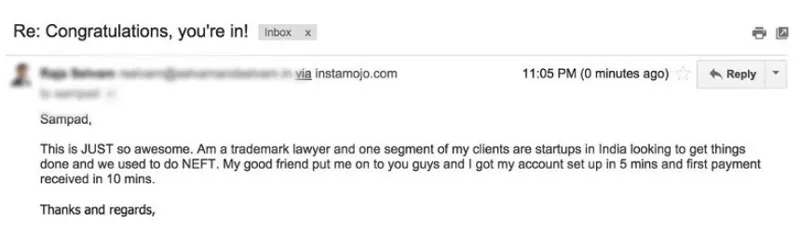

- Get started instantly at a fixed “success fee” model — You can get started in a few minutes to accept your 1st online payment to over millionth at no extra cost or hidden charges. And that too at a fixed success fee model i.e. pay when you make a successful transaction. It’s like magic!

Takes less than 5 minutes to accept your 1st online payment.

That being said, we are quietly disrupting digital payments in India by democratizing it. Soon, every small & micro merchant you encounter will send an Instamojo payment link to accept online payment and you’ll pay with your Instamojo account too.

As I write this, thousands of merchants are joining Instamojo everyday doing tens of thousands of daily transactions 24x7, on the go.

So if you’re interested, give it a spin. We are also running an interesting referral program — Get Rs 500, Give Rs 500!

Thanks to Aditya Sengupta, Akash Gehani & Anshumani Ruddra for reading the drafts.