How online lending can help those rejected by banks

Are you a small entrepreneur? Did your bank trash your loan application? Don’t worry, it’s not the end of the world: your digital footprint could well be your credit-worthy fingerprint. How? Read on.

A bit of history first. Despite the commendable contribution to the nation's economy, the SME (small and medium enterprises) sector had long been neglected by government departments, corporates, as well as banks and other financial institutions. However, at long last, the government has recognised SMEs’ significant contribution in gratifying various socio-economic objectives such as higher growth of employment, output, promotion of exports and fostering entrepreneurship.

Hitherto, the sector had been dealing with various legacy issues and challenges due to its suboptimal scale of operations, technological obsolescence, supply chain inefficiencies, increasing domestic and global competition, non-availability of required financial support, working capital mismatch, scarcity of skilled manpower, changes in manufacturing strategies, uncertain market conditions and lack of government policies.

New initiatives

Through policy initiatives, more supportive framework and measures, the SME units’ mortality rate has been brought down significantly in the past decade. There are now initiatives such as the Make in India campaign; allocation of Rs 10,000 crore through the Micro Units Development Refinance Agency (MUDRA) Bank; introduction of the GST (Goods and Service Tax) Bill; Prime Minister’s Employment Generation Programme (PMEGP) to facilitate participation of financial institutions for higher credit flow to the micro sector; ASPIRE (Scheme for Promotion of Innovation and Rural Entrepreneurship; SFURTI (Scheme of Fund for Regeneration of Traditional Industries, i.e., to make traditional industries more productive and competitive by organising the traditional industries and artisans into clusters); Performance & Credit Rating Scheme (to create an ecosystem of SMEs for easier/ cheaper access to credit for the rated enterprises) and many more to promote the sector. Another recent initiative is the government’s Startup India campaign.

Micro is macro now

The biggest hurdle that small businesses face in their day-to-day operations is shortage of funds and immediate requirements to keep the short working capital cycle running. The government has been proactive in injecting various types of financial aid to small businesses. The majority of microfinance in India is provided by commercial banks, regional rural banks (RRBs), self-help groups (SHGs), cooperative societies and microfinance institutions (MFIs) in their many avatars, including NGOs (registered as societies, trusts or Section 25 companies) and non-bank financial companies (NBFCs).

Microfinancing has been one of the Reserve Bank of India’s focus areas, wherein to provide credit facilities to micro businesses, licences have been given to 10 entities to set up small finance banks. RBI now targets a 90 percent financial inclusion by 2021.

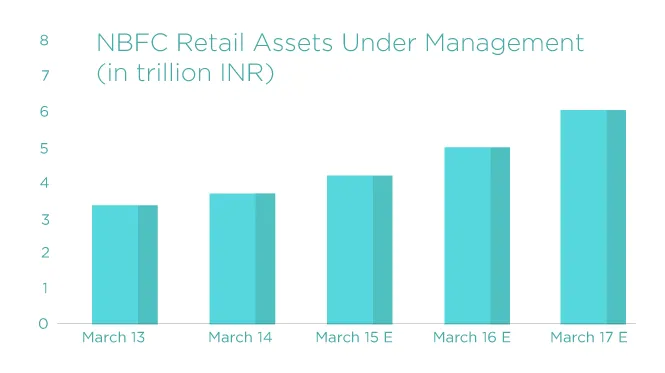

Source: PWC

However, despite all recent government efforts to channel funds to the small and vulnerable businesses in the country, there is still a vacuum left by traditional banks when it comes to extending easy credit. These loans are subject to cumbersome processes, unaffordable interest rates, need for collateral and securities against credit, small tenures, etc., making it anything but ‘easy’ for those in need of funds.

Traditional banks have not been able to fully meet customer needs which has led to the rise of microfinancing startups in the country.

Financial technology businesses have targeted the segment hitherto ignored by traditional banks. These newcomers have emerged as saviours of those deemed ‘ineligible’ by banks and have been able to make financial products and services more accessible and convenient to customers.

Online lending market

Today, various transaction-based lending models have been rolled out in India where borrowers are assessed with a broader perspective. Online portals centered on peer-to-peer (P2P) lending are among the most popular. These bring the lenders and the borrowers to the same platform and let them interact directly, enabling the customer to negotiate better interest rates while providing investors with an opportunity to earn lucrative returns.

The number of startups in the online consumer lending space has grown significantly from a mere two in 2013 to 30 in 2015. These firms either operate as NBFCs, intermediaries for banks/NBFCs or serve as a P2P lending marketplace. India Lends, Lendbox, Loancircle, Loanmeet, Faircent, and Cashkumar are some of the major players in the market today.

A different approach to credit appraisals

These technology businesses have changed the traditional approach employed by banks to access a customer. Traditional lenders such as banks and NBFCs have been relying majorly on credit bureau data and scores (CIBIL), which sometimes can be inaccurate or even misleading. Also, ‘safe’ policies such as minimum business vintage, Indian citizenship, age, guarantee by family member, etc., lead to excluding a chunk of the customers.

In a marked departure, the online lending businesses have decided to not rely on these scores blindly and as the sole criterion for credit appraisals. New techniques for analysing credit risk have been determined where a wide variety of consumer data is analysed -- digital footprint of customers gleaned from social networks, eCommerce, mobile usage, geo location and the like. The customer is accessed based on his/her demographic, geographic, financial and social activities.

Out of 350 million active Internet users in India in 2015, 134 million actively use social media platforms according to a PricewaterhouseCoopers (PwC) report. The exponential growth in internet and mobile penetration has led to an explosion in eCommerce, internet and social media usage and created a vast platform to track customers’ online presence to access their behavior, intent and, of course, creditworthiness.

Alternative data and analytics are used to access customer profile, enhance the credit underwriting as well as reach under served consumer segments. This model has been popular and successfully running in countries like Germany (Kreditech) and Hong Kong (Lenddo).

People in need of funds are going to these online portals for

- Quick money

- Less paperwork

- Flexible policies

- Transparency

- Different approach from traditional banks

Power of technology

The technology wave in the banking sector, especially microfinancing, has brought about major disruptions. For small-ticket loan disbursements, it is helping collection and analysis of data and in determining the loan amount and tenure in minimal time. Credit appraisals, which took days previously, are done a matter of hours. Also, the system-oriented processes are bringing about transparency. A customer gets real-time updates about his or her loan application through text messages.

This sea-change has goaded even banks to start structuring their processes to upgrade their technology to expedite loan disbursement processes. IndusInd Bank, in the last quarter, approved reconfiguration of branches and operations to be managed by hubs in Chennai and Mumbai as a step towards digital focus. This will cut costs by making branches leaner and could also result in higher incremental revenues.

Online loan applications and disbursements definitely is the next big thing in the lending sector.

YourStory take

Reports suggest that close to 70% of the Indian population remains under served by institutional lenders. By assessing alternative data points currently ignored by traditional credit bureaus, lenders can access a huge creditworthy customer base previously overlooked by the lending businesses.

This approach of using digital database for credit underwriting can help tap markets where credit information is scarce, providing growth and more control over risk to lenders.

This can help the government achieve its goal of financial inclusion by 2021 and reach out to the creditworthy but financially excluded section of society in its bid to drive growth and fight poverty.