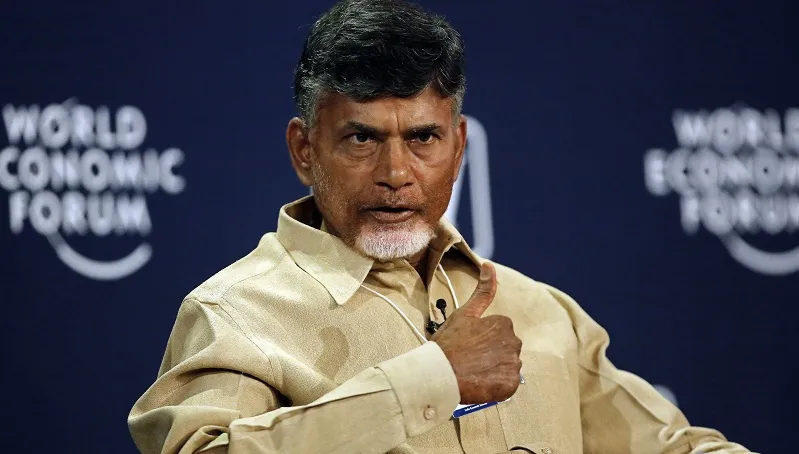

Modi forms a committee under the leadership of Chandrababu Naidu to promote digital payment systems

To promote the use of digital payment systems to encourage transparency and financial inclusion, and prepare a road map in this regard, the Modi government has formed a committee to look into the matter, headed by Andhra Pradesh Chief Minister Chandrababu Naidu.

Odisha CM Naveen Patnaik, Madhya Pradesh CM Shivraj Singh Chouhan, Sikkim CM Pawan Kumar Chamling, Puducherry CM V Narayanasamy and Maharashtra CM Devendra Fadnavis are the other Chief Ministers in the panel, which also includes NITI Aayog Vice-Chairman Arvind Panagariya and Amitabh Kant, CEO of NITI Aayog.

Nandan Nilekani, former Chairman of the UIDAI, Janmejaya Sinha, Chairman of the Boston Consulting Group, Rajesh Jain, Managing Director of netCORE, Sharad Sharma, Co-founder of iSPIRIT, and Jayant Varma, Professor (Finance) at IIM Ahmedabad, are experts who, as special invitees, are part of the high level panel.

According to officials, the terms of reference of the committee are identifying global best practices for implementing an economy primarily based on digital payments and examining the possibility of the adoption of these global standards in the Indian context.

The panel will also outline measures for the rapid expansion and adoption of systems of digital payments like cards (debit, credit and pre-paid), digital-wallets/e-wallets, internet banking, the Unified Payments Interface (UPI), and banking apps, and shall broadly indicate the road map to be implemented in one year.

Also read : Niti Aayog sets up committee on digital payments

It shall evolve an action plan to reach out to the public at large, with the objective of creating awareness and helping them understand the benefits of such a switchover to a digital economy, and will prepare a road map for the administrative machinery in the states to facilitate the adoption of digital modes of financial transactions.

Also read : Digital India — from dream to reality, via demonetisation

The high level group will identify and address bottlenecks pertaining to the growth of a digital payments economy. It will also consult with key stakeholders for the implementation, and delineate and adopt measures evolved by the Committee of Officers constituted for the purpose.

Digitisation of payments would significantly enhance financial inclusion by overcoming physical barriers, and would thus enhance access to financial services rapidly. In addition, it would also enable the formalisation of all financial transactions, thus increasing transparency and plugging leakages from the system, a senior official said.

The Committee may devise its own procedures for conducting business, meetings, constitution of sub-groups and so on.