‘Discover’ the Snapchat ‘Story’: Can the app based on disappearing data monetise and ensure sustainable growth?

Heraclitus, the pre-Socractic Greek philosopher, said, “change is the only constant in life”. We outgrow not only our old shoes and clothes, but also who we are as human beings. Transience goes hand in glove with life. While this can often be scary, because with change comes uncertainty about what lies in store for us, it also helps us grow as individuals.

Most social media, however, is based on the idea of permanence and everything that we allow onto it such as our likes, preferences, history, conversations, and pictures are saved as a permanent record of our lives. Because of this, we are most careful about what we post online. This is not only an onerous task, it forces us to police ourselves to be on our best behaviour, and put on a show of only what makes us look glamorous and perfect or even worse, what we think would be perceived as the ideal self by society.

“It seems odd that at the beginning of the internet, everyone decided everything should stick around forever. I think our application makes communication a lot more human and natural”, Evan Spiegel co-founder and CEO of Snapchat said, capturing succinctly why the app has gained traction in the years since its launch. The Snapchat team prides itself in taking cognisance of the ‘liquid’ self, the self that is dynamic and capable of growth. Being an app that only allows users to send ephemeral pictures and texts, it allows for self-expression, and of the little quirky things we do that comprise our day.

How Snapchat works and why its users love it

The opening screen of Snapchat is a camera that allows you to capture moments in a ‘snap’ and send them to your friends, either all friends or just some particular special ones you think worthy of that priceless snap. A snap can be viewed for a maximum duration of 10 seconds. In October 2013, Snapchat made an update to the platform that allowed users to string together snaps to form a story that is visible to all their friends on Snapchat for 24 hours. Alternatively, you can also send your friends messages on the chat window of Snapchat, which also disappears once opened and read. These features come together to form Snapchat’s exclusive social language, with tools to draw and write on photos, and data shared that seemed to be playing Picabo (it was originally called Picaboo) with its users, unlike any other existing social network. In November 2014, Snapchat launched Snapcash that allows users to send money to their friends through the app by partnering with Square, a payment-processing service.

While a typical public social network like Facebook leaves you with little control over who sees what you upload online, private communication networks—messengers like WhatsApp—leave you in full control of communication, either to an individual or a select group of individuals (group chat). The lure of Snapchat is that it combines the two. On swiping to the left, you arrive at the Snapchat messenger, which like any other messenger, allows you to text, or send pictures and videos from your gallery. It facilities one-on-one communication.

On swiping to the right, you reach the public social network window of Snapchat that has three features. The first one is the Discover feature, launched in early 2015, which is a collection of editorial content from different media houses like CNN, ESPN, MTV, National Geographic, Comedy Central etc., compiled specifically for Snapchat. It put companies in direct contact with the users, building a connection like never before, grabbing the attention of the youth. The second is the Live feature, a window that teleports you into stories from different parts of the globe, of live events in those places, or even just of the place, such as Spain’s Tomatina festival. The third feature, the newsfeed, personally connects users with the app, by bringing to them stories made by other Snapchat users, using only features available on Snapchat, and no pre-produced content.

Snapchat actively engages the user with the app because the first screen any user encounters is the camera. By making the user the creator of content first, and not just the recipient of information, it builds a bond that can only be developed through personal involvement of the user in the app. The creative lenses and filters available, and tools that allow users to doodle and write over their snaps and videos further engage the user creatively into the app and stimulate interest. Because of this, 65 percent Snapchat users upload pictures daily as compared to the 35 percent participation rate of Facebook users.

Snapchat’s vertical video makes it even more user-friendly by allowing users to watch video in portrait mode. It saves video real estate that is often lost in horizontal mode and also saves the user the effort of turning back the phone to the vertical, normal position after the video has been watched.

Vertical video has been found to have nine times the completion rate of horizontal video. Although this is a crucial selling point of the app to advertisers, it is by no means the only thing that draw advertisers to the app.

Why Snapchat appeals to millennials

Snapchat resonates, particularly with youngsters. It has a market penetration of 50 percent in the 18-24 age group; when combined with people in the 25-34 age group, the market penetration is 32.9 percent. 77 percent of college goers use Snapchat daily. With their parents getting on Facebook, youngsters needed an alternative platform on which to express themselves. They needed to be able to post pictures and videos that were products of their creativity without being afraid of constant policing by their parents and that over-friendly neighbours who thinks that they must, in the best interest of these youngsters, rat them out to their parents. So the appeal of Snapchat to millennials is in the fact that it is ‘not Facebook’. Just as they wouldn’t want to be seen hanging out at the same cafe as their moms, they definitely wouldn't want to be on the same social networking website as them. This led to the phenomenal increase in usage of Snapchat, which reached 10 million active users just a year after its launch.

Why brands love Snapchat

In 2015, Snapchat established itself as an advertising force to be taken seriously. It was named Adweek’s hottest digital brand, with reportedly more than 6 billion videos uploaded daily. It promises to become even bigger in 2016 in the advertising space as brands learn to create micro-moments by successfully leveraging all the advantages that advertising on Snapchat offers them.

Advertisers have to keep in mind the shortening attention spans of their consumers while coming up with advertising strategies. Snapchat messages, snaps, and videos offer the excitement of a tiny sneak peek into the content, keep the users hooked to their phones, rapt with attention for the duration of the snap or video, for the fear of missing out on what is being showcased. This is precisely what advertisers need—undivided attention to what they are promoting. The ability to keep intrigued users glued to their phones, although for a very limited period is the unique selling point Snapchat offers to advertisers.

Advertisers have to exercise utmost caution while doing so because intrusive ads are the perfect recipe to drive away teenagers. Snapchat’s special features allow advertisers to customise and tailor stories according to the needs of particular brands without interfering with the user experience of Snapchat. Brand Stories captures the stories of brands through 20-second videos, which remain for 24 hours before disappearing. Our Stories are not stories directly promoting brands but are sponsored by brands. This feature weaves together different stories sent by Snapchatters from a particular event, and brands that sponsor them often succeed in spreading the message about their brand through 10-second interstitials ingrained in them. For example, Macy’s, the mid-range chain of departmental stores in the US, sponsored the Our Stories feature of the Macy’s Thanksgiving Parade. Data from the Millard Brown 2014 Ad Reaction Study showed that advertising awareness grew by a minimum of 16 points among brands that used Snapchat to advertise. It also revealed that 60 percent users enjoyed ads on Our Stories, while 44 percent favoured Brand Stories, more than three times compared to users exposed to regular mobile ads.

Snapchat’s geo-filters offer another important and non-intrusive way of promoting brands. Geo-filters are in-app stickers that subscribers can use to emphasise their location or any event that they happen to be attending. They are most often available only in particular places stimulating users to use them as the filters become a sort of limited edition commodity, which they can deploy to differentiate their stories from the stories of their friends. These filters are only made available once the user turns on location services, giving Snapchat access to their location. Brands in the area, associated with Snapchat, can then leverage this valuable information to make available specific geo-filters of their stores to users. Using geo-filters has another added benefit— the user is made aware of the brand while using the filter, the recipient of the snap is also exposed to the brand on receiving the snap. McDonald’s was the first to launch its own geo-filter. Whenever a Snapchat user was close to a McDonald’s, an option of decorating their snaps with falling golden fries and a cheeseburger was made available to them.

Brands also use the Discover feature to promote particular products by creating content specifically for the purpose. The Live option complements this perfectly by allowing brands to post videos from major events amidst which they can sell ads.

Global donut chain Dunkin’ Donuts embarked on an ad campaign where they decided to give free cups of coffee to Snapchat users that unlocked its Dunkin Donut filters that were made available when the users were close to a store. The yogurt brand 16 Handles, encouraged people to send in snaps of their friends enjoying the frozen yogurt at certain locations. On sending the snap, they received a snap in return, which was a special coupon for 16 percent off, 50 percent off or even 100 percent off, offers they could avail on showing the snap to the cashier.

In a seminal report, Google discovered that 87 percent millennials always have their phones by their side and noted that people check their phones 150 times a day. A Sumpto research shows that while 73 percent of college students would open a snap from a known brand, 45 percent would even open a snap from an unknown brand. 69 percent would add known brands as friends on Snapchat, allowing for more personal engagement between brands and their consumers.

The aim of brands is to make an impact on the users by creating meaningful micro-moments that will hopefully lead to a next moment, or future action and engagement with the brand.

Snapchat’s growth story

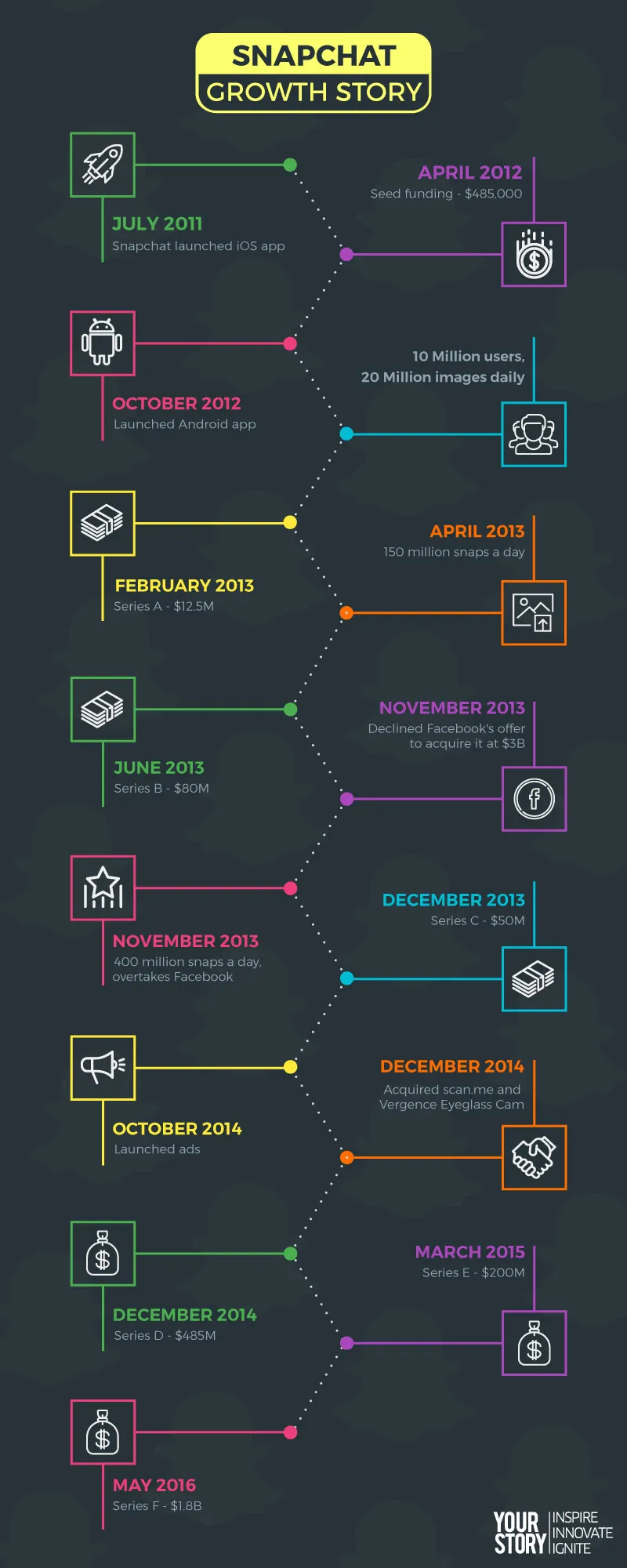

It all began in July 2011, when Evan Spiegel, Bobby Murphy, and Reggie Brown, launched Snapchat, an iOS only app that they created during their time at Stanford. Since its launch there has been no looking back. In April 2012, on learning about the app from his daughter, Barry Eggers, a managing director at venture capital firm Lightspeed Ventures and his partner Liew, pursued Snapchat and invested $485,000 in the company. By October, Snapchat launched its Android app and had a user base of 10 million, with users sharing about 20 million images daily. In December, Facebook launched Poke, an iOS app meant to be competition to Snapchat, which ironically only boosted Snapchat’s popularity even further. Snapchat raised $12.5 million in Series A led by Benchmark Capital, and was valued between $60-70 million. After reporting that users share 150 million snaps a day, Snapchat raised $80 million Series B at a valuation of $800 million, in a round led by Institutional Venture partners.

In November 2013, Snapchat declined Facebook’s offer of an acquisition at $3 billion, realising its tremendous potential owing to its popularity amongst millennials. Snapchat overtook Facebook with its users sharing a whopping 400 million snaps a day. It raised $50 million in Series C round of funding from Coatue Management in December. Despite a lawsuit filed by Reginald Brown, claiming a one-third stake in the company for an important role during the app’s inception, and a lapse that leaked 4.6 usernames and phone numbers, Snapchat managed to get back on track. They shut Brown out by changing the passwords of the server, settled the lawsuit in September 2014 and beefed up their security by allowing users to opt out of the Find Friends feature. In October 2014, Snapchat took it a step towards monetising their product by announcing that users would start receiving ads from brands under the Recent Updates section of the app. It made two acquisitions in December that year—QR scan company scan.me for $50 million and Vergence Eyeglass Cam for $15 million, and raised $485 million in Series D round of funding led by Kleiner Perkins Caufield & Byers (it was now valued at $10 billion).

Two more rounds of funding followed with Snapchat raising $200 million in Series E round from Chinese e-commerce giant Alibaba in March 2015 and $1.8 billion in Series F round of private funding in May 2016.

Is Snapchat’s growth sustainable?

Snapchat is the fastest growing social network. According to Bloomberg, Snapchat’s daily video views have grown by 400 percent over the course of a year, from 2 billion to 10 billion, from May 2015 to May 2016 (surpassing Facebook’s 8 billion daily views, despite it having roughly 15 times the number of times Snapchat’s users). Today, 60 percent of America’s millennials use Snapchat.

According to a leaked report of Snapchat’s performance in 2014 obtained by Gawker, the company generated ad revenues of $3.1 million (earned in a month and a half), only 3.7 percent of its expenses of $82.8 million. In addition to these expenses, which were already 26 times the ad revenue raised, they incurred an extraordinary expense of $49 million, probably in settlement of the suit filed by Reginald Brown and a data breach that had occurred on their part. The estimated loss incurred was $79.7 million, not taking into account extraordinary expenses. Although it does have a significant $320 million in cash, making it possible to survive despite making losses in the near future, sustainable growth would require that Snapchat quickly chalk out a plan to increase revenues.

Based on revenue generated in 2014, projected revenues for 2015 were $25 million. However, Snapchat raised $59 million from the ad revenue, more than double the projected amount.

It is expected that Snapchat will raise $250-350 million in 2015, and $500 million to $1 billion in 2016. As of 2015, only 1 percent of advertisers used Snapchat but the future of Snapchat as an advertising platform looks bright as it is estimated that 22 percent of ad executives plan to advertise on the app.

Snapchat’s main sources of revenue are advertising and in-app purchases and transactions, which although not yet sufficient to offset expenses incurred, are likely to grow enough to enable it to break even and even make profits in the future. This, coupled with its model that keeps costs low, makes Snapchat’s profitability more likely. Considering that its appeal lies in sharing data that disappears, its main costs involve those in operating the photo-sharing service and running efforts to monetise. Snapchat’s model of deleting data actually saves it from incurring significant costs that would arise in the event that they have to save all the data uploaded and shared on the platform. Although they do not have access to user content, they have information about who is communicating, where, how and when, which is what is necessary to be able to target consumers with particular ads. So while data is an asset, their model of deleting data proves to be a bigger asset for Snapchat.

With a phenomenal increase in the number of users, user engagement and advantages of adopting the platform early (Snapchat is less burdened with ads as compared to Facebook), it is not surprising that an increasing number of advertisers are tapping into the potential of Snapchat.

Why Snapchat should care About India

- Increasing penetration of internet and smartphones in India

According to Mary Meeker’s 2016 Internet Trends report, the number of internet users in India grew rapidly in 2015, by 40 percent to reach 277 million. India is the only country where the growth rate of internet users in 2015 was higher than the previous year (33 percent). Today, India has the second-largest number of internet users in the world, ahead of the US, and behind only China Further, with more than 220 million active unique smartphone users, India has become the second-biggest smartphone market, according to a report by Counterpoint Research. This is an important indicator that the Indian market provides significant opportunity for any player in mobile-connected system, such as Snapchat.

It has been estimated that mobile video traffic in India will grow at 83 percent CAGR between 2015 and 2020, according to a report by Cisco. Video content—which is a major appeal of Snapchat—will account for 50 percent of total mobile data consumption in India by 2017.

- Growing Indian middle class population

A larger number of people in emerging markets like India are on the verge of escaping grinding poverty and are now living comfortable middle class lifestyles. According to NCAER, India’s middle class population is estimated to be 267 million in 2016, a number likely to more than double by 2025-26, to reach 547 million. With a higher standard of living, people from emerging markets such as India are inevitably going to constitute an important chunk of consumers.

- Increase in FDI

The Make in India and Digital India initiatives, and increase in Foreign Direct Investment (FDI) have made India a hub of commercial activity. More importantly, they are a glimpse into the future of India as an increasingly open economy, which has already become a potential market for most major global players.

With internet advertising in the US having grown by roughly 20 percent since 2014, and reaching $60 billion, of which two-thirds comes from increase in spending on mobile ads, it understandable that Snapchat would first capitalise on the opportunity available for growth in ad revenues from the US, and other developed economies like the UK, Ireland, Sweden, Canada, etc. that form significant markets for advertisers.

India, however, one of the fastest-growing developing economies, with brands such as Nike, Dunkin’ Donuts, Taco Bell and McDonald’s, some of the brands that have leveraged Snapchat’s advertising potential in the US. The presence of these brands in India, and the fact that they are increasing their reach to a larger number of cities in India, suggests the importance of India as a market to these brands. Since Snapchat’s focus has to be on advertising in order to monetise, it makes sense for it to bandwagon with these brands on their trajectory they choose for growth. While Snapchat may not expand extensively in India, it will benefit largely from making its presence felt, making it easier for it to gain from the early mover advantage when it does decide to enter the market that is taking the world by storm.

And in a world where there is no such thing as bad publicity, Snapchat inadvertently made headlines recently when Tanmay Bhat’s video parodying Sachin Tendulkar and Lata Mangeshkar went viral. For Snapchat, which is already gaining traction among the younger generation, this controversy proved to be a zero cost brand marketing, further helping them steal the thunder in the world of social media.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory)