The future of digital content and media disruption in India

This is the first of two articles through which we aim to share our views on the India market, sketch out the startup landscape, and highlight a few key factors essential for the creation of new and large digital content companies in India.

The first print newspaper in India, the Bengal Gazette, started in 1870. Radio broadcasts in the country began in 1927 and satellite television arrived in the 1990s, unchaining us from Doordarshan. Today, there are over a hundred thousand publications (dailies and periodicals) in India and 1600+ TV stations. For much of the past 150 years, dissemination of media content – whether through audio, print, television or satellite -- has been top down and producer driven. But times are changing.

We were recently on a Jet Airways flight featuring “Jet Screen” -- their wireless streaming in-flight entertainment. All around me passengers connected to the service using their own smartphones and enjoyed a full range of self-selected personalised entertainment -- movies, music, video games, TV shows, and more. It was another data point on the change beginning to reshape the way Indians consume mass media in a mobile Internet era.

Key trends influencing digital media consumption in India

Smartphone becomes the personal media device

The mobile connectivity revolution in India is well understood. However, the change in usage patterns arising from smartphone penetration is an emerging wave.

There were an estimated 377M mobile Internet users and 220M smartphone users in the country as of June 2016. This is projected to approach 500M by 2020.

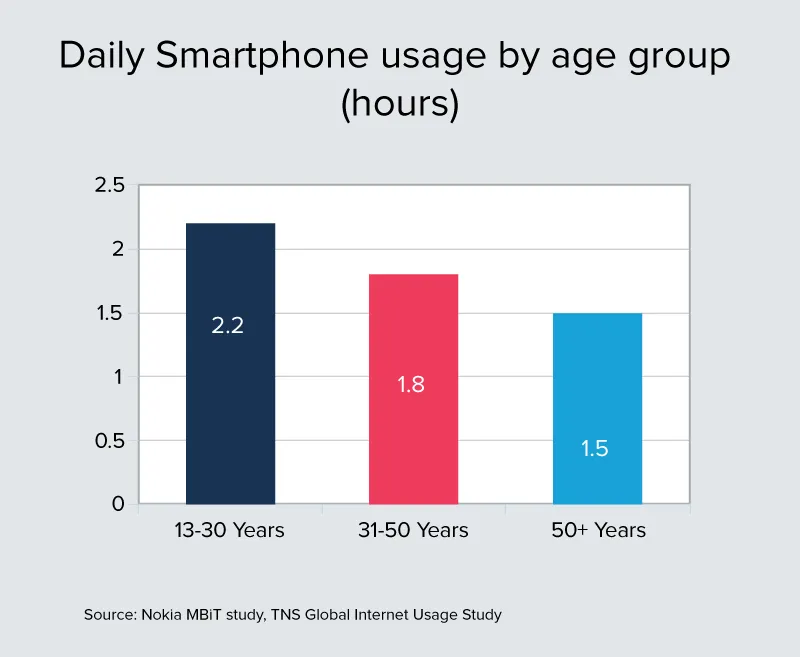

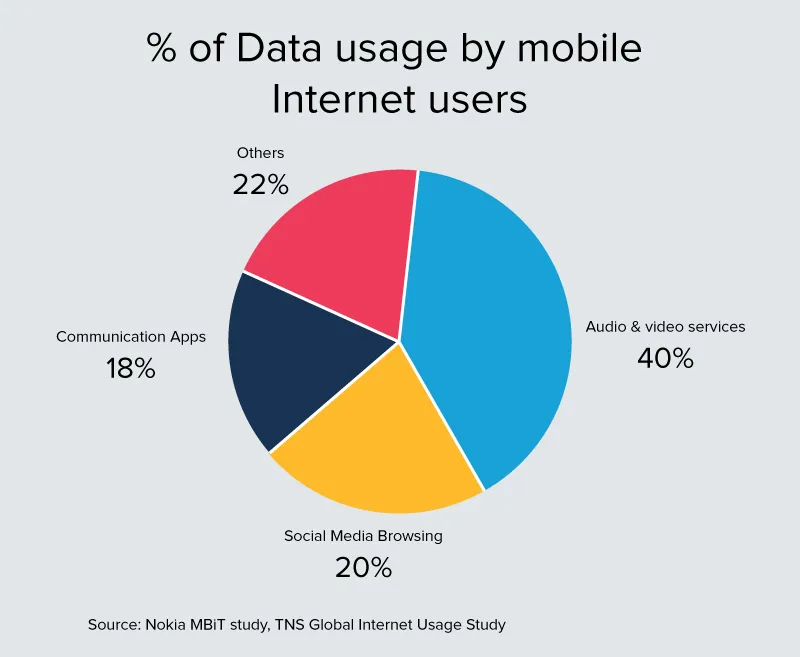

All smartphone users spend an inordinate amount of daily time with their devices. This ranges from 2.2+ hours for users in the coveted 16 – 30 age group to 1.5 hours in the 45-65 age group. As much as 40 percent of this time is spent on audio and video services.

Shift to on-demand, personalised, short form content

There are over 150M+ Facebook users, 160M+ Whatsapp users and 80M+ YouTube users in India. New platforms such as Daily Hunt (40M+ downloads) and ScoopWhoop (30M+ monthly active), Saavn (25M+ monthly active users), TVF (2M+ YouTube subscribers, 5M+ registered users) are just a sampling of the many ways in which a whole new generation of users is consuming text, video, and audio content. Given the form factor, data costs, and preferences of this audience, a good portion of digital content is moving towards short duration and highly personalised viewing.

Video is poised to become the format of choice. This requires continued expansion in 3G/4G access and lower data costs. Reliance Jio has emerged as a catalyst in this transition to India becoming one of the largest data consumption geographies with extremely competitive rates, comparable to what we have seen with voice.

The key point is that hundreds of millions of Indian youth in the 18 – 30 age group are unlikely to ever be heavy consumers of traditional media and are likely to lead the switch to new formats and properties that appeal to this category.

Smartphone penetration approaches TV/satellite reach

For digital to be viewed as a legitimate contender it has to match TV and cable/satellite reach in India. Currently, TV reaches 65 percent of the 267M households in India, or approximately 650M Indians. While India has 450M Internet users and a 220M smartphone base, the number of 3G/4G subscribers is around 100M. By this math, TV reach is around 6x that of digital. But within the next four years, 3G+ smartphone penetration is projected to approach 500M, representing a 5X jump. In our view, this is one of the key inflection points that is likely to catapult digital content in India into a mainstream medium approaching parity with TV.

The major assumption here is that data rates in India fall a lot more than where they are today. Our friends at Light Speed posted a valid viewpoint on the difference between “data” consumers and those with the ability to actually pay for high bandwidth digital content (you can read it here). Our belief is that lower data rates and higher usage are the only ways that telecom operators can recoup the billions spent on high-bandwidth network infrastructure. Just as it happened with voice, we expect falling data rates to dramatically accelerate digital content usage.

Advertiser budgets start to follow the audience

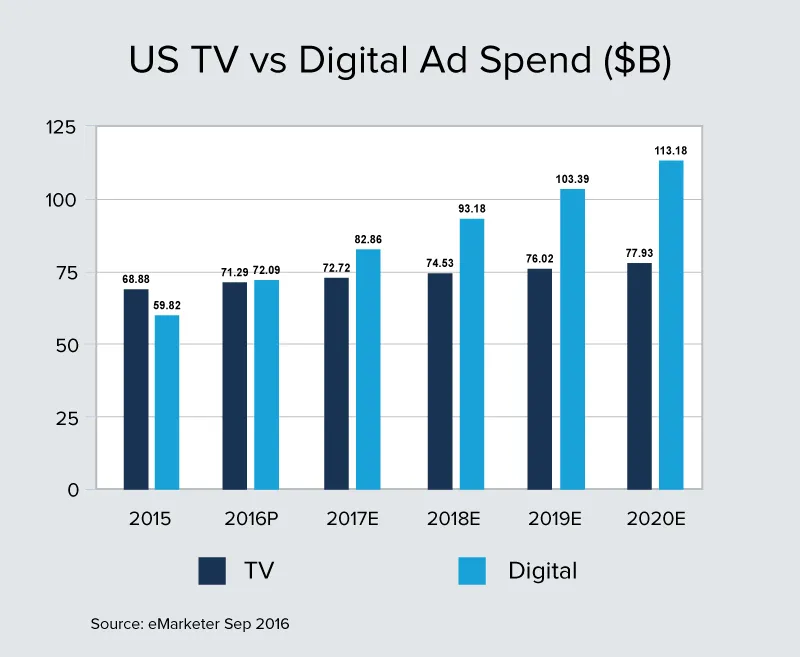

Global markets, particularly those in the West, have seen dramatic disruption in traditional media over the past decade. As the Google and Facebook juggernauts roll on, it has been a very painful experience for traditional media houses that are forced into restructuring mode to retain audiences as well as profits. Digital ad spend in the US is projected to overtake TV ad spend for the first time in 2016 and pull away permanently.

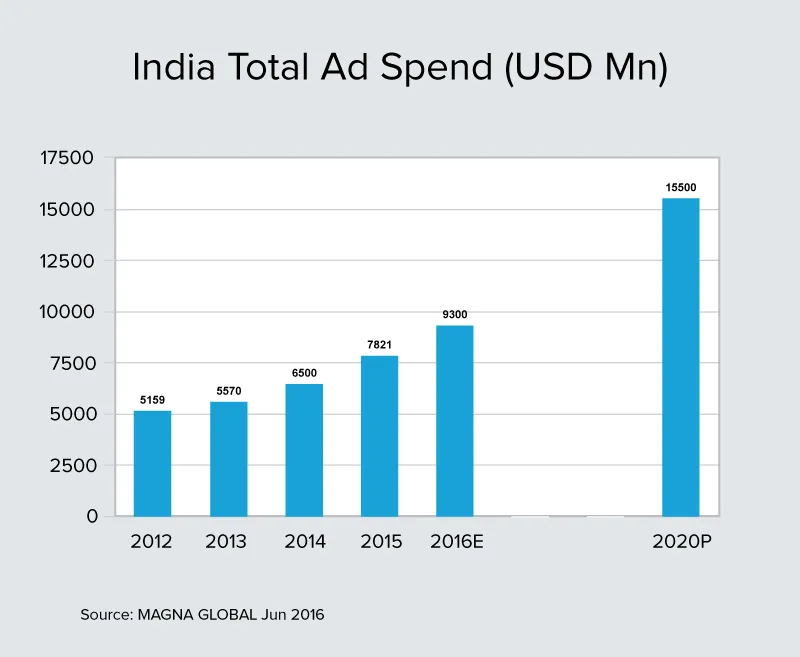

But India also remains one of the last bastions of growth, or at least stability, for traditional media. Until now it’s been a rather slow shift to digital in terms of brand spend and buy-in from agencies that control much of the ad budgets in India. Total ad spend in India is currently around $8B and rising to $20B over the next four years.

We expect digital ad spends in India to rise to 20 percent - 25 percent of total ad spend by 2020, creating significant monetisation opportunities for new age providers. However, as we discuss in a later section, startups will have to find clear differentiation and execute flawlessly to gain a share of this new profit pool that is likely to be dominated by Facebook and Google. The opportunity is there but requires new formats, unique content, and pricing models that work for India.

Traditional and digital merge

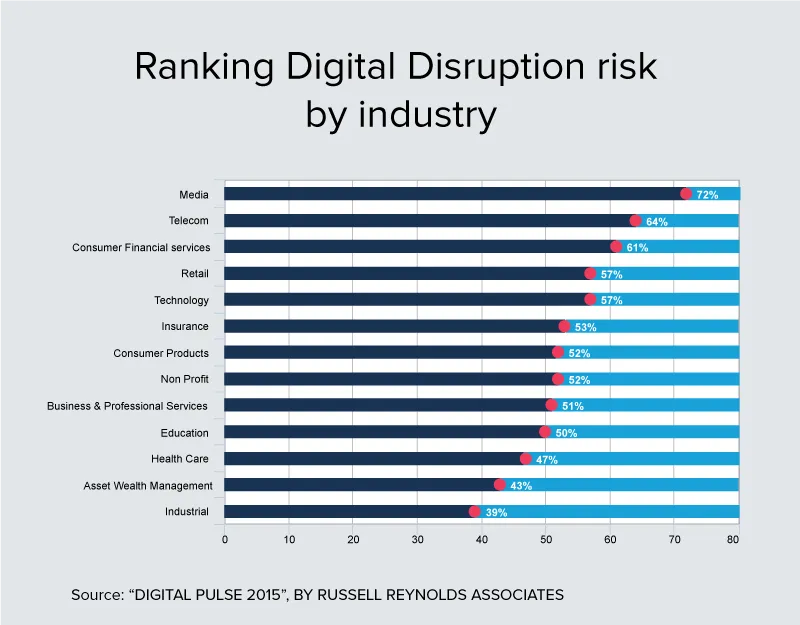

Every industry is under threat of digital disruption at some level. However, media ranks at the very top of the endangered list. Global media companies have been rethinking their future and actively trying to reshape events. Apart from large M&A deals such as that of AT&T and Time Warner, media giants have been aggressive in acquiring or investing in digital startups.

NBC investing $400M in BuzzFeed, Verizon and Hearst paying $250M for Complex Media (online publisher catering to young men), Disney’s $400M investment in Vice Media, Turner’s $45M investment in Refinery29, and Axel Springer buying Business Insider for $450M are just some examples of intense global activity in this space.

According to CB Insights, 2016 is likely to account for over $4B in deals involving large media companies and media startups.

Strategic drivers behind this frenzied pace of deal making are common across markets – millennial population, increasing time spent on digital devices, changing content preferences and formats. No longer do only large production houses control what audiences get to see and hear. Anybody can create and distribute content over the Internet.

This led to the emergence of new-age media companies that are able to produce, distribute, and measure media content at a much lower price as compared to traditional media. Without realignment, media giants are at a risk of losing an entire generation of consumers. As a result, there is a massive push to own high-quality content for various youth-centric genres. This ranges from entertainment to news to gaming, as well as experimentation with new formats, monetisation models, and omni-channel distribution. The hope is that this can also serve as a bulwark against disruption from massive ad distribution platforms such as Google and Facebook.

It’s hard to see this narrative not extending to the landscape in India. The big difference between the West and India has been in terms of digital reach versus a medium like TV and availability of high bandwidth Internet access. With genuine momentum in both these areas, we believe the scales are likely to tip significantly within the next 24 months.

It’s the calm before the storm for traditional media giants in India. We anticipate significant M&A activity over the next 24 months as traditional media figures out its digital strategy.

They are likely to aggressively invest or acquire new-age vendors to plug holes in existing portfolios spanning content differentiation, audience, technology platforms, and reach.

In Part 2, we will share our thoughts on the India digital content startup landscape. We will also try and call out the opportunities and challenges ahead for these companies in their quest to build scalable and profitable businesses in India.

(Co-authored by Darshit Vora)