Lessons in scaling up from unsung startup heroes

Once the initial euphoria around customer acceptance subsides, startups are faced with the inevitable challenge of scaling up. While stability in operations is imperative, it’s proven that sustainable businesses are the ones that have managed to timely scale up while remaining profitable. Scaling up is a necessity because of the requirement of the business model, or to keep up with competition. However, there have been some who chose to focus on process improvements rather than scaling up.

The foodtech sector is a perfect example of this. This sector has been losing its sheen in the investor community over the past few months, despite the initial surge of interest. News of of setbacks like Tiny Owl scaling down its operations in four cities, Zomato firing 300 sales employees, SpoonJoy shutting down and then being acquired by with Grofers – these are just a few instances of trouble in the foodtech sector. Market feedback suggests that these businesses were running so much after numbers that they compromised on services, and failed to sustain the exponential growth.

YourStory takes a close look at the operations of two foodtech startups that have followed very different trajectories to understand what went right and what wrong with their strategies. However, we would like to also point out that this is not an exhaustive study and the learning might not be applicable to everyone.

“Chefs Only” was a Mumbai based food distribution startup, which started operations in July 2014 and closed down in December of the same year. Started by three MISB Bocconi graduates, it followed the home cooked meal distribution model. The business witnessed a dip in turnover and profits resulting in eventual loss of faith by investors who provided seed money.

Gaurav Bhandari, CFO of Chefs Only, says:

We admit that we underestimated the immediate need of a website and investments in social media marketing to increase the customer base.

Looking at numbers and based on discussion with management we gather:

- Overheads remained out of control during the entire course of operation. The startup, which had gathered a small customer base, was focussing excessively on improving the quality of food.

- Concurrently, investments in technology (website, and mobile application) were put on the back burner and they failed to acquire newer customers.

- Over time, the unit economics failed to add up and investments dried up.

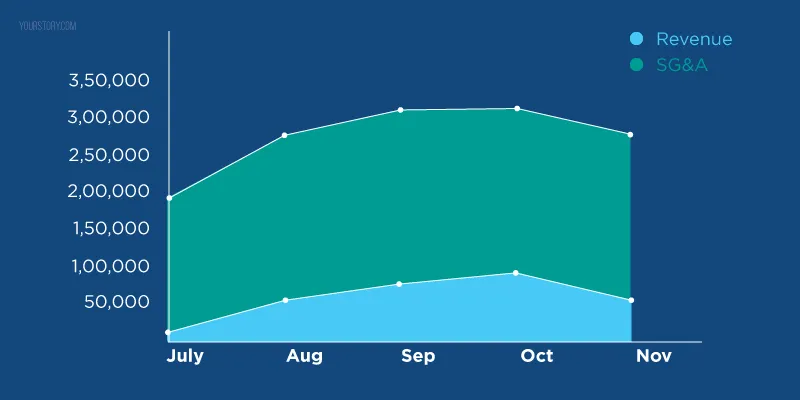

Ultimately, Chefs Only lost out to competition by failing to scale up. Though it grew initially, the number of orders served stagnated at 500 orders in September, increased marginally to 541 in October and then dipped eventually. “The gap between the overheads and revenues could not be narrowed over five months of operations, making the business non sustainable,” says Gaurav.

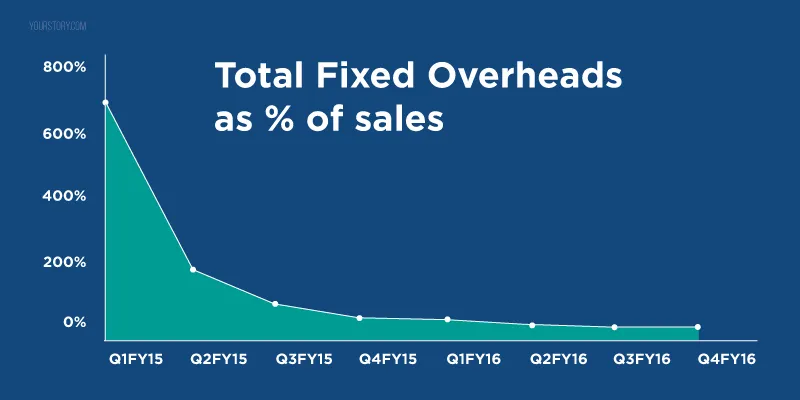

While running too fast comes with its own risks, stagnation and deceleration can also push one out of the race. It’s important for businesses to understand how revenues can be predictably generated and sustained at the right times, as fixed overhead costs are static.

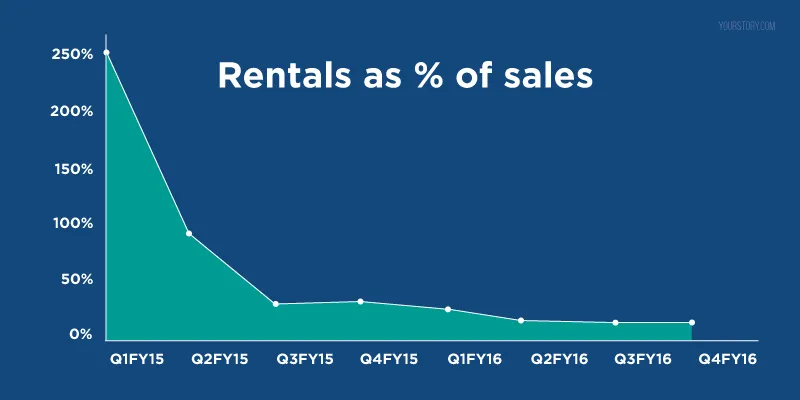

The bigger question is how to optimise overheads while scaling up. Fixed overheads are costs incurred irrespective of turnover such as rent for office space. Therefore, startups need to keep scaling up so as to reduce fixed costs as a percentage of sales.

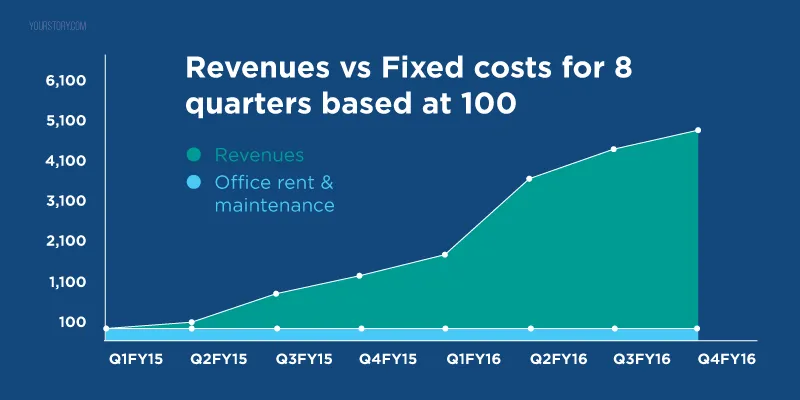

In contrast to Chefs Only, Consegna Services, based out of Gurgaon chose to scale up operations. Founded by IIM alumni, Consegna became operational in 2014 with the launch of professional food delivery services (including various value added services) for premium and mid-premium restaurants. From 30 orders per day in Q2 2015 in Gurgaon, Consegna clocked 150-200 orders/day on an average in Q4 2015 from 12 hubs in Gurgaon and Delhi. “This growth has been attained by calibrated expansion and providing personalised services to customers to increase frequency of orders from every restaurant,” says founder Amandeep Kaur, an IIM-K alumnus. They are growing 9.5 per cent week on week, and more importantly, covering over 80 per cent of delivery operation expenses and over 60 per cent of total business expenses, as confirmed by the management.

The revenue growth has assisted in keeping the fixed overheads regulated.

For any newly started business, regulating the overheads and sustaining unit economies is vital before leapfrogging to the next level. In case of Consegna, from Q1FY15 to Q4 FY16, the fixed expenses taken as a percentage of sales have only trended downwards. The management says this was achieved by:

- Steadily increasing the topline by leveraging existing customer relationships;

- Expanding in Delhi and Noida in less than two years; and

- Minimal incremental technology investment to support the increase in customer base as the product was already well-developed.

Consegna says that businesses must control overheads from inception. Amandeep states:

Our focus has always been to build a profitable and sustainable model. From day one, we have focused on unit economics and controlling overheads. While we are inching towards operational profitability, our target in the next six months is to be profitable on an overall basis, even after considering all overheads. Hence it becomes very important to closely monitor costs and minimize them, without adversely affecting the business.

Clearly if it’s a consumer-facing business whose success is predicated on scale, scaling up is imperative. While the importance of continuous innovation for process improvements cannot be denied, management needs to stay alert and keep up with competition and scale up while keeping costs in control.