How UPI will benefit the Indian startup ecosystem

Ever since the National Payment Corporation of India (NPCI) launched unified payment interface (UPI) earlier this year, there has been a buzz in the media on how it will supposedly transform the mobile payments landscape in the country. UPI is a payment system that allows money transfers between any two banks on its network. Recently, few banks released mobile apps built on UPI’s infrastructure to the consumers.

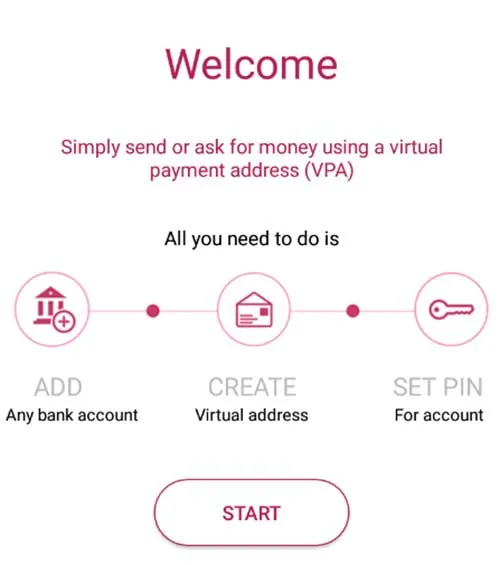

Initial screen of Axis Pay, Axis bank’s UPI app.

My own experience on one such UPI app has been amazing. Ease of use, simple and intuitive user flows, instantaneous money transfers — UPI has brought the future of mobile payments to reality for the Indian consumer.

So what makes UPI special? Why startups should start taking notice?

Send money like email

By using a virtual payment address (VPA) (more like a user name for each bank account), the set up time required to transfer money has been cut down drastically. You can now send money without the receiver’s bank account or IFSC code. Also, you do not have to wait for registering the payee’s account with your bank. Or postpone your transfer because it’s a public holiday.

This feature enables businesses and consumers to perform “live” transactions similar to debit cards without sharing any secure information. The VPAs created can be bound to various limits like one-time use, till a specific date, certain number of transactions, select payees, etc., making it even more secure.

And you do not have to use your own bank’s mobile app for using UPI. Just as you can use any email client (e.g. Outlook, Gmail) to access your email account, you can use any bank’s mobile app with UPI to access your bank account and perform transactions!

Track payments easily

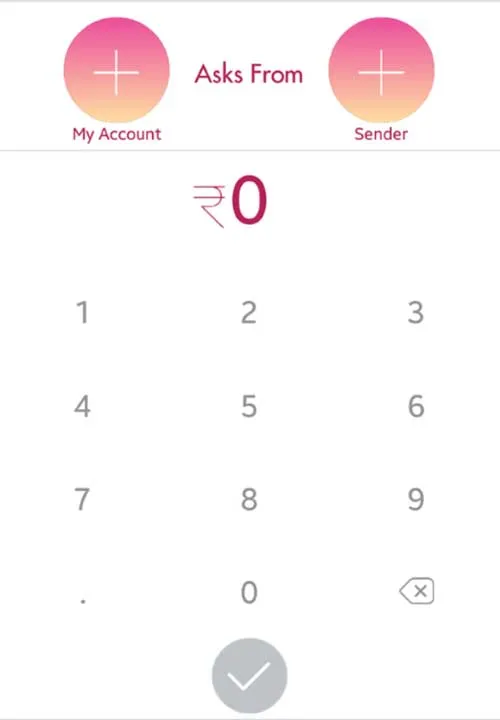

Businesses and individuals can now create payment requests to people using an “Ask” request. Payers get notified and will have to accept the request for the transfer to be completed.

Although not an entirely new concept, this feature can help businesses simplify payment experience for their consumers as well as manage payments efficiently.

An Ask Request, on Axis Pay.

Transact in seconds

The number of steps to perform a money transfer has been reduced to such an extent that net banking looks like an infant in comparison. The transaction reflects in your account immediately. Even on a 2G network, the time taken for the screens to load is decent.

This is the most critical part for UPI to become widely adopted, which in turn will create opportunities for richer and better products in the banking and commerce domains.

Now that the UPI is a reality, with more banks getting on to the bandwagon (currently 29 banks are on the network) how can startups utilise it? How the different players in the Indian startup ecosystem can take advantage of UPI?

1) E-commerce players

Studies reveal that the cart abandonment rates for Indian e-tailers is 51 percent. Some research indicates that it could be as high as 70–75 percent, costing e-commerce companies $10 billion yearly. Broken online payments experience is identified as one of the reasons for high rate of cart abandonment.

Cash on Delivery (COD) has been long considered as a necessary evil for Indian e-commerce companies. Some leading players do 80 percent of their transactions through COD, bringing in additional costs, increasing sales to cash cycles for merchants and reducing already low margins.

UPI can help e-commerce players reduce the pain of cart abandonment rates and handling COD. How?

Firstly, while checking out, all the consumers have to give is their VPA, drastically improving the checkout experience and eliminating any worries about payment security. This is one of the important points of cart abandonment today. E-commerce companies can send customers a payment request with a due date. Customers can be allowed to accept the payment request close to delivery of the product, cutting cash out of the process.

This will create a win-win situation for all stake holders in the e-commerce system. Knowing this, few of the e-commerce players have already jumped in to the game by launching their own UPI apps.

2) Fin-tech startups

UPI has opened up a bunch of opportunities for startups to come up with innovative solutions that elevate the customer experience.

Already a number of startups have jumped into the space by building solutions such as iris-based authentication, group and social payments, subscriptions, mobile POS (point of sales), etc.

There are also opportunities in crowdfunding, micro-finance, peer-to-peer lending, credit rating, loan disbursement, etc., which can be built upon UPI.

UPI being real time and zero charge, there is a huge scope in bringing the unorganised sector into the system. This would not only need innovations around the use cases, but also in user experience (currently all UPI apps are majorly English laden, which is the biggest barrier to entry for most of the country’s population).

There is also a big opportunity in peer-to-peer payments and social crowdfunding, wherein travel to nearest bank and cash handling can be eliminated.

With UPI, eKYC and Aadhar authentication, entrepreneurs can solve the problems in last mile delivery of financial products, taking the country to next level in terms of financial inclusion.

3) Offline merchants and small businesses

UPI can change the way merchants and small businesses collect payments from their customers, which is manual, mostly cash-based and tedious.

Using UPI, merchants can now remind customers to pay. Merchants can also create part payments asking the customer to pay a minimum say 10 percent up front and remaining on delivery of product or service. They can even set up specific dates for the customer to pay by, simplifying the collection process that takes multiple phone calls and reminders today.

Customers need not worry about their payment information being stored at the merchants’ side. This would definitely help the small businesses for whom customer’s trust level is low and the existing payment gateways costs are prohibitive.

More retailers, restaurants and pop up shops can directly initiate payment requests without the requirement of credit/debit cards or cash.

Reduction of dependence on cash will reduce the dependence on ATMs and banks for cash requirements, thereby reducing operational costs of financial entities and improving customer experience.

Whichever way you see, the potential of UPI is huge.

Can UPI really become interlinked with our daily lives in a way like WhatsApp or Facebook? We do not know this yet, as there are challenges in terms of internet connectivity, security, consumer education and banking regulations.

That being said, startups can utilise the infrastructure to not only improve customer experience, but also help achieve bigger goals like financial inclusion and “less cash” economy.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)