A few days ago, German pharmaceuticals company Bayer AG made headlines with its acquisition of biotech giant Monsanto in the largest cash deal ever at a whopping $66 billion. The new entity is now arguably the world’s largest pesticide firm.

Beyond the numbers, why do acquisitions make headlines? Putting it simply, acquisitions help the growth of companies and give them capability, which they would otherwise have not had, and strength in terms of team and products. Acquisitions and mergers matter for growth of any businesses – especially in an ecosystem that is still young and evolving. In India, e-commerce—the posterboy of the startup boom in the past few years—has seen unicorns being born out of disruptive models – amply backed by acquisitions of startups in various sectors.

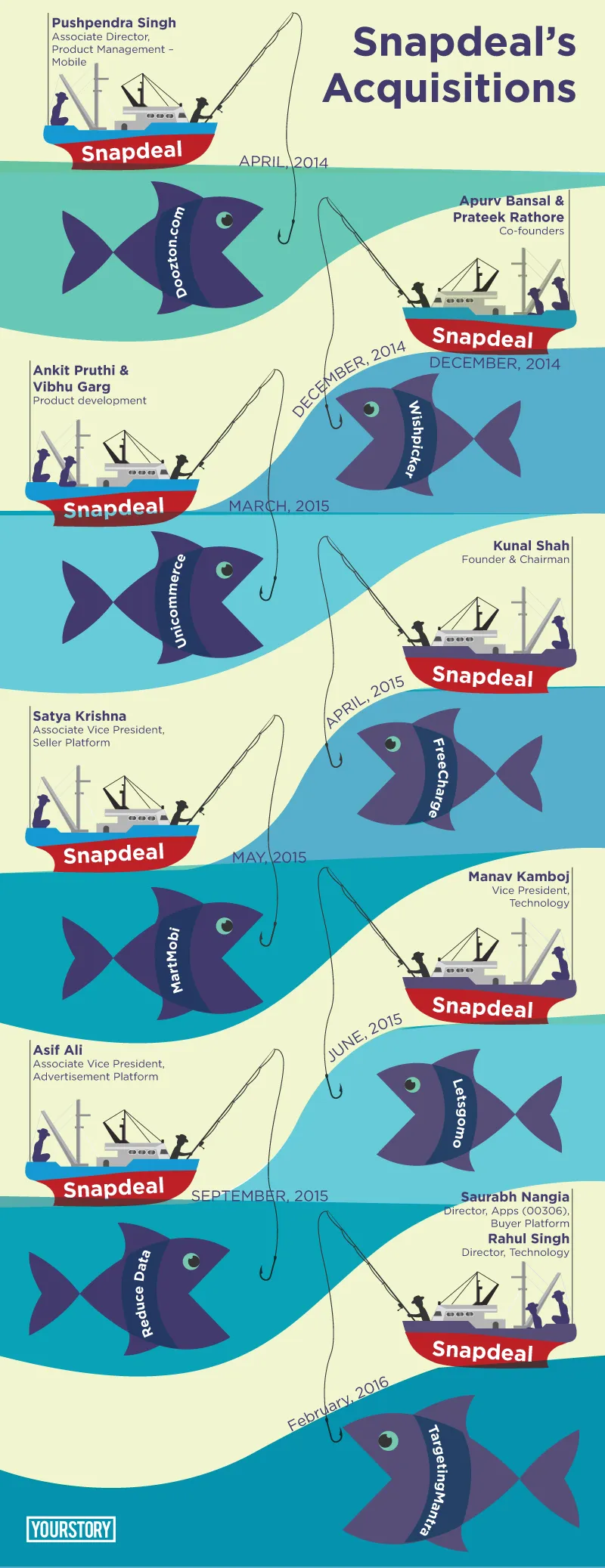

Online marketplace Snapdeal—valued at about $7 billion—has done a handful of acquisitions, aiming to build a frictionless ecosystem for buyers and sellers. In a recent interaction with YourStory, Saurab Nigam, VP-Human Resources, Snapdeal, noted that the company is open to bringing in great teams for requirements where in-house capabilities are not enough. “When we look at any acquisition, the proposition it should fulfill is that it should augment our capabilities. It helps organic growth by building capability within the organisation,” he added.

So what happens after an acquisition in Snapdeal? YourStory finds out.

How acquired companies are integrated

For any potential acquisition, the criteria to check is what the team is like, what they bring for the business needs of the acquirer, and what their talent, strategies, retention rate, and values are. “We are keen on alignment with Snapdeal’s values. After acquisition, we treat the team the same way as we do with the rest of the team,” said Saurabh, adding that Snapdeal invests heavily in motivating and retaining top talent. In fact, for almost all the acquisitions they have made so far, founders have stuck on with them. If not the same role that they had before acquisition, they go on to perform extremely important roles in Snapdeal, Saurabh claimed.

However, it is not common for a 100-percent alignment in culture between teams of two erstwhile separate entities. But after integrating, communication channels open with the founder and the team on why they do what they do. Saurabh said: “We plan to integrate different elements as people come on board. On day one when they come on board, all the data on policies that will impact them is easily available, and we are clear on expectations, goals, KRAs etc.” He also noted the important role the company's HR department plays in helping new teams assimilate into the organisation.

Snapdeal’s acquisitions are not done from an overall headcount perspective. In an earlier interaction with YourStory, Rajiv Mangla, CTO, Snapdeal, had said, “Most of the acquisitions have been completed from product and tech perspective and currently about five percent of our total headcount in product and tech teams comes from our acquired companies. In a startup scenario, as the companies and their team sizes are usually small, it does not lead to a major addition in headcount.”

How acquisitions benefited Snapdeal’s tech

It would not be wrong to assume that most e-commerce companies are keen on acquisitions that will boost their logistics and supply chain capabilities. For Snapdeal, beyond payment and logistics, the acquisitions are aimed at enhancing tech capability. In fact, Snapdeal claims to have the ability to become a ‘real time organisation’ as their technology helps make decisions and connect sellers, consumers, call centres and packages moving across the country in real time. Rajiv stressed on how technology has strengthened each and every aspect of Snapdeal. “Tech goes to the level where sometimes it is hard to find the size of a package in an environment where you yourself haven’t seen it, as it is with your sellers. So technology enables the smallest things; right from getting the size of the box right,” he says.

The upcoming acquisition plans also involve technology that Snapdeal wants to build for customer experience, logistics and everything that helps move towards a reliable and frictionless ecosystem. Saurabh explained, “Mobile commerce capability was enhanced by our acquisitions. Freecharge has helped us in digital commerce transaction – increasing number of daily transacting users on the platform. Targeting Mantra helps manage our customer base. Tech is the core around which our organisation revolves.” Both Targeting Mantra and Wishpicker have been tools for personalisation, targeting, and in turn conversions.

Snapdeal’s discovery platform was also visibly strengthened after the acquisition of Silicon Valley-based Reduce Data that works on artificial intelligence. Additionally, Snapdeal’s fashion discovery platform was launched with FindMyStyle, which uses machine learning along with image recognition. The mobile solutions company Letsgomo helped Snapdeal in building mobile strategies, and in the conceptualisation of app and mobile sites, while MartMobi built interfaces that enhance customer and seller experience on Snapdeal’s mobile platforms.

Tech in logistics

Snapdeal was a majority stakeholder in GoJavas, a four-year-old logistics firm with which it was reported to be in talks for acquisitions this year. However, the deal fell apart for unknown reasons, followed by Pigeon Express acquiring Gojavas last month. But Snapdeal seems to be strong in logistics, due to its home-grown arm, Vulcan Express. According to studies by PwC and Red Seer Consulting, Snapdeal is the fastest in delivery among e-commerce players in India. (In July 2016, their average time of delivery was 3.8 days, while Amazon’s was 4.9 and Flipkart’s was 4.5 according to Red Seer).

All the complex technology Snapdeal has acquired has come in handy here too. Rajiv said, “Tech enables what courier to pick at what time and what route, optimising the process by real-time tracking and making promises based on statistical machine learning model. Since Snapdeal also works with third party logistics partners, we help them plan future loads based on the foresight of the demand.”

To distribute the demand amongst the sellers, Snapdeal helps them plan their inventory too. Rajiv says: “We now are trying to solve how listing takes place on Snapdeal through images. When we put deep learning to the hundreds of images filed by sellers, it helps in quality check. We can also detect mis-classifications a seller might have made, through our technology.”

Snapdeal also has in its kitty RupeePower, an online platform connecting lenders and borrowers, to help solve the distribution challenges of the financial services ecosystem and make it more inclusive.

Ideating in and out of Snapdeal

While creating innovations in-house would take a long time, acquisitions often come with the advantage of a well-established customer base. For Snapdeal, the acquisition of FreeCharge gave an edge over rival Flipkart. Aiming for 20 million daily customers by 2020, Snapdeal’s future acquisitions will follow the same path.

But this does not mean that there is no space for innovations inside the company. Saurabh explained that senior folks often come up with business lines themselves. Snapdeal had acquired Shopo, hailed as Indian Etsy, and relaunched it after two years in late 2015 – as a C2C marketplace under Sandeep Komaravelly, senior VP at Snapdeal. Since then, Snapdeal has been hailing it as a dark horse and even claimed that it would start exploring monetisation avenues by April this year. However, expectation with Shopo appears to have come down. Over the last five months, there has not been much noise as far as Shopo is concerned.

Similarly, Snapdeal had acquired luxury and lifestyle products platform Exclusively to boost its presence in $15-billion fledgling luxury market. At the time of acquisition CEO Kunal Bahl anticipated it to become a $1-billion business in three years. However, after 18 months, decision of buying Exclusively turned south for the company as it fumbled to make any mark. Exclusively shut shop recently.

Saurabh noted that the company's culture is to encourage aspirations – even those outside Snapdeal. Amit Mishra was Chief Technology Officer at Snapdeal for 4 years before he left it in 2015 to start up in travel-tech. His venture, BonaVita, is now backed by MakeMyTrip. Likewise, Idi Srinivas Murthy was Senior Vice-President, Marketing, from April 2015, before he left to start up on his own in January 2016. Another case is that of Anand Chandrasekharan, an ex-Yahoo and Aritel executive, who was Chief Product Officer at Snapdeal till a few months ago. Having cofounded Aeroprise, an app software company that was acquired by BMC Software Inc., in 2011, he turned into an angel investor. A few days ago, he joined Facebook.

While experienced professionals taking up entrepreneurship will expand the horizons of startup ecosystem, acquisitions in relevant sector will play an important role in shaping the future. If Snapdeal can make the best out of it, one can expect stronger competition in e-commerce in India.

(with inputs from Jai Vardhan)

Graphics: Aditya Ranade